AIM A-Z Part 32: Cheap Serial Acquirer

Ticker 536 to 550 on London's Alternative Investment Market (AIM)

Welcome,

many average companies today. Either struggling with profitability or cash stacking up on the balance sheet. But one cheap consumer goods serial acquirer. Let’s go.

Here you find the last part:

Here you find all other parts: https://increasingodds.substack.com/s/a-z-uk-aim

536) Sunda Energy (Ticker: SNDA)

8£m no-revenue gas company with undeveloped projects in Asia. Pass.

537) Sundae Bar (Ticker: SBAR)

21£m no-revenue company ‘creating a marketplace for AI Agents’. Just raised 1£m. SBAR is so early stage, it was worth a RNS statement to tell the world you can now pay for their services on their platform. Impressive. At this point they already announced to buy bitcoin. First things first. Pass.

538) Sunrise Resources (Ticker: SRES)

2£m no-revenue mining company with projects in Nevada. Pass.

539) Supreme (Ticker: SUP)

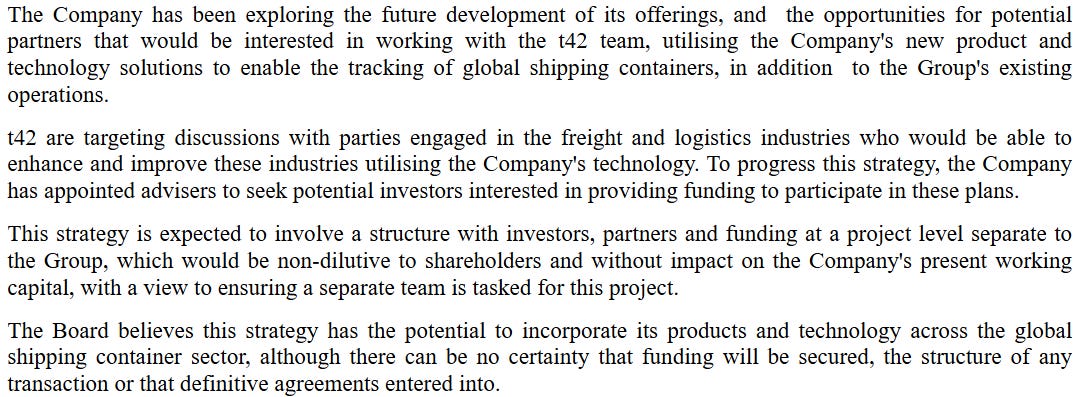

171£m ‘manufacturer, supplier, and brand owner of fast-moving consumer goods’. Operates through three divisions: vaping, drinks & wellness and lighting & batteries. Recent H1 results looking alright:

Growth driven by M&A, lower profitability due to a decline in the battery and lighting segment. Recent acquisitions are a tea brand, carpet care product brand, a soft drinks manufacturer and a brand offering nutrition products like protein shakes. Vaping accounts for >50% of revenue, CEO considers vaping to contribute to a smoke-free UK. I came across SUP before, questions about future vaping regulation form an obvious bear case here. Profits are H2 weighted, trades on 7-8x P/E. 3,5% dividend. CEO and founder owns 55%. It’s on my watchlist and the valuation makes this very interesting. Management is working on diversifying revenue streams. Can recommend write-ups by @Christian Schmidt and @Isaac:

540) Surface Transforms (Ticker: SCE)

23£m ‘manufacturer of carbon fibre reinforced ceramic automotive brake discs’. Recent H1 results show 70% revenue growth to 8£m, apparently due to capacity upgrades. Aims for 50£m revenue. ‘The business is making substantial progress towards sustainable and profitable operations.’ Operates unprofitable since ever. Road to profitability is ‘anchored in awarded contracts’, with 6 contracts in place with a lifetime value of 300£m to 400£m. Expects 20£m revenue and +-0£m EBITDA. Cash flow positive in H1, but only due to working capital impacts. Chairman is with the company since 2002 and is CFO of a 2£b US listed chemical business. CEO joined in 2005, new COO since 2023. It seems management is working on turning SCE into a better business, but it’s too early to tell whether they reach their targets. Also because the automotive market is a tough one, as we know. Pass.

541) Surgical Innovations Group (Ticker: SUN)

4£m manufacturer of medical products used in minimal invasive surgery. CFO will leave. Recent trading update highlights headwinds from ‘the global flu epidemic’, NHS strikes and quality issues. Revenue flat since years, unable to sustain profitability since Covid. Pass.

542) Sutton Harbour Group (Ticker: SUH)

7£m operator of the Sutton Harbour in Plymouth. This area contains residencies, a commercial districts, piers for boats and fishery and tourist activities. Apparently makes money with car parks, the boat piers and fishery activities, while developing land around the harbour. NAV of 34£m. Net debt of 26£m, similar debt levels to other years. Reports weak demand for development and ‘continues to towards its plans to reduce debt and refinance the Company’. ‘Attention is now being refocused to the sale of non-income producing assets, including development land, in addition to other asset sales where buyer interest is being progressed.’ Multiple share issues in recent years. Seems like rate hikes made SUH struggle. Pass.

543) Switch Metals (Ticker: SWT)

11£m no-revenue mining company with projects in the Ivory Coast. Pass.

544) Sylvania Platinum (Ticker: SLP)

301£m mining company focused on platinum group metals with projects in South Africa. Share price 2x in 2025. Q1 report shows 16% increase in volumes, 22$m EBITDA. 6x fwd. P/E (Koyfin). Some small buybacks in the past and a 1,5% dividend. Pass.

545) Symphony Environmental Technologies (Ticker: SYM)

2£m developer of biodegradable plastic technology. FY25 revenue of 5,4£m with 0,9£m adj. EBITDA loss. Is expanding in the middle east, lot of ‘reach’ RNS statements. Pass.

546) Synectics (Ticker: SNX)

36£m ‘leader in the design, integration, and support of advanced security and surveillance systems’. Stock just crashed 30% on FY trading update: 68£m revenue and adj. PBT of 6£m, including a one-off 12£m gaming contract. Excluding that, revenue was flat. Highlights weak end markets, but sees momentum in strategy and says its 26£m order book is ‘solid’. 2% dividend. CEO is happy about a 14£m cash pile with no debt. Maybe it’s time to put that cash to better use than just collecting interest. Overall I’m not sure why the share price crashed, the one-off contract was communicated as such before and FY results were above expectations from July. CEO (owns 6%) and CFO joined in 2024. Fwd. P/E of 18 (Koyfin). Looks like an alright business with an improvable capital allocation. Pass.

547) Synergia Energy (Ticker: SYN)

2£m energy company with a gas project in India and a CO2 storage project in the UK. Seeks to sell its project in India: The aggregate value of the proposed Transaction is US$14 million to be paid in two tranches, the first being US$6.5 million upon completion of the Sale and Purchase Agreement with the second tranche of US$7 million being 12 months after completion. SNX owns 50% here. Will return cash to shareholders via buybacks. Sought delisting from AIM, but shareholders did not approve. Can’t tell how much cash the UK project burns, but I would not expect the majority of cash to be returned. Pass.

548) SysGroup (Ticker: SYS)

14£m IT service provider/consultancy. 10£m revenue on 1,5£m loss, adj. EBITDA of 0,2£m. Lot of AI talk, cut its service desk by 1/3 with AI tools. 22£m NAV, mostly goodwill. Just acquired a ‘specialist provider of enterprise storage, data protection and hybrid infrastructure solutions’ for up to 1,75£m (3,5x ‘normalised’ EBITDA). Doesn’t talk about profitability, so I see no interesting case here. Many other well established, solid companies out there in this sector. Pass.

549) System1 Group (Ticker: SYS1)

28£m marketing company offering tools to predict performance of ads, innovations and ‘health’ of a brand. Recent H1 results show -3% revenue, but -95% PBT to 0,3£m due to lower spending from ‘many of its large customers’ and headcount increase by 20%. Now expects 2£m to 2,5£m adj. PBT for the full year. Reports rule of 40: 3. Close. Most revenue from the UK and US. 11£m cash, no debt. On the website, the CFO is described as: ‘Chris is our laser-sharp, pragmatic, and experienced gatekeeper of the money. He’s also been described as “too nice for a CFO”, which is precisely why he’s been our financial unicorn since 2020.’ Again, maybe update your capital allocation policy, that would be very nice. Pass.

550) T42 IOT Tracking Solutions (Ticker: TRAC)

2£m provider of global shipping container tracking solutions based, operating in Israel. Is working on funding solutions for further development of the technology:

H1 results show 2,3$m revenue and 0,24$m adj. EBITDA, driven by increased (and sustainable) gross margin. Signed a 2,5$ contract which will mostly contribute in FY26. Founder is CEO, he and his son own 14%. Liabilities > Assets, 2,3$m convertible notes repayment has just been postponed to 2027. Pass.

Wrap-up

550/669 companies covered so far.

Watchlist: 81/550.

Pass: 469/550.

No-Revenue counter: 116/550.

Feel free to provide opinions and sources on any of the stocks. Cheers.

Watchlist

Part 1: 4GBL (Delisted), ABDP, ASCO, AMS; Part 2: ALT, ALU, AMCO, ANG; Part 3: ANCR, AT, AVG, BPM; Part 4: BGO, BEG, BIG, BRCK; Part 5: CBOX; Part 6: CLBS, CEPS, CER, CKT, CHH Part 7: CFX; Part 8: CSSG, CRPR, CVSG; Part 9: DFCH, DOTD; Part 10: EAAS; Part 11: None; Part 12: FIN, FNTL, FKE; Part 13: FLO, TUNE, FRAN, GBG; Part 14: DATA; Part 15: HDD, HAYD, HERC; Part 16: IDOX, ING; Part 17: JNEO, JDG; Part 18: KITW; Part 19: LST, WINK; Part 20: MLVN, MBH; Part 21: MAB1, MWE; Part 22: WINE, NWT, NTBR; Part 23: OHGR, OGN; Part 24: OMG, PEB; Part 25: TPFG; Part 26: QTX, REAT, RLE; Part 27: RCN, RNWH, RGG; Part 28: ROSE, RTC, RWS, SDG; Part 29: SAG, SDI; Part 30: SRC, SFT; Part 31: SAL, SPSC/SPSY, SRT, STAF, KETL; Part 32: SUP

The Supreme writeup caught my attention here. The diversification away from vaping into more defensive consumer goods makes sense given the regulatory uncertainty, but the real value prop seems to be the serial acquirer model at 7-8x P/E. I've seen similar businesses struggle when they try to manage too many disparate product lines tho. The founder owning 55% is a good alignment check, but depends on whether management can actually integrate these acquisitions without losing focus.

Good write up as always Saesch. I find it fascinating that a company like Sutton Harbour is listed at all. It either should be part of a larger listed niche real estate business or it should be private. It's been around forever and the free float, on an already tiny business, is less than 10%