AIM A-Z Part 22: Buybacks, NAV Discounts, Quality Medtech and Solid Drinks

Ticker 391 to 405 on London's Alternative Investment Market (AIM)

Welcome,

this part is one of the better. Despite some struggling companies, most are profitable. Lot of NAV discounts and buybacks, mix of various industries. Three for my watchlist, only one mining & biotech shitco. Let’s go.

Here you find the last part:

Here you find all other parts: https://increasingodds.substack.com/s/a-z-uk-aim

391) N4 Pharma (Ticker: N4P)

5£m no-revenue biotech focused on cancer therapies. Pass.

392) Nahl Group (Ticker: NAH)

19£m provider of marketing services for law firms, services for claimmants and defendants in the serious injury market, surveys and property searches. Revenue flat since years, so is EBIT (about 40£m and 4£m). 40£m goodwill impairment in 2024. NAV = Market cap. No dividends or buybacks, cash used to repay debt and for payment to ‘Limited Liability Partnerships’. 6x EV/EBIT, more like 12x when adjusting for LLP payments. Pass.

393) Naked Wines (Ticker: WINE)

58£m online retailer of wines. Just completed a 2£m buyback at ‘prices well below the Board’s view of intrinsic value’. Latest trading update confirms FY26 guidance of 200£m to 216£m revenue, 5,5£m to 7,5£m adj. EBITDA and up to 39£m net cash at the end of the year. This excludes ~12£m in anticipated inventory liquidation costs as management works on reducing inventory levels to raise up to 40£m in liquidity. Management communicated a new plan to stabilize the business at 200£m to 225£m by FY29 (revenues peaked at 340£m during covid) and reaching 10£m - 15£m EBITDA due to cost reductions. G&A costs have already been reduced by 5£m last year and management says the company is operating cash flow positive fundamentally. Cash flow elevated right now due to the inventory reduction.

We are also sharing our new Capital Allocation Priorities. Our focus is to maximise intrinsic value per share, prioritising the agreement of a near-term ongoing limited distribution strategy with our finance partners, and unlocking significant potential one-off shareholder returns over the Medium Term as the business is sustainably profitable. […] More significant distributions [than the 2£m buyback] are envisaged in the Medium Term, supported by cash generation and growth in profitability.

No long-term debt, only question is what’s the real value of the 97£m inventory. Seems like there is a membership model of monthly wine deliveries and customers can support winemakers with monthly payments to get some more exclusive deals (so called Angel Funds). I have no clue about wines, but this strategic review seems to be going into the right direction. CEO joined in 2023, with experience in the online beverage sector. CFO joined from Mind Gym (covered in the last part) last year. Watchlist.

394) Nativo Resources (Ticker: NTVO)

2£m no-revenue gold exploration and development company with projects in Peru and Argentinia. Pass.

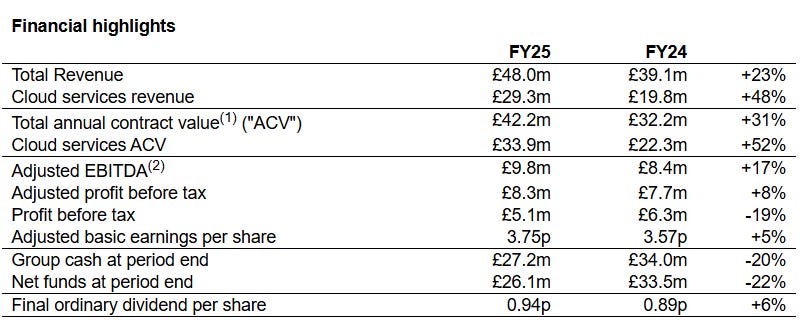

395) Netcall (Ticker: NET)

207£m ‘software company that unites automation and customer engagement in one AI-powered platform’. Basically it’s all about digitising and simplifying processes. Latest results are a mixed bag:

Organic growth of 10%, 80% recurring, margins down due to investments. Reading the RNS the focus is really on top line growth here. FCF incl. SBC ~6£m, ~3£m software capex. Chair joined in 2004 and was CEO for 20 years, new CEO joined in 2010, but only 5% insider ownership. Not my cup of tea, pass.

396) Newmark Security (Ticker: NWT)

12£m provider of security installations like access control tools. Share price is up 70% since September after solid FY results with just 3% revenue growth but >10% profit growth due to increased gross margin. 0,7£m after-tax profits, but incl. a tax credit. CEO who joined in 2013 owns 20%. Another shareholder who owns 20% wanted to replace a board member, but withdrew its vote against him after ‘constructive work’: We are grateful for the assurances that we have received that the proposed reconstitution of the NWT Board will lead to closer alignment of Management’s compensation with the profitability attributable to the Company’s shareholders. We look forward to working constructively with NWT’s board for the benefit of all NWT shareholders.

Profitability is generally increasing after an unprofitable 2022. Fwd. EV/EBIT ~ 8 (Koyfin). Strategic review for two divisions is ongoing. Is positive for FY26 generally. Worth digging into the past here to understand the shareholders actions regarding management’s compensation. Watchlist.

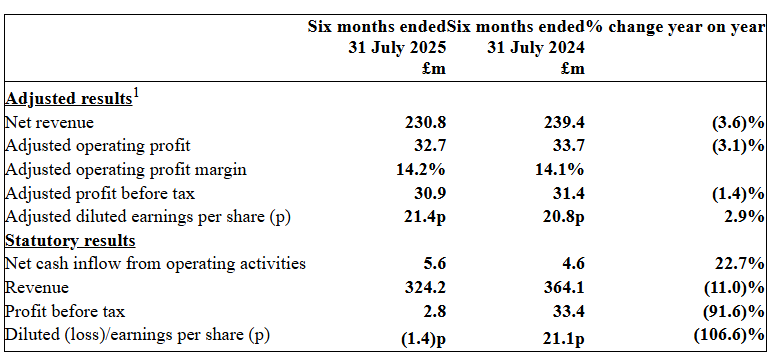

397) Next 15 Group (Ticker: NFG)

390£m growth consultancy combined with market services. Latest results looking meh, including an impairment. New CEO and CFO are working on simplifying the group: reduced portfolio from 22 to 12 businesses. Some sold, some integrated into others, one written off. Just announced one more sale, price not disclosed.

Start of H2 FY26 similar to the prior year, expects trading in line with market expectations without mentioning what they look like. Top line weak due to ‘uncertain macroeconomic backdrop, US tariffs’ what affects marketing spending. Cash equals bank debt. Fwd. P/E of 9 (Koyfin), 4% dividend. Ex CEO owns 5%. Looks like any other average consulting business, rather a pass for me. Write-up by @Robin Research:

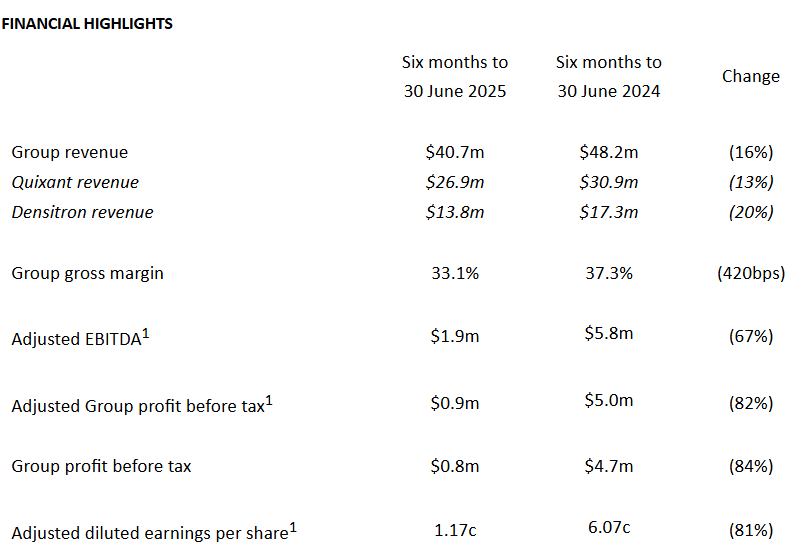

398) Nexteq (Ticker: NXQ)

51£m ‘hardware product business, operating as a technology design and supply chain partner to customers in selected industrial markets.’ Latest results looking ugly due to a change of revenue seasonality. Margins impacted by different product mix and lower customer volumes. Reporting in $.

Highlights ‘strong’ order intake, expects 3,6$m adj. PBT for the full year on 85$m revenue. ‘targeting revenue of $108m-$120m, gross margin of 35-38% and 10-15% EBITDA margin by the end of 2027.’ Drivers for this growth will be ‘understanding of its addressable markets, product innovation, deep customer relationships’. But this is basically just a rebound to 2023 numbers.

Repurchased 10% of shares and is seeking approval for another 10% buyback. The Quixant divison is related to the gambling market as it seems, just received a ‘mass production purchase order’ in Brazil, no contract value mentioned. NCAV = MC, NAV of 70$m. Deputy Chair is the founder of Quixant, owns 19%, Mullins family owns ~10%. Revenue flat since years, struggling with margins since covid. Pass.

399) Nexus Infrastructure (Ticker: NEXS)

13£m civil engineering provider for housing and infrastructure projects. Operates unprofitable, but FY25 trading update highlights 16% revenue growth (partly through M&A), reduced losses and a strong order book. Coleman was acquired last year for 5,4£m or 7,7x adj. EBITDA. NCAV 17£m, NAV 28£m. Three customers accounted for more than 20% of sales each last year. Pass.

400) Nichols (Ticker: NICL)

382£m soft drinks group. Latest H1 results show more or less flat numbers with 85,5£m revenue and 14,6£m adj. EBIT. Working on simplifying its ‘out of home’ division. Implementing new ERP system. Revenue flat since 3 years, operating margin 6% below pre-covid levels. 3% dividend, 15x fwd. P/E. Reports 23% ROCE. CEO joined in 2013 and is the only executive board member, looking for new CFO. Expects 33,1£m adj. PBT for the full year. 60£m in cash, no debt. Seems like a solid company, but that’s it. Pass.

401) Niox Group (Ticker: NIOX)

288£m manufacturer of diagnostic products for asthma and COPD. Latest H1 results show 20% revenue growth, 30% adj. EBITDA growth to 9,2£m driven by operating leverage. 20% of revenue related to research such as clinical trials. 70% is recurring revenue from consumables. Got profitable in 2023, margins growing since then. Debt-free, 5£m dividend and returned 21£m via tender offer. New CEO/CFO, but both joined the company in 2019 in other roles already. 23x fwd. adj. P/E (Koyfin). Expects sustained growth. Looks like a quality medtech company, but rather a pass for now, for valuation reasons.

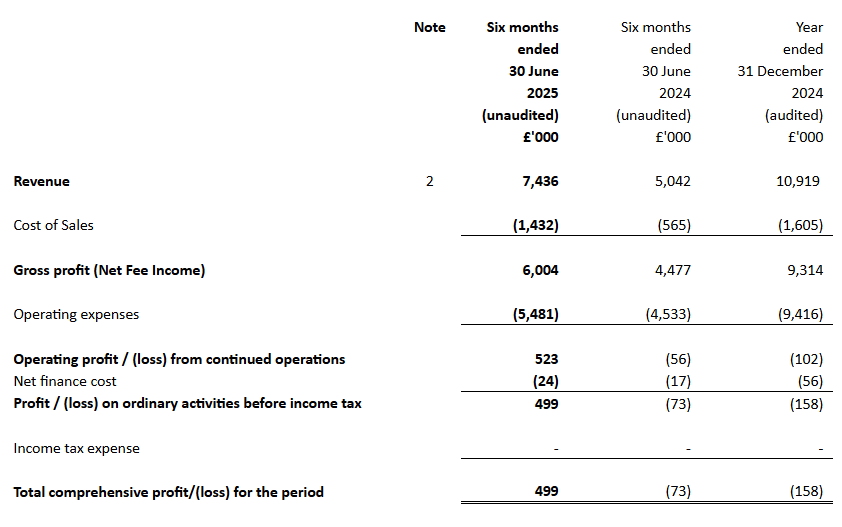

402) Norman Broadbent (Ticker: NBB)

5£m ‘professional services firm focused on executive search, senior interim management solutions and bespoke leadership advisory services’. Share price just doubled on strong performance. Did a share reverse split.

Growth and return to profitability driven by: ‘direct result of our business transformation, our upgrading of staff and the strategic investments made in headcount growth over recent years. The significant NFI growth in the first half has been achieved with no net increase in fee earner headcount, and reflects the staff upgrades we’ve made and new hires becoming more established and increasing their contribution. Furthermore, our continual focus on productivity and discipline on overheads is ensuring this growth translates into healthy EBITDA and cash generation.’ Highest backlog of projects in history. Expects continued profitability in H2, despite not on the H1 level. Worth mentioning there was no tax charge, likely due to tax credits from unprofitable days. Financials are bumpy historically. Pass.

403) Northamber (Ticker: NAR)

8£m unprofitable IT and audio-visual distributor. New CFO. Just acquired an unprofitable distributor in the Netherlands for 2£m (roughly equals tangible assets), also repurchased ~1% of shares. Latest results show increased losses and ~20% organic revenue, offset by M&A. Reminds me of MIDW who also reported a depressed market. ‘In the mid-term we are cautiously optimistic that our focus and investments will allow us to drive growth of strategic business units and therefore unlock long term value for shareholders.’ Did various M&A deals, some units are operating profitable. NAV of 21£m, NCAV > MC as well. Probably in need of new capital as they need to invest in inventory for growth, but there is no long-term debt. Operates unprofitable since ever. Pass.

404) Northcoders Group (Ticker: CODE)

3£m technology training business focused on teaching software development or data engineering. Share price crashed 80% ytd, I assume because a 10£m government contract was not extended, but CODE is still profitable (~0,1£m in H1). 5,4£m NAV. Contract was not extended as the government wants to move to a more localised contract structure and it seems like CODE is waiting for these local contracts now. Founder owns 16%, COO owns 12%. Announced a couple small contracts in private sectors. With 9£m revenue last year, losing a 10£m contract (over 18 months) is horrible obviously. Reduced overhead costs by 20%, reports unprofitable years regularly. Pass, but probably one that rebounds once contracts are announced.

405) Northern Bear (Ticker: NTBR)

15£m ‘group of specialist building services companies offering construction, roofing, electrical, and fire protection services across Northern England’. Share price doubled ytd after strong FY25 results due to dry winter months which benefited the roofing division. FY26 numbers will likely be flat (3,8£m adj. EBIT). Used a 3,5£m loan to buy back 28% of shares last year (an amazing decision considering the doubled share price today). Due to a one-off this loan was recently repaid. Also paid special dividends in 2023 and 2025. That’s some good capital allocation for such a small business. NAV of 22£m. Appointed the ex-Chair Howard Gold as ‘Life President’ for his work during the financial crisis, in this role he is part of the board today. But highlights hard to predict operational performance due to monthly variability. 6,5x P/E. Not the highest quality industry to operate in, but it’s cheap with solid capital allocation, watchlist. Piece by @Cyrill:

Wrap-up

405/669 companies covered so far.

Watchlist: 55/405.

Pass: 350/405.

No-Revenue counter: 85/350.

Feel free to provide opinions and sources on any of the stocks. Cheers.

Watchlist

Part 1: 4GBL (Delisted), ABDP, ASCO, AMS; Part 2: ALT, ALU, AMCO, ANG; Part 3: ANCR, AT, AVG, BPM; Part 4: BGO, BEG, BIG, BRCK; Part 5: CBOX; Part 6: CLBS, CEPS, CER, CKT, CHH Part 7: CFX; Part 8: CSSG, CRPR, CVSG; Part 9: DFCH, DOTD; Part 10: EAAS; Part 11: None; Part 12: FIN, FNTL, FKE; Part 13: FLO, TUNE, FRAN, GBG; Part 14: DATA; Part 15: HDD, HAYD, HERC; Part 16: IDOX, ING; Part 17: JNEO, JDG; Part 18: KITW; Part 19: LST, WINK; Part 20: MLVN, MBH; Part 21: MAB1, MWE; Part 22: WINE, NWT, NTBR

Lovely job. Thank you. (Nichol's are the Vimto people. They have big sales in the Middle East, especially around Ramadan. At the mo it remains overpriced, but there have been two failed takeover attempts in the past. These were blocked by the family interest, who still have two board members. If they lose interest and the price gets into the 800s again, it could represent an opportunity).