AIM A-Z Part 30: Serial Acquirers and a Cyclical Niche Leader

Ticker 511 to 520 on London's Alternative Investment Market (AIM)

Welcome and Merry Christmas to everyone who celebrates,

10 tickers today, most profitable. Two companies with an M&A focus for my watchlist. As of today, there are 629 companies listed on AIM, so we have 109 left. This means there will be 6-8 parts of this series in the new year and afterwards, I will likely keep going on the main market.

Here you find the last part:

Here you find all other parts: https://increasingodds.substack.com/s/a-z-uk-aim

511) Shuka Minerals (Ticker: SKA)

3£m no-revenue mining company with a helium project in Africa. Working on buying more interest in a zinc mine. Pass.

512) Sigmaroc (Ticker: SRC)

1,4£b construction material group focused on lime/limestone. Is ‘purchasing assets in fragmented materials markets and extracting efficiencies through active management and by forming the assets into larger groups’. Is the #1 or #2 in most of its markets. Fundamentals look good in the first place, but growth is only driven by M&A. FY24 was already weak on a pro-forma basis and lower volumes continued in FY25. Due to synergies and cost control EBITDA margins increased. Expects EPS to be ‘no less than 9,5p → 13,5 P/E. 500£b net debt (~2x EBITDA), expects >100£m pre-growth capex FCF, reports ROIC of 6%. Shares outstanding 4x in last 4 years. Highlights first sign of optimism in construction markets. Chair and CEO got a construction materials background. The M&A strategy seems aggressive to me: Revenue 10x in just 5 years. It’s somewhat interesting, but aggressive M&A in cyclical markets can backfire quickly. Low reported ROIC might be depressed due to high M&A upfront investments before synergies are realized. I want to follow along, watchlist. Here you find a summary of their latest capital markets day by @310 Value:

513) Silver Bullet Data Services Group (Ticker: SBDS)

4£m company providing data-based customer relation/marketing services. Lot of AI in recent statements. Raised 3£m, cost cutting ongoing, 2£m loss on 5£m revenue in H1. Two co-founders involved. Pass.

514) Sintana Energy (Ticker: SEI)

~125£m O&G exploration company, IPO’d on 23rd this month. Projects in America and Africa. No revenue in H1 2025. Directors own 14%, pass.

515) Skillcast Group (Ticker: SKL)

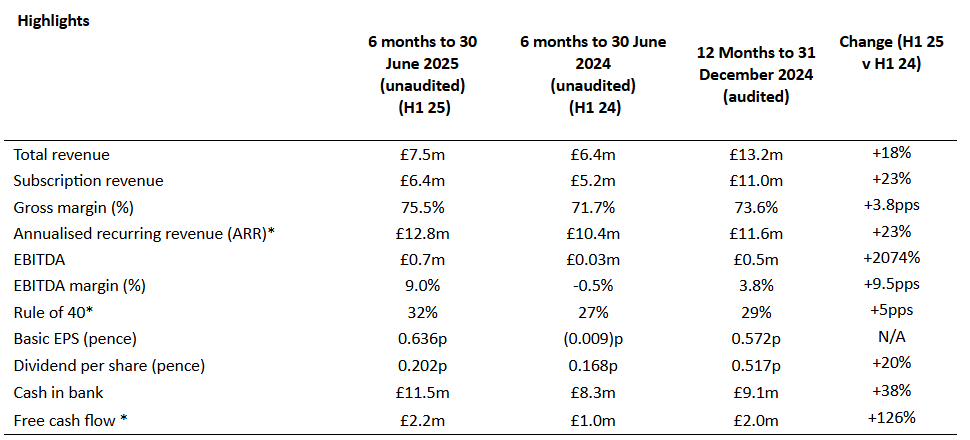

64£m SaaS business offering tools for learning content, activity tracking, compliance: ‘Building ethical and resilient workplaces’. Latest H1 results looking solid:

Mostly recurring revenue, 7% churn rate. CEO is focused on ‘meeting the Rule of 40’ (Calculated as ARR Growth + EBITDA Margin). FCF looking strong due to upfront subscription payments. 40x fwd. P/E (Koyfin), no long-term debt. Looks like an average software business with a high valuation. Three co-founders involved as CEO, CTO and CCO who own 73%. Pass.

516) Skinbiotherapeutics (Ticker: SBTX)

35£m ‘life science group focused on skin health’, selling food supplements, skin and foot care products. Expects 6,2£m and adj. EBITDA of 0,7£m for FY26. FY25 results: 4,6£m revenue and -1,1£m EBIT. I’m not sure what the adjustements to EBITDA are here. Reports some postponed orders into FY26 and it sounds like margin enhancements are expected, also through M&A synergies. High growth generally driven by M&A. Billionaire Mark Dixon owns 13%. Shares outstanding doubled in the last years. Pass.

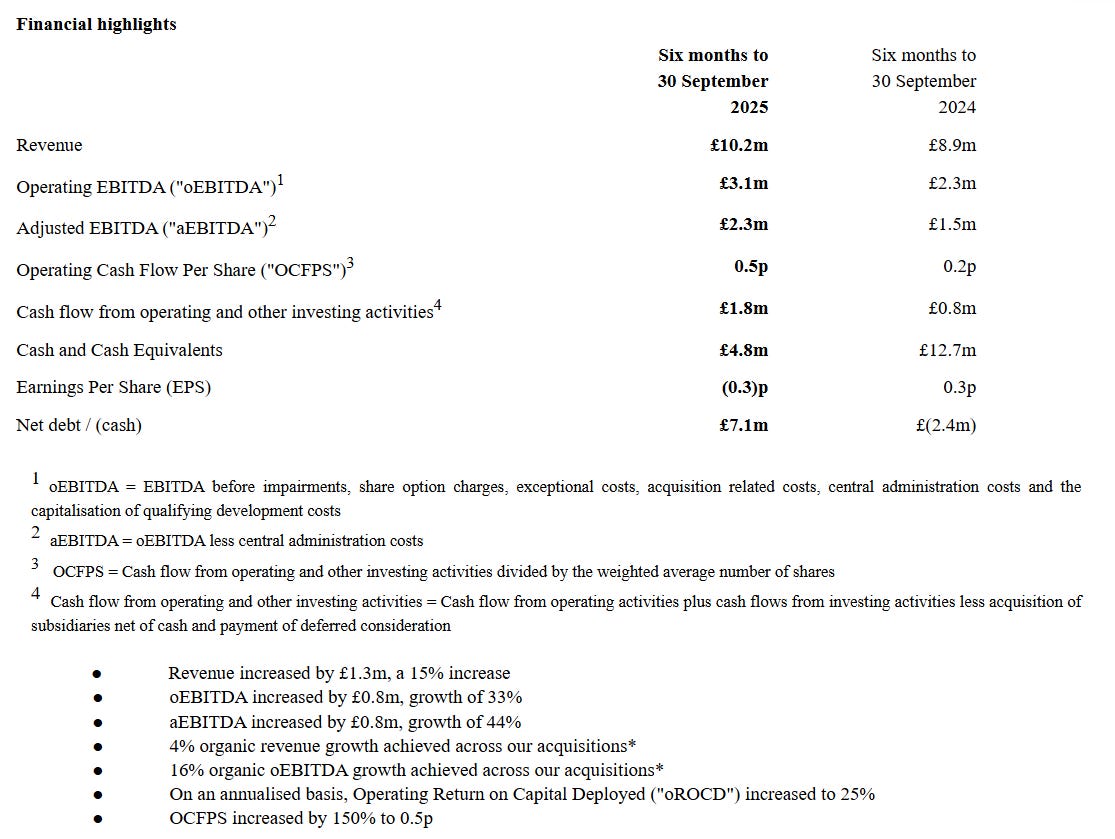

517) Software Circle (Ticker: SFT)

93£m serial acquirer describing its plan as: ‘to be a leading serial acquirer and operator of Vertical Market Software (VMS) businesses in the UK and Ireland - a permanent home for software leaders, teams, and customers’. H1 results:

Reports an operating loss, but mainly due to the amortisation of acquired intangibles. Adj. EBITDA seems fair here, except the 0,5£m capitalized development costs. Consists of 11 business, 24£m revenue run rate with 25% adj. EBITDA margin → ~ 4,5£m adj. EBITDA incl. development costs. Latest acquisitions are:

- AIF, a software platform for insurers, mortage brokers and lenders for 5£m (+4£m earn-outs), 2,2£m revenue and 0,7£m adj. EBIT,

- BIS, a client management software provider for brokers and advisors in Ireland, for 8,25£m, 1,8£m revenue and 0,9£m EBIT.

Seems like fair multiples paid for high-margin software businesses. Two german assets managers hold 40%, German VMS player Chapters Group AG owns 10%. COO of Chapters Group was at Constellation Software before, sits on the board of SFT. Chairman is a manager of a German asset manager (P&R Value). CFO of Judges Scientific (UK Serial Acquirer) is also on the board, interesting guys. CEO and CFO are with SFT since a couple years. Looks interesting overall, even though the valuation of >20x EV/adj. EBITDA is not exciting. Watchlist.

You find various articles about serial acquirers on Substack, especially about vertical market software ones (Constellation Software from Canada, SFT from the UK, Chapters Group from Germany, Vitec from Sweden, …). I want to recommend these two general overviews:

518) Solid State (Ticker: SOLI)

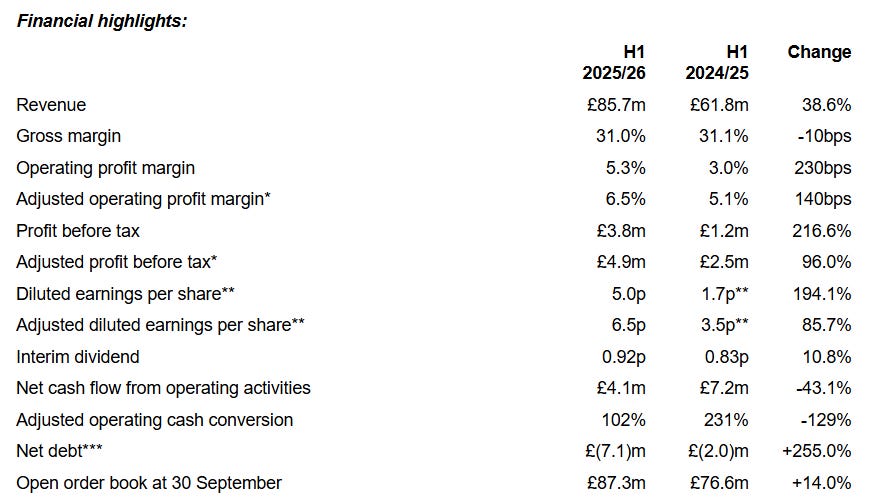

91£m electronic equipment group providing components and systems. Long-standing CEO just died, interim CEO is the managing director of one division. He is with SOLI since 20 years. H1 results looking good:

Revenue growth driven by large contracts in the communication sector. Order book at 30th November of 97£m, highlights various big contracts wins. Expects to deliver on market expectations of 145£m revenue and 7,2£m adj. PBT → 12,5 P/Adj. PBT. Suffering from a weak industrial market, but sees first signs of improvement. No material insider ownership. 30% defense exposure. Acquiring regulary, two companies in 2024. A large 33£m acquisition in 2022. Wants to grow organically by developing sales channels for own brand products, expanding facilities and expand in the US. 1,5% dividend. Some customer concentration from time to time, e.g. 20% of revenue from one customer in 2024. Looks like an alright business, benefiting from defense spending, suffering from weak industrial markets. Rather a pass.

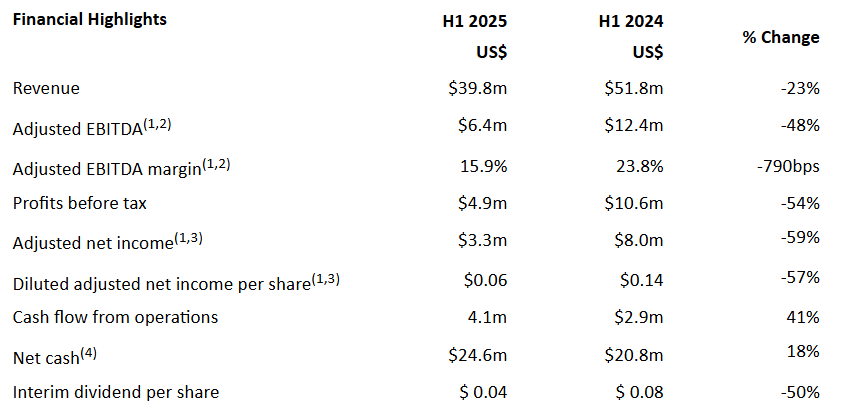

519) Somero Enterprises (Ticker: SOM)

117£m provider of concrete-levelling equipment, training, education. Latest results looking bad ($ reporting):

Reports weak markets amit geopolitical uncertainity. I looked at them before and that’s exactly the problem: SOM is cyclical. The products are fairly simple to understand and margins in good times are very nice, but things get ugly quickly. ‘Ugly’ here looks fairly beautiful compared to many other companies though. Expects 90$m revenue and 18$m EBITDA for FY25 (7,5x EV/EBITDA). New CEO and Chairman. Usually >5% dividend yield. Mostly focused on the US market, that’s where the growth story has been told in the last decade. A stock to buy on a low valuation at the cyclical bottom. Pass. Great post:

520) Sorted Group Holdings (Ticker: SORT)

2£m software provider ‘supports retailers in providing exceptional delivery experiences and analysing post-purchase performance’ by tracking deliveries, returns and exchange of parcels. CFO just left. 2£m losses on 2,5£m revenue in H1. Talks about cost cutting, but not about profitability. Pass.

Wrap-up

520/669 companies covered so far.

Watchlist: 74/520.

Pass: 446/520.

No-Revenue counter: 110/520.

Feel free to provide opinions and sources on any of the stocks. Cheers.

Watchlist

Part 1: 4GBL (Delisted), ABDP, ASCO, AMS; Part 2: ALT, ALU, AMCO, ANG; Part 3: ANCR, AT, AVG, BPM; Part 4: BGO, BEG, BIG, BRCK; Part 5: CBOX; Part 6: CLBS, CEPS, CER, CKT, CHH Part 7: CFX; Part 8: CSSG, CRPR, CVSG; Part 9: DFCH, DOTD; Part 10: EAAS; Part 11: None; Part 12: FIN, FNTL, FKE; Part 13: FLO, TUNE, FRAN, GBG; Part 14: DATA; Part 15: HDD, HAYD, HERC; Part 16: IDOX, ING; Part 17: JNEO, JDG; Part 18: KITW; Part 19: LST, WINK; Part 20: MLVN, MBH; Part 21: MAB1, MWE; Part 22: WINE, NWT, NTBR; Part 23: OHGR, OGN; Part 24: OMG, PEB; Part 25: TPFG; Part 26: QTX, REAT, RLE; Part 27: RCN, RNWH, RGG; Part 28: ROSE, RTC, RWS, SDG; Part 29: SAG, SDI; Part 30: SRC, SFT

I've owned SOM for a while. Always wondered why someone like PE hasn't snapped it up and why it was listed in the UK as a US domicile in the first place. Apparently whenever it's asked they just give some vague answer like current shareholders are a good fit. Don't seem to care about their monopoly slipping, just spitting all profits out as dividends despite no insider ownership. All very strange.

Digging a bit deeper, Regent Gas now own 12%. They took TClarke private last year for £90m and SOM is a similar size.

https://www.easterneye.biz/deep-valecha-regent-group-tclarke/

Could maybe benefit from a change in leadership either from a t/o or the CEO retirement.

Hey, great read as always. Your detailed breakdown of M&A-driven growth models is essential for comprehending true underlying value. How do you account for the cumulative integration complexity when assessing long-term performance for these types of serial aquirers?