AIM A-Z Part 23: High-Margin Landscaping driving Profits, Take That Recordings and Efficient Surgeons

Ticker 406 to 420 on London's Alternative Investment Market (AIM)

Welcome again,

in the last parts we didn’t see many biotech/mining companies, but this part makes up for those wonderful missed opportunities. Jokes aside, the other companies are mostly profitable and interesting. Two for my watchlist. You’ll find a special situation in India, a niche music rights manager, an UK small cap asset manager in case you need more AIM exposure and a company with a strongly growing landscaping business somewhat hidden by a cyclical agriculture segment. Let’s go.

Here you find the last part:

Here you find all other parts: https://increasingodds.substack.com/s/a-z-uk-aim

406) Novacyt (Ticker: NCYT)

28£m unprofitable ‘molecular diagnostics company providing a broad portfolio of integrated technologies and services, primarily focused on the delivery of genomic medicine’. Cost reduction ongoing, but still reporting 7£m EBIT losses in H1 2025. No bank debt, 23£m in cash. Pass.

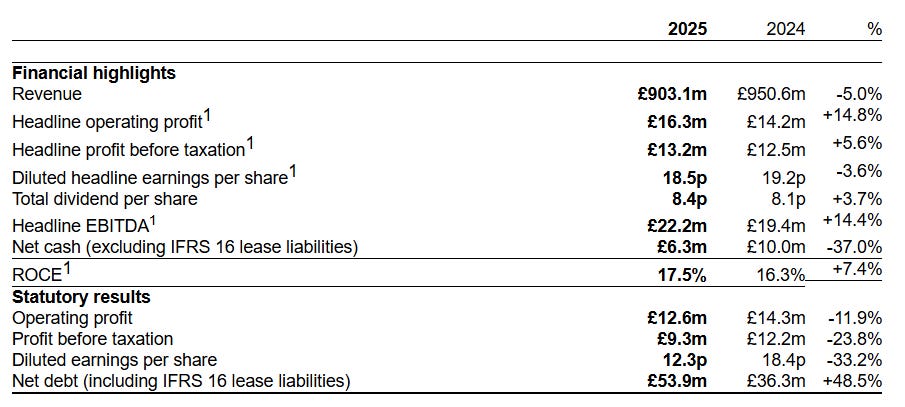

407) NWF Group (Ticker: NWF)

84£m fuel, food and animal feed distributor. Latest trading update highlights lower demand in fuel, but strong performance from food & feed due to high volumes in feed and successful restructuring of the food segment.

In FY25 NWF’s revenue was suffering from decreased feed and oil prices, partly offset by named restructuring. Fuel accounts for 50% of profits. NAV = market cap. 5% dividend. 8x fwd. P/E. Not expensive, but probably fairly valued considering commodity price and regulatory risk. Most cash flow used for lease payments and capex. CEO joined in 2017. I think I’d prefer distributors in other niches. Pass.

408) Ondine Biomedical (Ticker: OBI)

64£m highly unprofitable life sciences company ‘leading the charge in breakthrough photodisinfection-based therapies to prevent and treat serious infections.’ Likely in need of more cash soon. Reports increasing adoption of technology by hospitals and clinical trials. Pass.

409) One Health Group (Ticker: OHGR)

33£m ‘independent provider of NHS-funded surgical procedures’. Surgeons are mostly employed by NHS with subcontracts, procedures are done in independent hospitals and clinics. Got 80 ‘consultants’, who are basically surgeons as far as I understand, plus anaesthetists. Completed 4000 surgical procedures in H1, up 17% (driven by more consultants and hospitals/clinics). Board expects 29,6£m revenue and 2,3£m adj. EBITDA for FY26. IPO’d in March. Funds will be used to grow organically with more surgeons. Wants to build up its own ‘surgical operating capacity’ and is waiting for approval, so there will be some capex spend on construction.

UK government aims that 92% of patients should not wait longer than 18 weeks for treatment by March 2029, with an interim target of 65% by March 2026. This policy seems to be the driver for OHGR’s subcontract model. Requires some more research on competition for surgeons between OHGR and hospitals or whether it’s rather a cooperation between them, as well as the NHS funding. I have no idea, but I could imagine one government policy could end this business model? There is a 5-year contract in place with NHS that backs about 70% of revenue. 11x EV/adj. EBITDA. Chairman is the founder who worked for the NHS before (he and his wife own 40% of shares), CEO joined in 2018, COO joined in 2005. Watchlist.

410) One Media IP Group (Ticker: OMIP)

8£m music rights acquirer, publisher and distributor. E.g. operates Youtube channels or is licensing its music right for TV shows. H1 report shows a weak top-line, but increased margins due to cost control. Sold a loss-making subsidiary. 0,5£m profits for H1 (excl. losses from the sold subsidiary). 1,5% dividend, 11x fwd. P/E (Koyfin). Some big share issues in the past, I assume for acquisitions as OMIP operates highly profitable since 15 years. Founder & CEO owns 12%. Acquires catalogues of licenses regularly, e.g. some unreleased Take That recordings in 2021. Highlights placement of music in TV shows regularly, seems important. Not sure whether I like the business, rather a pass as nothing sparks my interest.

411) Onward Opportunities (Ticker: ONWD)

39£m investment company focused on small LSE companies ‘with potential for increased valuation through strategic, operational, or management initiatives. It aims to hold minority stakes of 5-25%’. NAV up 40% since April 2023, is invested in various companies covered in this series. Chairman is also on the board of Pershing Square. Might be interesting for people who want UK small cap exposure with some sort of catalyst investing style. Pass.

412) OPG Power Ventures (Ticker: OPG)

23£m developer of power generation assets in India. Just announced a tender offer with a 15% premium for up to 45,4% of outstanding shares. NAV of 164£m. NCAV of ~30£m. An investigation into alleged regulatory non-compliances is ongoing, maybe that explains why nobody cares about the buyback announcement? Repaid its debt, cash flow looking strong. Assuming the investigation leading to a bad outcome is the bear case, this may present an interesting special situation betting on a good outcome. 20£m operating cash flow, just 3,5£m capex, not really much debt left to deleverage further. Pass for me tho.

Edit: @Going Concerns explained the tender to be an attempt to take OPG private as the Gupta Family owns the remaining shares. This explains why the stock price didn’t really react to the tender announcement.

413) Optibiotix Health (Ticker: OPTI)

8£m unprofitable biotech working on human microbiome modulators. Unprofitable since ever, revenue bumpy. Just listed on an US otc market. H1 results show doubled revenue to 0,5£m but on increased 1,5£m losses. Highlights new distribution agreement and other partnerships. Can’t tell whether it’s just another bumpy revenue year or some sort of inflection point. Pass.

414) Optima Health (Ticker: OPT)

176£m provider of corporate health solutions in occupational health. Trading update shows 17% growth in H1 to 59£m revenue. Working on a 210£m contract to deliver services to UK armed forces and expanded to Ireland. M&A is part of the strategy. Adj. EBIT margin of 13%, IPO’d last year. One customer accounts for ~14% of revenue. British billionaire Michael Ashcroft owns 25% of shares. CEO joined in 2013, led the company through a management buyout in 2015 and the acquisition by Marlowe in 2022, as well as the de-merger leading to the IPO in 2024. OPT seems to offer mainly consulting, but also organizes on-site events and health assessments and employs physicians, nurses and therapists. 16x fwd. adj. P/E (Koyfin). I can see why the services are needed, I’m just wondering how popular health services delivered through the employer really are. Rather a pass.

415) Oracle Power (Ticker: ORCP)

7£m no-revenue natural resource development company with projects in Australia and Pakistan. A partner in their gold project received a ‘material contract’ in October, so the share price jumped 4x that day. Pass.

416) Orcadian Energy (Ticker: ORCA)

11£m no-revenue oil exploration and development company with off-shore projects in the UK. Pass.

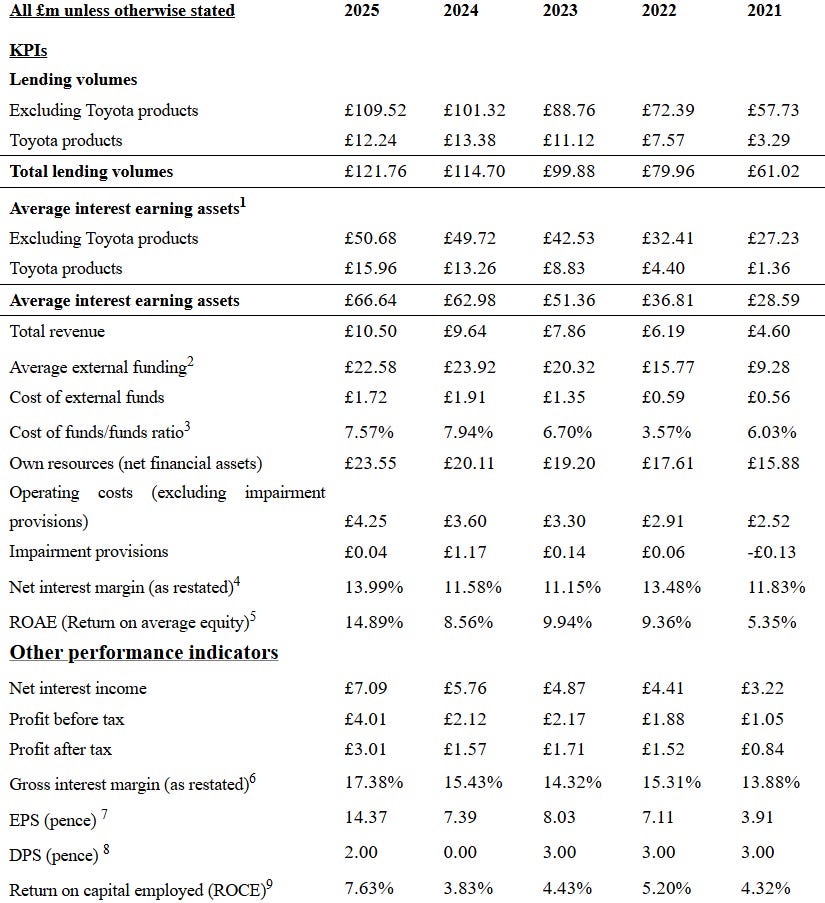

417) Orchard Funding Group (Ticker: ORCH)

13£m financial service company offering insurance premium funding to UK insurance brokers and professional customised fee funding solutions to accounting firms, professionals and small businesses. CEO joined in 2015 and owns 57% of shares. In 2024 the board said that benefits of the AIM listing are limited due to costs, low liquidity and lag of insitutional interest and was highlighting potential tender offers instead of dividends, but nothing happened since then as far as I can tell. Paid a dividend again in 2025. NAV of 21£m. Generally numbers head into the right direction:

It’s cheap, but illiquid and not my cup of tea. Pass. Write up by @No-Brainer Stocks

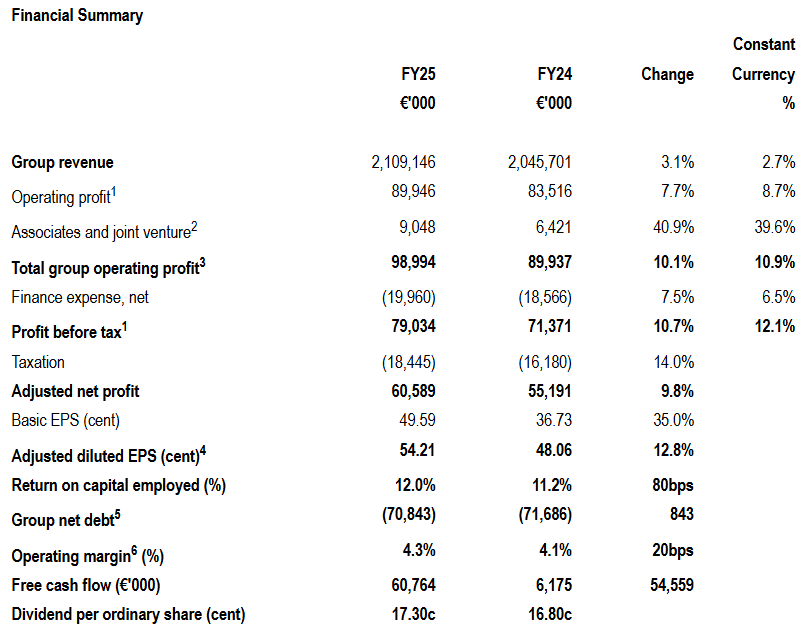

418) Origin Enterprises (Ticker: OGN)

352£m company offering agriculture products like seeds, nutritions, crop protection, distribution of fertilisers and animal nutrition. Additionally, offering line marking paint for sport facilities or equipment for parks, landscaping materials and services such as land restoration and conservation. 4,5% dividend, repurchased 15% of shares in last 3 years. Latest FY numbers looking solid:

Profit growth driven by the higher margin landscaping division, which accounts for <10% of revenue, but 18% of operating profit. This division grew revenue by 25% and profit by 40% through organic expansion and M&A. It seems growing that part is the general plan to be less dependent on agriculture. It’s obviously cheap and the setup of a growing high-margin segment is interesting. CEO joined in 2020 and got no agriculture/landscape background. CFO at least worked for a human nutrition company before joining last year. On track to meet its FY22-FY26 targets, so we might see a capital markets day next year with new targets. Aims for landscape to account for 30% of profits by the end of next year, which is probably not a great KPI considering agriculture is a bumpy business, but at least this confirms the basic investment case. Returned 160£m to shareholders since 2022 (benefited from inflated agriculture earnings in 22/23). I’m interested, watchlist.

419) Oriole Resources (Ticker: ORR)

10£m no-revenue gold exploration company operating in Cameroon and West Africa. Lot of ‘reach’ RNS statements. Just announced secured financing for its drilling programme. Pass.

420) Orosur Mining (Ticker: OMI)

74£m no-revenue gold exploration and development company operating in South America. Share price doubled on positive drilling results. Pass.

Wrap-up

420/669 companies covered so far.

Watchlist: 57/420.

Pass: 363/420.

No-Revenue counter: 89/420.

Feel free to provide opinions and sources on any of the stocks. Cheers.

Watchlist

Part 1: 4GBL (Delisted), ABDP, ASCO, AMS; Part 2: ALT, ALU, AMCO, ANG; Part 3: ANCR, AT, AVG, BPM; Part 4: BGO, BEG, BIG, BRCK; Part 5: CBOX; Part 6: CLBS, CEPS, CER, CKT, CHH Part 7: CFX; Part 8: CSSG, CRPR, CVSG; Part 9: DFCH, DOTD; Part 10: EAAS; Part 11: None; Part 12: FIN, FNTL, FKE; Part 13: FLO, TUNE, FRAN, GBG; Part 14: DATA; Part 15: HDD, HAYD, HERC; Part 16: IDOX, ING; Part 17: JNEO, JDG; Part 18: KITW; Part 19: LST, WINK; Part 20: MLVN, MBH; Part 21: MAB1, MWE; Part 22: WINE, NWT, NTBR; Part 23: OHGR, OGN

NWF is a manufacturer as well as a supplier of animal feeds. They are also acquiring more fuel supply businesses. The business is a lot more dynamic than it appears. They also have an excellent record on dividends. Having said that, the agricultural sector remains in turmoil, so not the safest place to invest currently. At them mo they seem priced about right to me, but if they hit the 140s again they could be a good buy for dividend seekers.

On 412) the share buyback is a take private (at a minuscule premium) - the Gupta family own the remaining 60% of shares. This is why there has been no response. They will be delisting (another AIM listing bites the dust)