AIM A-Z Part 26: Quality Vehicle Tracking, Cheap Deep Cleaning and the Wind-Down of a REIT?

Ticker 456 to 470 on London's Alternative Investment Market (AIM)

Hello again, a way better part than last week today. Three for my watchlist. We got some more early stage high growth stories, a REIT taking advantage of its NAV discount and various other interesting companies, partly well covered by other authors on Substack!

Here you find the last part:

Here you find all other parts: https://increasingodds.substack.com/s/a-z-uk-aim

456) Proteome Sciences (Ticker: PRM)

5£m biotech focused on proteomics, research around proteins. Its products are distributed by ThermoFisher. Also offers contract research. Revenue peaked in in 2022, so did profitability. Now back to unprofitability due to US tariffs and budget cuts in academics (H1: 1,6£m loss on 1,8£m revenue). Has been operating profitable on similar revenue levels before. Expects continued headwinds in the US, but remains optimistic in the long run. Chairman owns 12% and is with PRM ‘since inception’. Pass.

457) Provexis (Ticker: PXS)

14£m developer and seller of its functional food ingredient ‘Fruitflow’, maintaining healthy blood flow. On the homepage it’s compared to Aspirin: Fruitflow has a similar antiplatelet effect to a single dose of Aspirin – but when taken daily, it has none of aspirin’s side effects. PXS relies on DSM Nutritional Products, a long-term partner which owns 11% of shares, to commercialise Fruitflow. The Agreement was renewed in 2022 and PXS took over outsourced parts of the supply chain and production. Latest FY25 results show 61% revenue growth to 1,29£m and reduced losses to 0,452£m. Will expand in China. Still looks ugly, but revenue tripled in the last 2 years. SBC accounting for ~13% of sales. Pass.

458) Public Policy Holding Company (Ticker: PPHC)

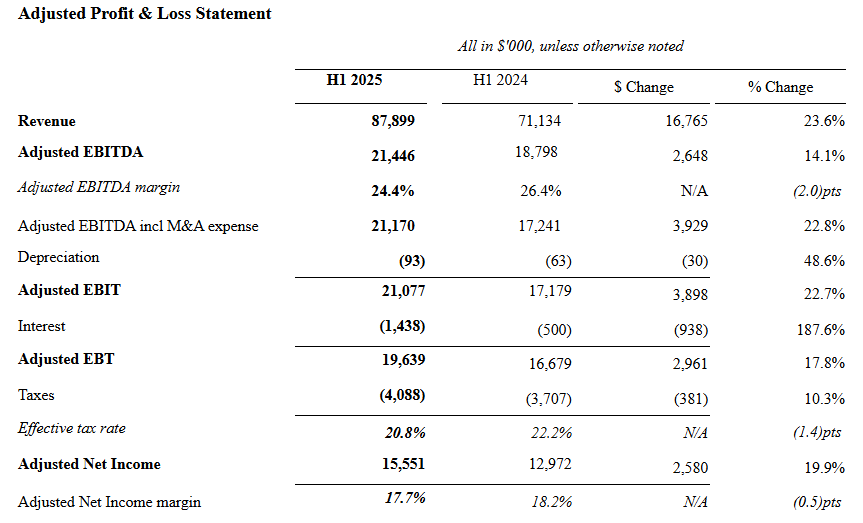

275£m strategic communications provider operating in the USA. Wants to list in the US on Nasdaq. 60% of revenue from government relations consulting. Reports in $.

Growth mainly driven by M&A. Organic growth driven by US ‘compliance & insights’ services. Adj. profits are more or less zero when paying attention to SBC, the issue persists since the IPO. 3,5% dividend. Most assets are intangibles and goodwill from their M&A activity. Latest acquisition: 13$m (18x PBT, 10$m is will be paid conditional on profits levels until 2028.) for another consulting business in the US. CEO is Co-Founder and owns 5%, Jeffrey Forbes and Daniel Tate, both founders of a similar communication company, own 15%. There were many consulting/professional service companies in this series which looked way better than PPHC. Questionable whether they remain listed on AIM once listed on Nasdaq. Pass. But: reading through the work of @Brian Flasker, it seems that under the surface PPHC is more interesting than it first seems:

@Contrarian and Correct added his view too:

459) Pulsar Group (Ticker: PULS)

48£m SaaS provider for the marketing and communication industry. Just raised 3£m. 95% recurring revenue, grew by 2% in H1. Adj. EBITDA up 20% to 3,6£m due to cost savings, further savings are expected. Wants to ‘optimise the business for profitable growth and free cash flow generation’. Adjusts for ‘Non-recurring administrative expenses’ which are somehow recurring since 2,5 years. 4£m net loss unadjusted. 3£m intangibles capex. CEO joined in 2011 as COO and was promoted in 2014. Pass.

460) Pulsar Helium (Ticker: PLSR)

58£m no-revenue helium exploration and development company with projects in the USA and Greenland. Many RNS statements on project development. Share price doubled in October, but crashed back to old levels. Pass.

461) Quadrise (Ticker: QED)

57£m no-revenue licensor of heavy oil and synthetic biofuel technology to produce a certain type of fuel for the shipping industry. Expects ‘commercial opportunities’ during 2026. Pass.

462) Quantum Base Holdings (Ticker: QUBE)

13£m company providing it’s own ‘Q-ID’ authentication solution, aims to replace usual identification solutions such as face ID. IPO in April, raised 3,4£m. 18£k revenue from its first commercial success. Expanded a contract with its biggest customer for 0,35£m, expected to turn into revenue in FY26. Announced a new customer: The Agreement is a comprehensive 15-year deal with exclusivity in the art market, worth a total value of £9.4 million. This includes revenues of £135,000 in FY2026, with expected annual recurring revenue (”ARR”) growing incrementally from £175,000 in 2027 to £880,000 in 2032 onwards, with additional scope for extension.

So QUBE might be a high growth story in the coming years, assuming they will win some more customers. Co-Founder is Chief Science Officer and owns 16%. 36% insider ownership in total. It’s a spin off from the Lancaster University, which also owns 7%. Pass due to it’s early stage, but this might be one to come back to some day.

463) Quantum Blockchain Technologies (Ticker: QBT)

10£m no-revenue ‘company focusing on a R&D and investment programme within blockchain technology’. 7,5£m long-term debt on 3,7£m total assets. Pass.

Quantum Helium (Ticker: QHE) would be the next (I sort the list of stocks on the LSE homepage by name), but it was already covered, just appears again due to a name change (MSMN.L before).

464) Quartix Technologies (Ticker: QTX)

134£m provider of vehicle tracking solutions. Expects to exceed market expectations of 36£m revenue, 7,1£m adj. PBT and 4,1£m FCF. Most revenue is recurring, 97% net revenue retention rate, ARR grew by 14%, subscription base by 12%. Is upgrading its devices to 4G. Mostly operating in the UK and France. Number of tracked vehicles is growing in every market, number of individual customers is growing everywhere except the UK. About 4k new customers a year (now 32k in total). Is focused on SMEs providing site-based services such as facility management or landscaping. This may explain the low revenue per vehicle of 111£/year.

Chairman is the founder and owns 22%. COO joined in 2017. No long-term debt. 1,5% dividend, basically no capex. There is a lot of room to grow outside the UK and the costs for customers are just a small part of their cost base. I’m just wondering whether vehicle tracking is that important for their customer base. But there are only ~10 tracked vehicles for every customer, so they pay like 1,3£k a year, not much benefit needed to justify this I guess. Trades on <20x adj. PBT. Revenues were flat for years before covid, worth finding out what happened since then, I’m interested. Watchlist.

465) Ramsdens Holdings (Ticker: RFX)

110£m financial services provider and retailer offering ‘foreign currency exchange, pawnbroking loans, precious metals buying and selling and retailing of second hand and new jewellery’. Expects FY results to be ‘slightly ahead’ of 15,4£m PBT, supported by an increased gold price, more purchased gold and higher pawnbroking activity, both driven by new website launches. FX activity flat YoY against a strong comparative due to the UEFA Euro in 2024. Expects to open 8 to 12 new stores (169 at the moment). Interim dividend increased by 25%, about 3% yield.

CEO says lower gold prices would not impact pawnbroking profitability and would lower input prices for jewellery retail. No words on precious metal purchase, but I’d assume lower gold prices to have a negative impact here after the CEO highlights the gold price as a driver for profit growth. CEO owns 4% and joined in 2001, CFO joined in 2009. 10x fwd. P/E (Koyfin), close to its long term mean. Despite great fundamental development, the exposure to the gold price probably justifies some sort of discount. Nevertheless one to keep in mind in case you ever want indirect exposure to the gold price. Pass for me. Opinion from @🐝 Elric Langton:

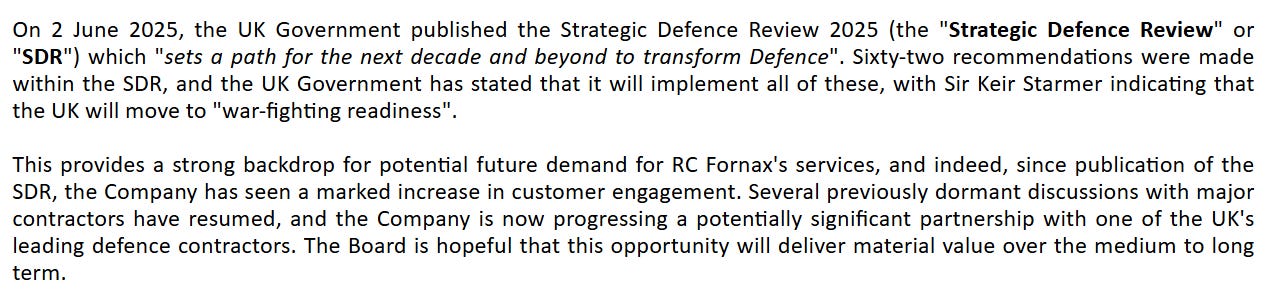

466) RC Fornax (Ticker: RCFX)

4£m engineering consultancy. Expects 4,1£m revenue and 1,5£m net loss due to higher costs for a new headquarter in Bristol and ‘strategic investments’. Seems focused on the defense market and is confident to benefit from the so called Strategic Defense Review by the UK government:

Recent unprofitability is also attributable to weak sales team performance and delayed spending by customers. Is engaging in multiple contract discussions, just announced a 0,4£m one. Remains unclear how easily they’ll return to profitability. IPO’d in January, raised 5£m, now raised 2,3£m additionally. Was co-founded in 2020 by Paul Reeves who owns 39% and is CEO. Other co-founder was COO and just left, owns 26%. We have no annual report yet, maybe there is some customer concentration. Pass.

467) Reabold Resources (Ticker: RBD)

5£m gas exploration and development investing company. Owns interest in projects in the US, Italy, Romania and the UK. Basically no debt, 41£m NAV, 4£m cash. Just secured a deal to receive up to 16£m from the gas field in Italy once production starts in 2027. The company operating the gas field aims to list on AIM to raise 3,5£m, RBD owns 29% here and it sounds will keep its shares. So it seems things are moving here and it’s not just a dead natural resource company. Not my cup of tea, worth a look for others. Pass.

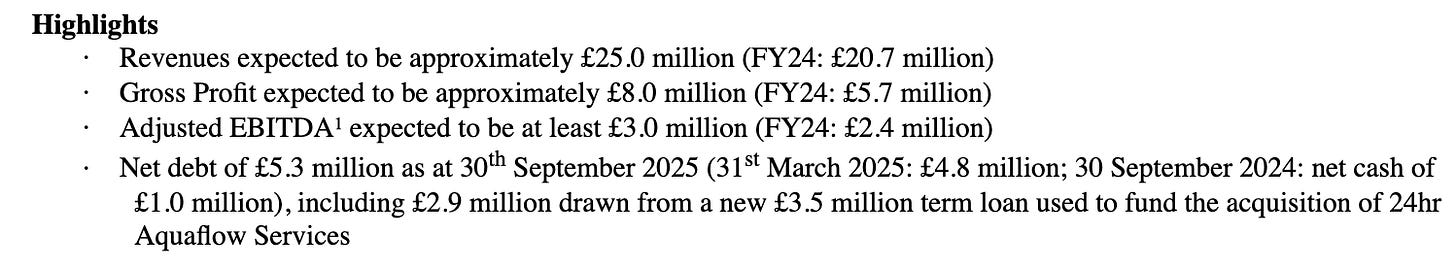

468) React Group (Ticker: REAT)

12£m special cleaning provider. Recent trading update looking good:

Growth driven by M&A and ‘continued momentum across service lines’. 85% recurring through maintenance contracts. Nevertheless highlights delay of decision making of customers. Aquaflow was acquired for up to 7,4£m (6x EBITDA), its founder remained involved. REAT sold its unprofitable rail cleaning business last year. Adj. EBITDA is mostly adjusted for amortisation of intangibles. Low capex, no dividend, most cash used for M&A. Trading at ~7x EV/adj. EBIT. Chair owns 2%, CEO joined in 2019. Did benefit from covid, top line growth continued afterwards but profitability reduced. Looks interesting, watchlist. There are multiple great write-ups: Write-up by @Eli Courtney, write-up by @Matt Newell, write-up by @Just A Value Investor.

469) Real Estate Investors (Ticker: RLE)

58£m UK real estate investment trust, focussed on commercial properties. 9£m rent income a year, 82% occupancy. Reducing debt and selling properties. 54£m ‘larger assets prepared for disposal in 2026, offering a clear path to full debt repayment and enabling future capital returns to shareholders’, representing about 45% of all property assets. 88£m NAV, 37£m bank debt. 5% dividend yield (dividends decrease over time as they sell their income generating assets). Is selling properties since years to repay debt, that’s why revenue peaked during covid. Did some share buybacks. Sold properties for 20£m/year every year since 2020. So I’d not expect them to repay all debt next year. Cost of debt reduced from 6,5% to 6%. I think it’s the first real estate company I come across on AIM which is taking advantage of a NAV discount. Chair joined in 2010, CEO in 2006 and owns 10%. I’m not sure whether the plan is to just sell it all and shut down the business, but from a capital allocation perspective it’s interesting to watch. Watchlist. Write up by @The Oak Bloke:

470) Red Rock Resources (Ticker: RRR)

3£m exploration and development company for various metals and O&G around the world. Actively managing its portfolio. E.g. just sold licences in the Ivory Coast for 0,3£m and will receive royalties in the long run. 12£m NAV. Pass.

Wrap-up

470/669 companies covered so far.

Watchlist: 63/470.

Pass: 407/470.

No-Revenue counter: 101/470.

Feel free to provide opinions and sources on any of the stocks. Cheers.

Watchlist

Part 1: 4GBL (Delisted), ABDP, ASCO, AMS; Part 2: ALT, ALU, AMCO, ANG; Part 3: ANCR, AT, AVG, BPM; Part 4: BGO, BEG, BIG, BRCK; Part 5: CBOX; Part 6: CLBS, CEPS, CER, CKT, CHH Part 7: CFX; Part 8: CSSG, CRPR, CVSG; Part 9: DFCH, DOTD; Part 10: EAAS; Part 11: None; Part 12: FIN, FNTL, FKE; Part 13: FLO, TUNE, FRAN, GBG; Part 14: DATA; Part 15: HDD, HAYD, HERC; Part 16: IDOX, ING; Part 17: JNEO, JDG; Part 18: KITW; Part 19: LST, WINK; Part 20: MLVN, MBH; Part 21: MAB1, MWE; Part 22: WINE, NWT, NTBR; Part 23: OHGR, OGN; Part 24: OMG, PEB; Part 25: TPFG; Part 26: QTX, REAT, RLE

Just a couple of comments re QTX. I drive a works wagon with a Masternaut system, one of the QTX rivals. They are owned by Michelin, who took them over c2019. It is a good service and well supported when it fails. A stiff competitor maybe? As you mention there has been an uptick in business post-covid, there could be two reasons. First I think this is when the CEO returned. The company had languished after he left, but his return seems to have boosted the business again. Also there has been an explosion of plant thefts, mainly to order and for export to Eastern Europe. Using tracking devices is now required by some insurers. I agree it is one to watch, but a current PER of 20 is not inviting.

Thank you Saesch for the cross reference. I'd forgotten about my article "Keepin' i' RLE". Is it coz I is forgetful? https://increasingodds.substack.com/i/180016527/real-estate-investors-ticker-rle

I enjoy your series and read it every week. But it always seems that you make more passes than Don Quixote! But then you are clear in what you are looking for - passing on what you dislike makes sense.

Best

OB