AIM A-Z Part 34: Retail, Gold, Whiskey

Ticker 561 to 572 on London's Alternative Investment Market (AIM)

Welcome,

Mix of everything today. Some niche businesses, some more general retail. Some struggling, some more quality. Three for the watchlist.

Here you find the last part:

Here you find all other parts: https://increasingodds.substack.com/s/a-z-uk-aim

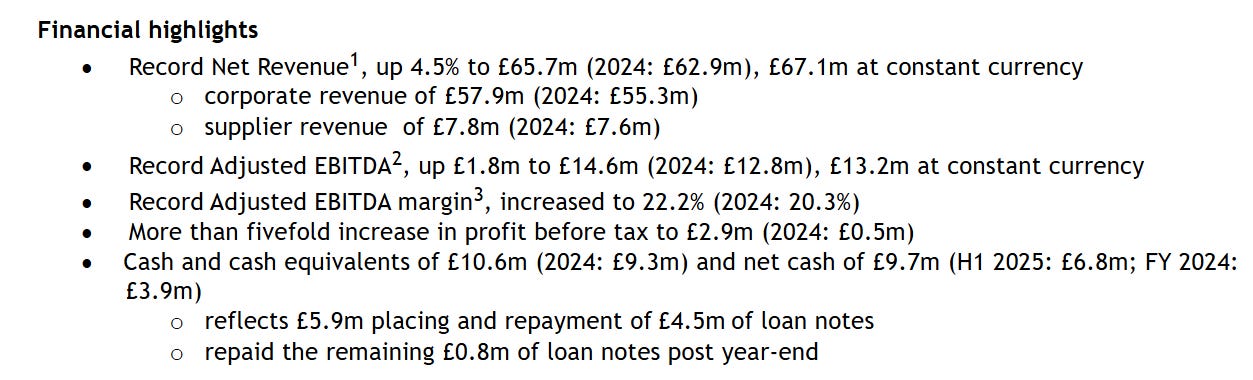

561) Ten Lifestyle Group (Ticker: TENG)

69£m ‘concierge technology platform driving customer loyalty for financial institutions and other premium brands’. Latest FY results looking solid:

Highlights contract wins. Trading at the start of FY26 in line with market expectations of 73£m revenue and adj. EBITDA of 15,5£m. Two customers account for 30% of revenue. Operates profitable since 2023, revenue flat since three years. Corporate clients are mostly banks and payment providers, but also luxury brands such as Patek Philippe. ‘Ten provides affluent members with exclusive benefits and access […] across travel, dining and lifestyle…‘ 387k active members who used TENG’s services in the last 12 months, but also 1,8m who didn’t use it.

Co-founders are CEO and CFO, CEO owns 12% of shares. The whole case is build around the effect of their services on client retention for corporate customers, and apparently it works out. Just questionable how far management can scale this. ‘Material contracts’, which are contracts with a value of more than 0,25£m, only increased from 25 to 31 in recent years. Fwd. P/E of 14 (Koyfin), no dividend/buyback. Rather a pass, hard to wrap my head around how this actually works out in practice.

562) Tern (Ticker: TERN)

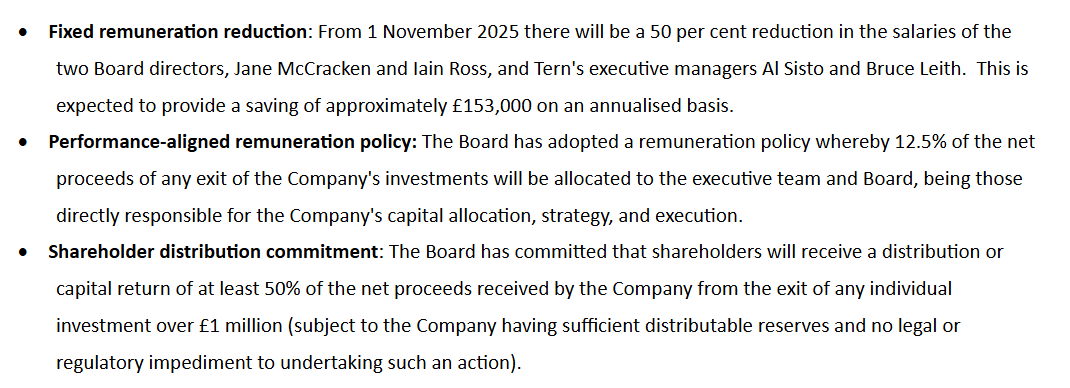

3£m investment company focused on ‘early-stage, disruptive Internet of Things technology businesses’. 10£m NAV. Consistently raising capital through share issues and convertible loans. Updated its renumeration and distribution policy:

Except one little sale of 1,7% in one of their holdings for 0,2£m, there has been no disposal in the last three years. One company went bankrupt. Pass.

563) Tertiary Minerals (Ticker: TYM)

5£m mineral exploration and development company with projects in Zambia, the US and Sweden. Mostly focused on copper. 0,1£m revenue, unprofitable. Share price doubled YTD, only RNS statement is a new 4% shareholder. Pass.

564) The Artisanal Spirits Company (Ticker: ART)

24£m whiskey producer. US government shutdown is a headwind as new products won’t be approved as quickly as usual. Additionally to some restructuring efforts in the US, this will reduce FY25 revenues by up to 4,5£m and EBITDA by up to 3,5£m. Expects a flat FY26 (excl. postponed US sales), whatever that really means, no FY25 numbers mentioned in the trading update (FY24: 24£m revenue with 1,6£m EBITDA). Got 40k members in its whiskey communities. Net debt of 29,5£m, mostly related to inventory financing, on 10£m H1 revenue and negative adj. EBITDA during a weak underlying market. Cost reductions ongoing. A consumer brand focused investor owns 17%. CEO and CFO joined in 2023. Pass.

565) The Character Group (Ticker: CCT)

43£m ‘independent toy company’. Trading update for the 4 months period before Christmas shows -11% revenue. Expects improvements in 2026, leading to a flat year and doubled profits due to ‘mix and enhancements within our product portfolio’. This would mean about 100£m revenue and 2,5£m PBT. Just completed a 3£m buyback program. Managing directors joined 35 years ago, one is a co-founder, own 17% together. 6% dividend. Reports 12£m net cash, with only 0,6£m on the balance sheet, biggest asset is ‘Amounts due from subsidiary undertakings’, I assume net cash includes some of these receivables? Rather a pass, though if we see a recovery of demand, margins and profits would double again and another buyback could be announced, but that’s a wild guess.

566) The Mission Group (Ticker: TMG)

18£m group of marketing agencies. FY25 results: 68£m revenue and 5,1£m adj. operating profit. New CEO since Sep 2025, aims to consolidate agencies to streamline operations. Expects up to 2£m in cost savings. Highlights delayed projects due to macroeconomic uncertainty. New CEO got an oil and fuel station background. 9£m net debt, so TMG is trading on 5x EV/adj. EBIT, before cost savings. 6% dividend. Looks interesting from an improvement perspective, while the underlying market, a kind of random CEO appointment and too much corporate bla bla and AI talk raise some concerns, watchlist. Brave Bison, number 90 of this series, wanted to acquire TMG. TMG write-up by @No-Brainer Stocks:

567) The Pebble Group (Ticker: PEBB)

74£m ‘provider of digital commerce, products and related services to the global promotional products industry’. PEBB connects brands, supplies and distributors in this industry. FY trading update shows slightly reduced performance to 125£m revenue and 15,8£m adj. EBITDA. In March, the board will ‘provide detail on our capital allocation priorities considering the Group's high cash generation characteristics, underpinned by a strong, debt free, balance sheet.’ Pays a 4% dividend and repurchased 10% of shares in the last year, so more capital returns would not be surprising.

CEO is with PEBB since 24 years, led a management buyout and the transformation to what PEBB is today. CFO joined 16 years ago. They own 6% together. 13x fwd. P/E (Koyfin). ALT is a listed competitor (smaller, growing, lower profitability), number 28 of this series. I liked ALT, so I like PEBB as well, especially considering the capital allocation, watchlist.

568) The Revel Collective (Ticker: TRC)

0,4£m operator of premium bars and gastro pubs. Suspended from trading and administrators were appointed after a strategic review led to the sale of 2/3 of its bars and pubs, while the other 1/3 were closed. ‘At the current time, the transactions being contemplated would not be expected to deliver any return to shareholders.’ Pass.

569) Theracryf (Ticker: TCF)

5£m no-revenue biotech company developing medicines for addiction and nervous system disorders. Pass.

570) The Works (Ticker: WRKS)

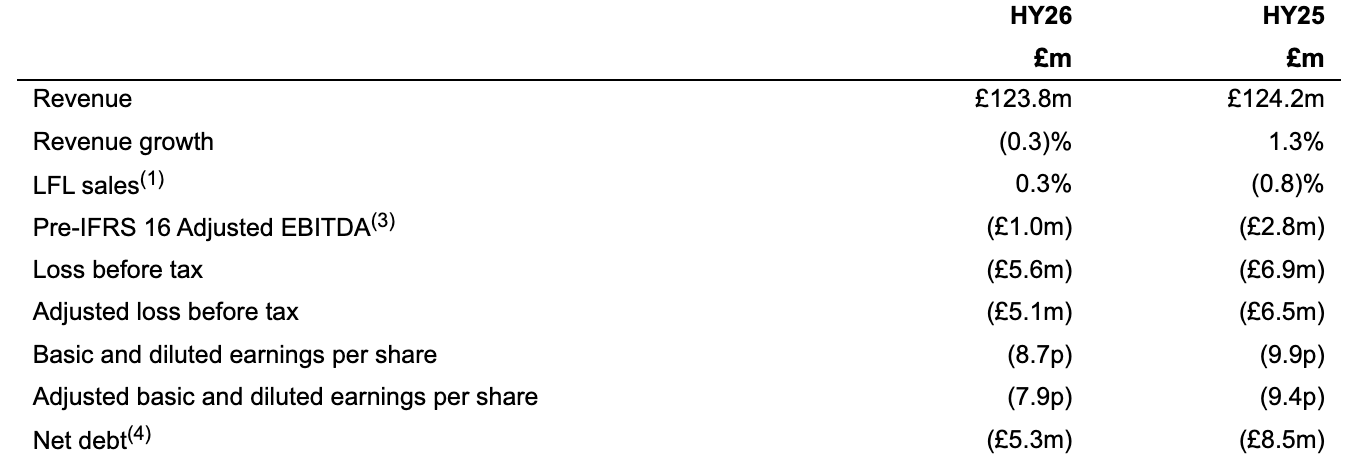

20£m ‘retailer of affordable, screen-free activities for the whole family’ with over 500 stores. H1 trading update, profits are H2 weighted apparently.

Expects 11£m adj. EBITDA for FY26 and ‘sales and profit growth in FY27’. 5% dividend cancelled. 4,6£m adj. PBT last year. Most operating cash flow used for interest payments, lease payments and capex. Average payback period of stores is 18 months, plans 60 new stores in the next 5 years and reach 375£m sales with a 6% EBITDA margin = 22,5£m. And I assume that’s what the case is about here: some new stores, some cost savings, some same store sales growth. I am not sure if this ‘screen-free activity’ niche really exists, I mean, everyone could buy screen-free toys elsewhere. CEO is prior CFO who led the IPO in 2019. But if they reach their targets, it’s obviously cheap, too cheap. Watchlist. @The Oak Bloke wrote about WRKS in September:

571) Thor Energy (Ticker: THR)

7£m no-revenue ‘exploration company focused on natural hydrogen and helium’ with projects in the US and Australia. Just received a 1,15£m for the sale of a copper joint venture. Pass.

572) Thor Explorations (Ticker: THX)

653£m ‘low-cost gold producer’. Share price 5x in last 12 months, likely due to gold price development. 108$m Q4 revenue on 60% net profit margin. 5x fwd. P/E (Koyfin). Aims for 75k to 85k ounces next year. Pass for me.

Wrap-up

572/669 companies covered so far.

Watchlist: 86/572.

Pass: 486/572.

No-Revenue counter: 119/572.

Feel free to provide opinions and sources on any of the stocks. Cheers.

Watchlist

Part 1: 4GBL (Delisted), ABDP, ASCO, AMS; Part 2: ALT, ALU, AMCO, ANG; Part 3: ANCR, AT, AVG, BPM; Part 4: BGO, BEG, BIG, BRCK; Part 5: CBOX; Part 6: CLBS, CEPS, CER, CKT, CHH Part 7: CFX; Part 8: CSSG, CRPR, CVSG; Part 9: DFCH, DOTD; Part 10: EAAS; Part 11: None; Part 12: FIN, FNTL, FKE; Part 13: FLO, TUNE, FRAN, GBG; Part 14: DATA; Part 15: HDD, HAYD, HERC; Part 16: IDOX, ING; Part 17: JNEO, JDG; Part 18: KITW; Part 19: LST, WINK; Part 20: MLVN, MBH; Part 21: MAB1, MWE; Part 22: WINE, NWT, NTBR; Part 23: OHGR, OGN; Part 24: OMG, PEB; Part 25: TPFG; Part 26: QTX, REAT, RLE; Part 27: RCN, RNWH, RGG; Part 28: ROSE, RTC, RWS, SDG; Part 29: SAG, SDI; Part 30: SRC, SFT; Part 31: SAL, SPSC/SPSY, SRT, STAF, KETL; Part 32: SUP; Part 33: TAM, TIG; Part 34: TMG, PEBB, WRKS

Great breakdown of these AIM companies. The Pebble Group catching the highest cashgeneration angle ahead of a capital allocation announcement is smart positioning. I've noticed simmilar patterns with smaller UK listed firms where management telegraphs returns before actually executing, gives a nice entry window if fundamentals hold.

The Works is interesting, like one of the spiritual successors to Woolworths. I'm pretty surprised they're planning to open 50+ new stores tbh, I would have thought they already have too many.