AIM A-Z Part 33: Trials, Strategic Review, Asset Management

Ticker 551 to 560 on London's Alternative Investment Market (AIM)

Welcome,

two cases with ongoing trials. Many asset managers, one interesting for the quality dividend people plus an interesting strategic review setup. No pre-revenue company! Let’s go.

Here you find the last part:

Here you find all other parts: https://increasingodds.substack.com/s/a-z-uk-aim

551) Tan Delta Systems (Ticker: TAND)

27£m ‘provider of intelligent monitoring and maintenance systems for commercial and industrial equipment’, apparently for oil applications. 1,2£m revenue, unprofitable. Reports pipeline of 64£m, based on 17 trials with customers. CEO is Co-founder and owns 6,5%. Chairman owns 15% and is CEO of SRT Marine Systems, covered recently in this series, looked like a successful growth story. SRT was one for the watchlist, but TAND is a pass, too early stage.

552) Tandem Group (Ticker: TND)

10£m ‘designer, developer, distributor and retailer of sports, leisure and mobility products’. E.g. sells toys for kids, e-bikes or golf equipment. H1 results show 14% growth to 11£m revenue and increased gross margin, but continued unprofitability. Reports NAV of 23£m, is focused on inventory management ‘to drive profitability’. Losses reduced to 200£k. Expects trading in line with expectation without mentioning how these look like. Looked like a good retail growth story until revenues peaked in 2021 and got cut in half until the bottom in 2023. But revenues today are even far below 2018 levels, so the story seems more complex than just talking about inflated Covid earnings. 24% insider ownership, pass.

553) Tanfield Group (Ticker: TAN)

10£m investment company, owning 49% of Snorkel International Holdings and 5,8% of Smith Electric Vehicles. Snorkel is valued at 19£m. There is a trial ongoing regarding some call options on interest in Snorkel from a company called Xtreme, JV partner of TAN. Snorkel produces industrial lifts. Trial will begin in first half of 2026. Smith Electric Vehicles is bankrupt apparently. 22£m NAV, pass.

554) Tap Global Group (Ticker: TAP)

13£m crypto fintech focused on crypto settlement solutions. 400k users, 3,5£m revenue, >1£m EBIT loss. Impairments of 20£m in the last two years, never operated profitable. CEO and Co-Founder owns 60%, got a crypto trading background. Pass.

555) Tatton Asset Management (Ticker: TAM)

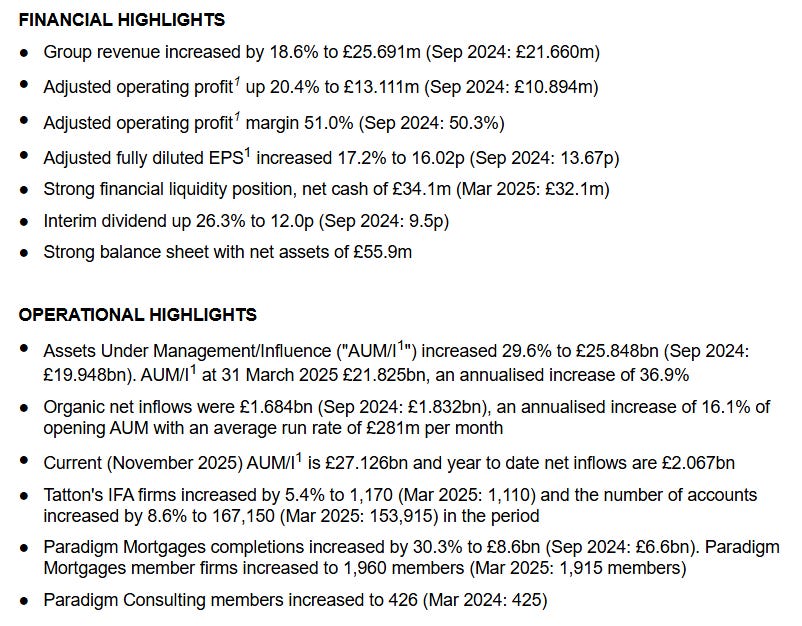

403£m provider of fund management, mortgage, regulatory, compliance and consulting services. Recent results look strong in all segments:

A partnership will conclude in Jan 2026, leading to 3,5£b loss in AuM. Wants to achieve 30£b AuM in 2029 (36% growth needed). Asset management accounts for 87% of revenue. CEO owns 15%, Blackrock 10%, Chief Investment Officer was at Octopus Investments before, a name you know when looking at UK companies more often. Not much more to say here, looks like a quality company and the case seems to be: keep doing what you are doing already. 19x fwd. P/E, 3% dividend. Watchlist.

556) Tavistock Investments (Ticker: TAVI)

19£m wealth manager. Trials ongoing with Titan, an asset manager who acquired TAVI’s asset management business. According to the TAVI board, Titan failed ‘to honour the undertakings that it gave regarding the management of the acquired business led to a collapse in the performance of the ACUMEN Funds’. Trial expected in 2027. Wants to refocus on the ‘less privileged’ people, acquired two businesses and disposed the named asset management and its independent financial advisor network for over 60£m in 2021 and 2024.

The Board believes that the most exciting aspect of the Group's current activity is its refocusing as a fintech business to make extensive use of AI (artificial intelligence) to provide cost effective financial advice and investment management services to all UK adults regardless of wealth.

Will receive about 5,5£m in dividends from a 10£m investment into LEBC (talks about recovering money here) and further earn-outs from its disposals. No idea what LEBC is, but apparently didn’t work out. 40£m NAV. A lot going on here in combination with unprofitability. CEO and Co-Founder owns 14%. Rather a pass for me, but it could be worth to dig into this and calculate how much cash they will receive overall and what’s the worst case for the trial.

557) Team Internet Group (Ticker: TIG)

119£m (160$m) software company offering various services such a monetizing traffic, building ad campaigns, brand protection, domain buying, … . Announced a strategic review ‘to unlock shareholder value’:

The Board believes that Team Internet's share price does not reflect the intrinsic value of its individual businesses […] We are in active discussions regarding the divestment or formation of strategic partnerships for substantially all parts of the business in separate transactions. […] The strategic review does not include soliciting an offer for the Company.

Board thinks its Domains, Identity & Software (DIS) segment is worth more than the current market cap (40% of revenue and profits). TIG reported a net loss last H1 due to market headwinds and restructuring costs, but the DIS segmented reported adj. EBITDA of 10,7$m. Assume 20$m for the full year, they need to sell it for 8x adj. EBITDA to reach current market cap. Other segments operate adj. EBITDA positive too with higher margins. Most adjustments are restructuring costs and amortisation of intangibles which seems reasonable to reflect underlying cash generation.

Latest update: Board expects about 42$m adj. EBITDA for the full year, says discussions for a disposal of DIS are ‘progressing well’ and confirms expected proceeds in excess of market cap. Shares outstanding have been reduced by 20% in last 3 years, pays a small dividend, so a capital return seems likely in case of a disposal. About 50% insider ownership, 27% owned by Kestrel Investment Partners: our aim is to generate superior long-term returns for our clients by investing and driving change in under-valued companies. I got no expertise in this kind of special situation, but the setup does not seem too bad. Share price moved ~10% since the review announcement. Watchlist.

558) Team (Ticker: TEAM)

17£m wealth, asset management and complementary financial services group. Wants to merge with aim listed company WH Ireland, another wealth manager, for about 13£m in shares. 257% premium to the last close before the offer, 400% premium to 60 and 90 day trading periods. Latest H1 results show revenue growth to 5,8£m, but decreased gross margins and persisting losses. >1£b AuM, wants to grow to 4£b and 20£m annual revenue. Raised 3£m last year. WH Ireland operates unprofitable as well. Pass.

559) TEKCAPITAL (Ticker: TEK)

27£m investment company focused on ‘new, university-developed discoveries’. IPO’d GenIP, number 251 of this series (Ticker: GNIP), unprofitable AI stuff, still owns over 60%. Other investments are a retailer of ‘ChatGPT smart eyewear’ (NASDAQ:LUCY), an unprofitable listed low sodium salt producer (Ticker: SALT), an unprofitable medtech (Ticker: BELL) and a software company for remote monitoring of autonomous vehicles and drones. Reports net assets of 77$m. Pass.

560) Tekmar Group (Ticker: TGP)

15£m provider of engineering services for offshore assets and marine infrastructure. Share price doubled on two new 8€m contracts. Expects FY25 adj. EBITDA of 1,7£m, 2,6£m net debt. The contract were more or less expected to be awarded. New CFO. With revenue of 12£m in H1, there is definitely some customer concentration. Operates unprofitable since years, but is aiming for profitability since the new CEO joined in 2024. Pass.

Wrap-up

560/669 companies covered so far.

Watchlist: 83/560.

Pass: 477/560.

No-Revenue counter: 116/560.

Feel free to provide opinions and sources on any of the stocks. Cheers.

Watchlist

Part 1: 4GBL (Delisted), ABDP, ASCO, AMS; Part 2: ALT, ALU, AMCO, ANG; Part 3: ANCR, AT, AVG, BPM; Part 4: BGO, BEG, BIG, BRCK; Part 5: CBOX; Part 6: CLBS, CEPS, CER, CKT, CHH Part 7: CFX; Part 8: CSSG, CRPR, CVSG; Part 9: DFCH, DOTD; Part 10: EAAS; Part 11: None; Part 12: FIN, FNTL, FKE; Part 13: FLO, TUNE, FRAN, GBG; Part 14: DATA; Part 15: HDD, HAYD, HERC; Part 16: IDOX, ING; Part 17: JNEO, JDG; Part 18: KITW; Part 19: LST, WINK; Part 20: MLVN, MBH; Part 21: MAB1, MWE; Part 22: WINE, NWT, NTBR; Part 23: OHGR, OGN; Part 24: OMG, PEB; Part 25: TPFG; Part 26: QTX, REAT, RLE; Part 27: RCN, RNWH, RGG; Part 28: ROSE, RTC, RWS, SDG; Part 29: SAG, SDI; Part 30: SRC, SFT; Part 31: SAL, SPSC/SPSY, SRT, STAF, KETL; Part 32: SUP; Part 33: TAM, TIG