AIM A-Z Part 28: Buy-Improve-Sell Playbook and 3x solid >7% Dividends

Ticker 486 to 495 on London's Alternative Investment Market (AIM)

Welcome,

I thought this would be the part where we reach ticker 500, but as there are four watchlist companies in just 10 tickers, the part would have been too long. A cash shell, led by Ex-Melrose CEO, finally bought another company and three cheap companies with dividend yields >7%, two being rather boring ones with a solid track record while the other goes through a SaaS transition.

Before diving in, I would appreciate if you take a minute to help deciding about future content on this blog: As I started this series back in April, my plan was to cover all tickers until the end of 2025. I won’t achieve that, but this AIM series will come to an end within the next two months nevertheless. So the questions arises: what’s next?

I would like to keep some sort of AIM series going, sharing interesting developments of covered companies and IPO’s on AIM. But this will not be a weekly series.

So I thought about a weekly or bi-weekly A-Z on the UK Main Market (~1000 companies, 72% are smaller than 1£b, 7% are above 10£b). This is just an idea so far and I would appreciate feedback on how to improve the structure / increase the value of an A-Z series.

If you got other ideas or would be interested in another market, feel free to comment or send me a DM here or on X. Anyways, let’s go into the tickers.

Here you find the last part:

Here you find all other parts: https://increasingodds.substack.com/s/a-z-uk-aim

486) Rosebank Industries (Ticker: ROSE)

Some may know Melrose (7B market cap), a ‘buy, improve, sell’ group. Rosebank was founded by ex-Melrose people to ‘recreate the same’. The Rosebank founder and CEO was CEO of Melrose until 2024. ROSE IPO’d without an operating business in 2024 and acquired ECI in August 2025 for 1,9£b (9x adj. EBITDA), financed through a 1,2£b equity issue and debt. Before, ROSE was a cash shell and temporary suspended from AIM trading (usual procedure when cash shells don’t acquire another business after some time).

Today, ROSE is a 1,4£b company owning ECI, a ‘leading supplier of electrical distribution systems, control box assemblies, and other critical engineered components.’ Management is confident to double the investment within 3-5 years. Here you find their H1 presentation, with more information on the Melrose model and how to improve ECI. In short, operating margins will be increased from 13% to 18%, debt load will be reduced and cash generation will be improved, at least that’s the plan. These three areas were also what has driven returns at Melrose, there was no focus on sales growth for example. To achieve that, working capital arrangements will be improved, sites will be closed, central costs will be reduced. A new finance director was hired for ECI from a company that was owned by Melrose before. Wants to move to the Main Market in Q2. Overall, this is an interesting story, but it just started. For now, it’s all about whether you trust this group of Ex-Melrose people to copy the success or not. No material insider ownership. Total return of Melrose in the last 5 and 10 years: 76%, 473% (I don’t know if there have been spin-offs). Watchlist. Overview by @Cocoa Beans Podcast:

487) Rosslyn Data Technologies (Ticker: RDT)

2£m provider of procurement analytics. Operates unprofitable since ever, multiple share issues, revenues peaked during covid. Reports cash burn at 0,16£m a month (reduced from 0,22£m). 3£m revenue, 80% recurring. Revenue peak apparently attributable to ‘strategic decision not to renew certain low-margin contracts as the Group prioritized sustainable revenue generation’. 1,7£m cash, highlights contract wins, but it does not seem RDT is close to profitability. Pass.

488) RTC Group (Ticker: RTC)

12£m engineering (highways, rail, energy, …) recruitment agency. Latest trading update confirms performance in line with last year, meaning ~97£m revenue and ~2,6£m PBT. Except during the financial crises and Covid, RTC operated profitable since IPO 30 years ago. In H1 2025 alone, 1,5£m was spend on dividends and buybacks. The shares were purchased from an asset manager at a 10% discount. Another buyback tranche in 2024 was executed in the open market. Net cash, P/E ~7, 7,5% dividend. CEO is ‘confident in our positioning and optimistic about our short, medium, and long-term prospects’ and highlights ‘clear revenue visibility’. He owns 5,5%, joined the board in 2007 and was appointed as CEO in 2023 following the death of the prior one, CFO joined in 2014. In 2024, two customers accounted for 40% of revenues. I’m still not sure whether seeing that high customer concentration as a red flag in competitive industries like this or not. But it’s cheap with solid capital allocation, watchlist.

489) Rua Life Sciences (Ticker: RUA)

8£m contract developer and manufacturer of medical devices with its own licensed implantable products. 60% of revenue from two customers. 5,1£m revenue, was operating unprofitable since ever, but is now expected to ‘continue to be EBITDA positive’. Acquired a company that was part of a wider medical devices group which went insolvent for 80£k, which now contributed revenues of 2,2£m. Management believes this company can have a 30% net margin on 3£m revenue. No insider ownership, CEO joined in 2011. There are no detailed recent numbers and in the latest ones management highlighted operating breakeven, but only after a non-operating gain on the bargain purchase of that mentioned company. Pass.

490) RWS Holdings (Ticker: RWS)

285£m ‘AI solutions company’, mainly providing translation software tools, but also knowledge and IP management. Recent FY results show -4% revenue and -43% adj. PBT due to lower gross margins to 60£m. 90£m goodwill impairment ‘relating to Language Services and Regulated Industries’, 22£m restructuring costs. Company is in ‘transition to a technology-led, AI-driven growth strategy’. Expects low single digit revenue growth and slight margin expansion for 2026, with momentum accelerating in the medium-term. 763£m NAV (mostly intangibles). Dividend cut by 50%, still a 14% yield. Chairman stepped down. Is transitioning to as SaaS model, representing 46% of licensing revenue. There was a 10% buyback in 2024. Margins cut in half over the last decade. This feels like a company looking for its place in the AI era which missed out on the SaaS era, but the market does not seem to trust it to find one with an P/Adj. PBT of 5 and a that high yield. CEO just joined. One director owns 24%, he was Chairman from 2003 to 2023 and led the buy-in of RWS in 1995. Many things look ugly here and I’m not sure how relevant their tools really are, but the SaaS transition and valuation are interesting and if 2025 was the operational bottom, it’s too cheap. Watchlist.

491) Sabien Technology Group (Ticker: SNT)

2£m company providing technology to reduce CO2 production in heating, cooling and transport. Operates unprofitable since ever with a bumpy top-line. Opened its first regenerated green oil plant in Korea. Only number that increased in recent years is the number of outstanding shares, pass.

492) Safestay (Ticker: SSTY)

11£m European hostel group. Is selling and leasing back freehold properties in the UK: ‘the Board is considering various strategic options, including further disposals and/or the sale and leasebacks of certain of the Company’s properties and/or an equity fundraising’. 3,3£m operating cash flow in H1, 80% of that used for capex, leases and interest payments. Highlights continued pricing pressure. Operates 21 hostels and is developing more. 68% occupancy rate in H1. Average revenue per bed/night of 16£. 31£m NAV, freehold properties valued at 23£m. Costs well controlled, flat since 3 years. Nothing sparks my interest, pass.

493) Sancus Lending Group (Ticker: LEND)

2£m ‘alternative finance business, which owns a small and medium enterprises lender and a portfolio of FinTech SME-focused lending platforms’. Wants so simplify its capital structure by buying back its zero dividend preference shares. Latest trading update shows 25% revenue growth to 16,7£m in the last 10 months, with 147£m newly written loan facilities and loans under management of 301£m. Is working on ‘achieving long term operating profitability. A family office owns 51% of shares, CEO joined from them in 2021. Pass.

494) Sanderson Design Group (Ticker: SDG)

32£m ‘luxury interior furnishings company that designs, manufactures and markets wallpapers and fabrics’. @David Katunarić wrote about SDG last year in more detail:

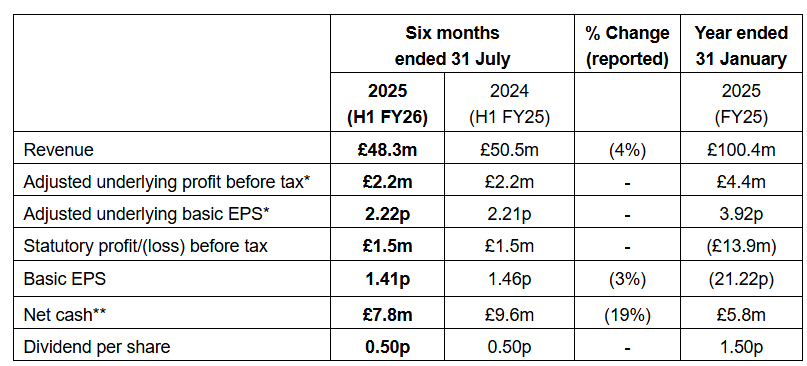

Latest H1 results look alright:

Reports weak consumer sentiment. Expects 1,5£m annual cost savings from factory restructuring, additionally to 1£m expected cost savings from reduced central overhead costs. Highlights new licensing agreements for their brands and launch of an online shop in the US. Licensing revenue grew 6% what partly explains flat profits despite decreased revenue, as gross margins here are 100%. Net cash increased due to lower inventory. 69£m NAV. No capex planned for their factories currently after higher investments for digital printers in the prior year. 7% dividend, P/E excluding cost savings ~9-10. The outlined areas for potential growth by David, the US expansion and licensing, are performing well, but are masked by weak performance of other segments. Generally, revenue ranges between 90£m and 115£m since 2017. There is no material insider ownership, CEO joined in 2019 from a brand owned by LVMH. It’s on my watchlist anyways. CFX is an AIM-listed competitor, probably the only buyback machine on this exchange. David covered this as well:

495) Sareum Holdings (Ticker: SAR)

Who hoped for a no-no-revenue-part, sorry. 17£m no-revenue biotech. Share price got cut in half for no obvious reason in October. Afterwards, SAR discontinued a 16 week study for safety reasons. The available data until this point suggests that their drug is not effective. Pass.

Wrap-up

495/669 companies covered so far.

Watchlist: 70/495.

Pass: 425/495.

No-Revenue counter: 106/495.

Feel free to provide opinions and sources on any of the stocks. Cheers.

Watchlist

Part 1: 4GBL (Delisted), ABDP, ASCO, AMS; Part 2: ALT, ALU, AMCO, ANG; Part 3: ANCR, AT, AVG, BPM; Part 4: BGO, BEG, BIG, BRCK; Part 5: CBOX; Part 6: CLBS, CEPS, CER, CKT, CHH Part 7: CFX; Part 8: CSSG, CRPR, CVSG; Part 9: DFCH, DOTD; Part 10: EAAS; Part 11: None; Part 12: FIN, FNTL, FKE; Part 13: FLO, TUNE, FRAN, GBG; Part 14: DATA; Part 15: HDD, HAYD, HERC; Part 16: IDOX, ING; Part 17: JNEO, JDG; Part 18: KITW; Part 19: LST, WINK; Part 20: MLVN, MBH; Part 21: MAB1, MWE; Part 22: WINE, NWT, NTBR; Part 23: OHGR, OGN; Part 24: OMG, PEB; Part 25: TPFG; Part 26: QTX, REAT, RLE; Part 27: RCN, RNWH, RGG;

RTC…The conference centre does run a lot of events and houses a large number of the recruitment and training employees in the buildings on the site.

It certainly washes its face as far as the cost of running the site is concerned and actually moved into profit recently.

Mello held its tenth anniversary event there just over a year ago so 400 investors will have seen it close up…A very interesting building and there are 48 hotel bedrooms on site too.

The biggest issue for me as a long term shareholder is that the directors are paid at least twice the level of remuneration that one would expect in a £11.5m market cap company and a large group of shareholders are about to act on the situation.

The company has had static turnover and profits for the past three years but the directors take huge bonuses as if to say they have have massively increased the returns for shareholders too…but they have not!

It needs to stop and there would be a benefit to a larger company if the £1.5m cost of the board could be reduced significantly and added to the £2.6m of pbt each year not to mention the listing costs and HQ savings.

So if any of you are RTC shareholders do let me know as we are currently at 23% in agreement on this and growing. We have written to the board with our request for a strategic review and so change should happen in a positive way we hope.

Thank you again. As usual, a great read. Just an add on RTC: they have a massive conference centre in Derby. I think it was the old LNER training school. I was in it once, and it must cost a fortune to maintain. It seems rather a luxury to me, massaging the egos of managers who foster links to the golden age of the railways. Having said that, if the government ever gets its act together and launches some infrastructure projects, this should fly (has a horrible spread and is very thinly traded).