AIM A-Z Part 29: NAV Discounts, Gold and an Ex-Fintwit-Favourite

Ticker 496 to 510 on London's Alternative Investment Market (AIM)

Welcome,

reaching ticker 500. Coming across ex-fintwit favorite SDI Group, profitable gold producer and O&G off-shore companies, a struggling shoe retailer. Nothing too crazy before Christmas.

I won’t take a Christmas break here by the way, so you’ll get something to read underneath the mistletoe next Friday. Let’s go.

Here you find the last part:

Here you find all other parts: https://increasingodds.substack.com/s/a-z-uk-aim

496) Savannah Energy (Ticker: SAVE)

140£m energy (gas and renewables) company with projects in Africa. Also owns interest in oil transport infrastructure. CEO owns 12%. Just raised 11£m and signed an agreement to buy back shares from certain shareholders (~7% of shares). 444$m NAV. H1 was only profitable due to ‘Gain on acquisition of a subsidiary’. 62$m interest paid, about 50% of revenue. Pass.

497) Savannah Resources (Ticker: SAV)

99£m no-revenue developer of the ‘largest battery-grade spodumene lithium resource outlined to date in Europe’ in Portugal. Drilling ongoing. Raised 9,2£m to finance the development. Pass.

498) Scancell Holdings (Ticker: SCLP)

106£m clinical-stage cancer biotech. Operates highly unprofitable, only revenue is related to a partnership with a Danish company, which executed a licensing option for SCLP’s antibodies for a 5£m (+1£m upfront) payment that was recognized as revenue. SCLP does not expect any royalty income for now. Pass.

499) Science Group (Ticker: SAG)

236£m group providing professional services, such as product development and advisory services, and manufacturing submarine atmosphere management systems and radio and audio semiconductors and modules. Acquired ~22% of shares of a engineering consultancy firm in H1 2025 which has been acquired months later, leading to a net return of 23,7£m. Following that, the buyback limit has been increased, no idea to which level. Limit was 10£m before. Latest trading update says ‘Science Group remains on track to deliver another strong performance for the year ending 31 December 2025 with AOP in line or slightly ahead of the Board’s expectations’ - whatever that means. H1 adj. operating profit of 11,3£m with revenues up 6,5% to 57,2£m driven by the manufacturing division. Both manufacturing businesses have been acquired in 2019 and 2023, board mentions a ‘successful turnaround since acquisition’ of the submarine business. Net cash of 66£m, 1,5% dividend, 15x fwd. P/E (Koyfin). Executive chair joined in 2010 and owns 18%, managing director in 2004. Looks interesting overall, watchlist.

There is an interesting article by @Mark Allery about SAG’s investment in the consulting firm, although the whole thing is now history: https://substack.com/home/post/p-164630885

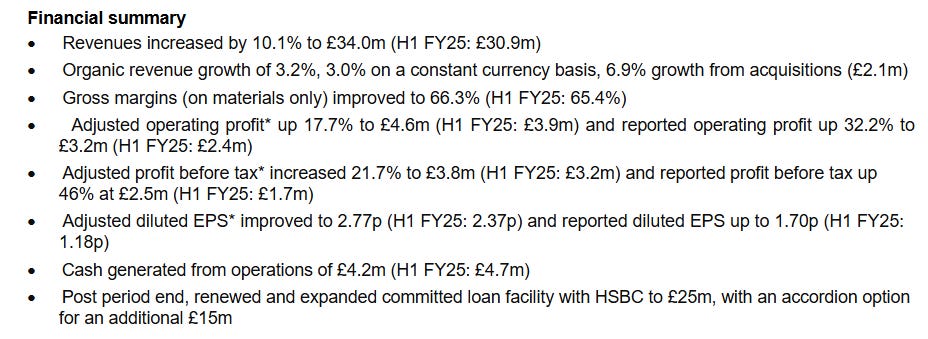

500) SDI Group (Ticker: SDI)

Once a really popular serial acquirer benefiting from Covid, owned it for 1,5 years. 78£m ‘buy and build group, focused on companies which design and manufacture specialist lab equipment, industrial & scientific sensors and industrial & scientific products’. Old CEO who is responsible for the great growth story until the Covid peak left in 2024 and the recently appointed COO took over. The focus then was to stabilize the group. H1 results suggest this was successful:

Board expects trading in line with market expecations (Revenue 75,2£m, Adj. operating profit 11,4£m and adj. PBT 9,8£m). Net debt of 23,5£m, so we have a 9x EV/adj. EBIT multiple. I have SDI on my watchlist anyways, @Emerging Value pitched SDI after the serial acquirer covid hype:

There are a lot of write-ups on Substack, you’ll also find management interviews @La Newsletter de Momentum:

501) Secure Property Development & Investment (Ticker: SPDI)

2£m real estate company focused on ‘high yielding commercial, retail and industrial properties in South Eastern Europe’. Trading is suspended as SPDI is working on the acquisition of AdvEn, a company producing carbon materials for energy storage. Readmission to AIM expected to be completed by 30 June 2026. 6,4£m NAV. Pass.

502) Seed Innovations (Ticker: SEED)

5£m investment company with a focus on ‘humanoid robotics, artificial intelligence (’AI’) and enabling technologies’. Reports NAV of 11,2£m. New chair:

… the Board set out a clear commitment: to address the persistent discount to NAV, to act decisively in returning value where appropriate, and to reset SEED’s strategic direction toward sustainable long-term performance.

The new chair is the billionair Jim Mellon, he owns 22% and is also the chair of MFX (Number 358 of this series), a fintech group. Did a 2£m tender offer in August. The reset of the strategic direction means a focus on AI and robotics, most current investments are in biotech companies. Pass.

503) SEEEN (Ticker: SEEN)

Yes, written with three e’s. 6£m ‘AI-powered Video Experience Platform’ to manage video content. Shares outstanding nearly tripled in three years. Working on a contract to ‘supply YouTube Creator Service Partner’ worth 3,5£m in annual revenue (5£m total revenue FY25, 6,5£m annual revenue run-rate). Reports first 6 months of EBITDA profitability, but only when adjusting for amortisation of capitalized development costs. Chair is executive chair of the AIM listed company Water Intelligence (providing water infrastructure services), WATR owns 6% of SEEN. Losses are shrinking with increasing revenues. Pass.

504) Seeing Machines (Ticker: SEE)

236£m provider of driver monitoring systems. Means cameras and softwares to track driver behavior e.g. in cars. I know there are laws coming up requiring this technology in all new cars in the EU. Smart Eye from Sweden is a listed competitor. Similar to Smart Eye, SEE announced various contract wins with global car manufacturers in the last years. There are 4m cars using SEE’s technology, up 60% YoY. But technology is also used in science or by companies like Caterpillar. While revenues grow, losses persist on a relative scale for now. SEE and Smart Eye probably have some sort of first mover advantage, but both operate unprofitable and it’s rather about winning more contracts than profitability for now. Mitsubishy Electric owns 20% of SEE, Generali, an insurance player, owns 5,5%. This technology is one to keep an eye (pun intended) on, but for now it’s a pass.

@Colin Barnden got a whole Substack (Understanding DMS) related to driver monitoring systems for those interested.

505) Selkirk Group (Ticker: SELK)

8£m ‘investment vehicle focused on acquiring undervalued companies or businesses in the consumer, e-commerce, technology and digital media sectors’. Cash shell with 7£m in cash. Pass.

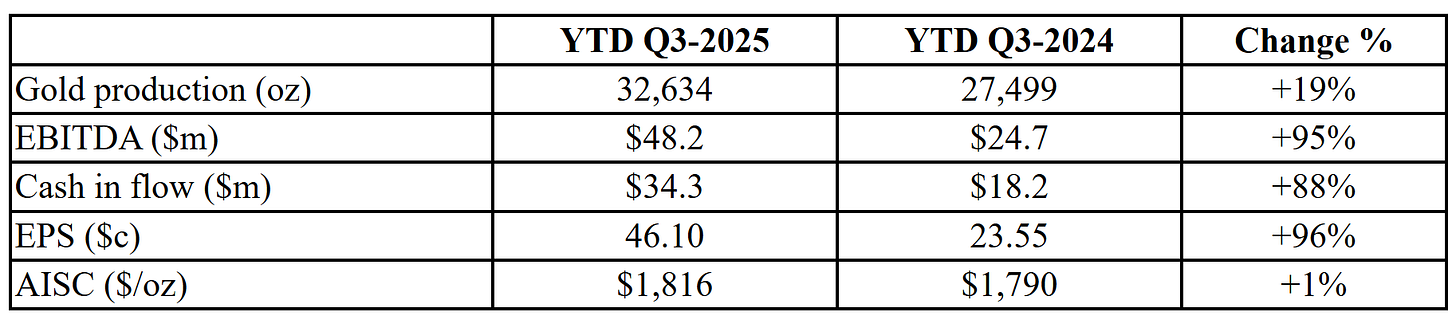

506) Serabi Gold (Ticker: SRB)

208£m gold exploration and production company with projects in Brazil. Share price doubled ytd on record gold production and the high gold price.

Fwd. P/E of 5 (Koyfin), no dividend or buyback. 38$m cash, debt free. Pass.

507) Serica Energy (Ticker: SQZ)

668£m O&G exploration and production company with off-shore assets in the North Sea. Expects ‘sustainable cash generation’. Profitable history, ~10% dividend. Production volume down due to a temporary issue that will be resolved soon. 118$m H1 2025 EBITDA, low net debt. Pass.

508) Shearwater Group (Ticker: SWG)

10£m provider of cyber security and advisory solutions. Bumpy revenue and no consistent profitability, but FCF positive year by year as most D&A is related to intangibles. CEO just bought some shares, now owns 11%. Just extended a contract with a value of 7£m (20% of revenue). 11£m goodwill impairment. 33£m NAV, mostly intangibles. <1£m in adj. EBIT when adjusting for the amortisation, but just ~6x EV/EBIT due to a 5£m cash pile, no dividend. Three customers accounted for 55% of revenue. Expects to grow in FY26, pass.

509) Shield Therapeutics (Ticker: STX)

125£m commercial-stage biotech delivering products to help with iron deficiency. Stock price 4x ytd, apparently due to commercial success of their product (doubled sales, licence agreements), 10$£m losses in H1, reduced from 15£m. Pass.

510) Shoe Zone (Ticker: SHOE)

33£m footwear retailer. Full year trading update shows revenue down by 7% to 149£m, partly due to the closure of 28 stores. PBT down to 2,4£m from 10£m due to higher employee costs and container prices. 30£m NAV, liabilities are only lease liabilities, 22£m payable over ~2 years. Capex cut back to 1£m from 5£m, dividend on hold. Management is ‘cautious’ about the near-term outlook. Chairman is prior COO and owns 26%, another person with the same last name owns 36%. Things look obviously ugly here, increased costs are hard to pass to customers when sentiment is down, especially in the low price segment SHOE is focused on. Could be an interesting turnaround play if someone wants to time a rebound in consumer sentiment. Pass.

Wrap-up

510/669 companies covered so far.

Watchlist: 72/510.

Pass: 438/510.

No-Revenue counter: 108/510.

Feel free to provide opinions and sources on any of the stocks. Cheers.

Watchlist

Part 1: 4GBL (Delisted), ABDP, ASCO, AMS; Part 2: ALT, ALU, AMCO, ANG; Part 3: ANCR, AT, AVG, BPM; Part 4: BGO, BEG, BIG, BRCK; Part 5: CBOX; Part 6: CLBS, CEPS, CER, CKT, CHH Part 7: CFX; Part 8: CSSG, CRPR, CVSG; Part 9: DFCH, DOTD; Part 10: EAAS; Part 11: None; Part 12: FIN, FNTL, FKE; Part 13: FLO, TUNE, FRAN, GBG; Part 14: DATA; Part 15: HDD, HAYD, HERC; Part 16: IDOX, ING; Part 17: JNEO, JDG; Part 18: KITW; Part 19: LST, WINK; Part 20: MLVN, MBH; Part 21: MAB1, MWE; Part 22: WINE, NWT, NTBR; Part 23: OHGR, OGN; Part 24: OMG, PEB; Part 25: TPFG; Part 26: QTX, REAT, RLE; Part 27: RCN, RNWH, RGG; Part 28: ROSE, RTC, RWS, SDG; Part 29: SAG, SDI

Nice breakdown on this batch. The Shearwater Group entry caught my attention—that 7m contract extension representing 20% of revenue is material when your client base is that concentrated. I tend to get cautious around cyber security firms where three clients drive over half the revenue since customer stickness can be unpredictable even when contracts renew. That said, the 6x EV/EBIT with the cash position is pretty attractive if FY26 growth actually materializes. Have you seen any commentary from the CEO on diversifying that client base?