A Year of Cash and Calm: Reflections on 2024

About Fomo, Poker and Lessons from a year with >50% in Cash

Peter Lynch once said the person that turns over the most rocks wins the game. 2024 taught me: I voluntarily lose.

With that, let’s dive into my 2024 recap.

2024 Recap

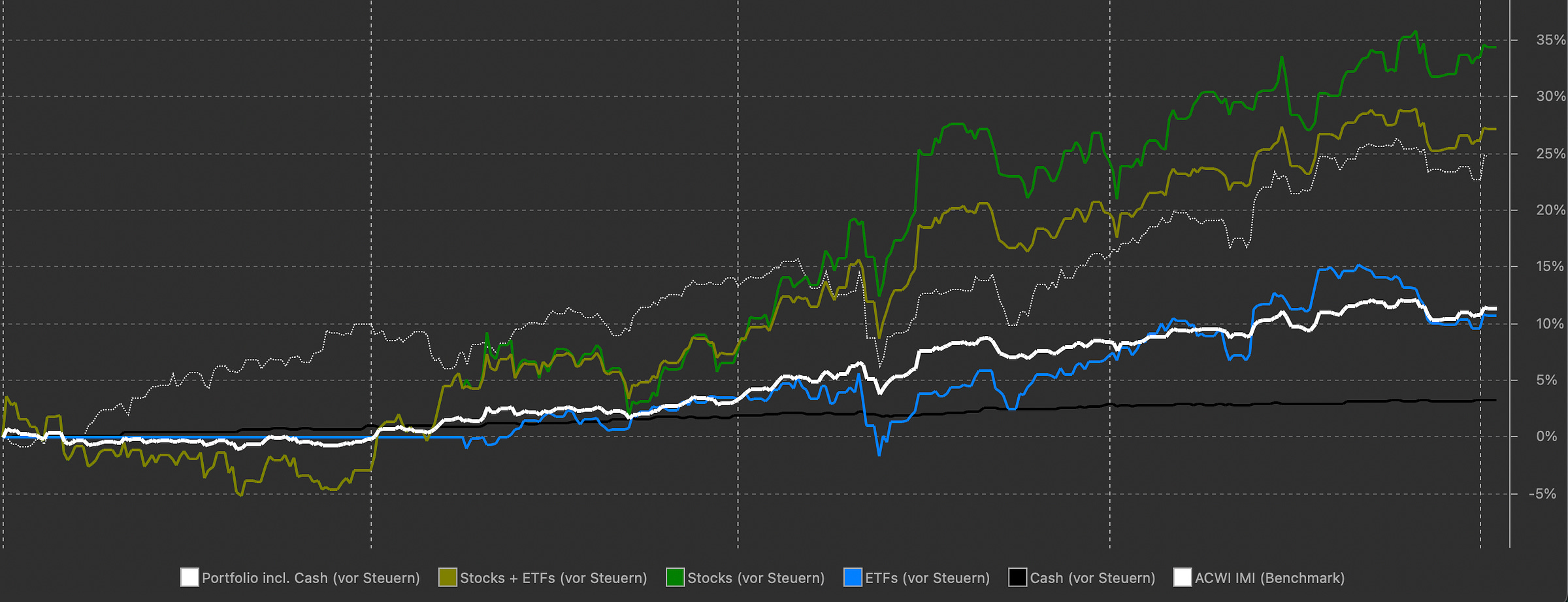

2024 was my 5th year investing money in the stock market. For most parts of the year, I had >50% in cash, I bought index funds and I didn’t spend that much time on researching on stocks as I initially planned to do. Below you can see my true-time weighted rate of return (TTWROR) for 2024:

The thick line represents the performance of my portfolio incl. funds, stocks and cash. The thin grey line is the All-County World Investable Market Index, which includes developed and developing countries, as well as large and small caps weighted by market cap.

As you can see, I significantly underperformed the worldwide stock market. While my stocks and ETFs (yellow graph) performed in line, the huge cash position (black graph) has been a drag on my performance unsurprisingly, despite collecting interest throughout the whole year.

The year started with buying Card Factory, which turned out to be the best contributor to my performance (48% TTWROR, sold in September). In the first half I sold SDI Group (management changes) and Sesa (signs of slowing operating performance). Both sells have been good sells in hindsight as both stocks are down >20% since I sold. Of course that’s only a short-term perspective. I replaced these two with Norbit ASA and Volex. Additionally, I started buying an index fund and sold Macfarlane Group, buying it back in August.

In the second half, I have been adding to funds, starting positions in Kri-Kri, Defama and Simply Better Brands and doing some smaller trades as I had so much cash. As I’m writing this, ~1/3 of my portfolio is in funds, 1/3 in stocks and 1/3 in cash. I will elaborate on this allocation later.

My journey so far

To understand why I had/have so much cash, I guess it’s important to look into the past. I started investing in 2020 by buying some index funds and growth stocks. That worked out well until late 2021, as many experienced themselves. In 2022 I got rid of many stocks that were left from my growth-investing era and I wrote a recap for the year on this substack. I pointed out 3 key points: I was naive, I didn’t care about risk and I didn’t have an approach/framework/strategy.

Therefore, I wanted to take my time, read, learn and improve as an investor in 2023. I read The Investment Checklist by Michael Shearn. The book gives a good overview of most topics for researching stocks, but does not dive in too deep into each, so for experienced investors it might be kind of boring, but in case you are interested I summarized it and added some thoughts: Part 1, Part 2, Part 3.

I wanted to turn over many rocks, dig through my watchlist and screeners and actively research businesses. But aside from reading this book and more or less following some stocks, I didn’t do much. I ended 2023 with 80% allocated in cash as I did not find the motivation to really do what I thought I wanted to do.

Investing and Poker

This Substack is called Increasing Odds for a reason. I like to compare investing to poker as there are notable similarities between the two. When playing the investing game - especially when picking stocks - you have to think in expected values. Even if you are not actively doing that, implicitly our thinking about risk and returns forms an expected value/return. There is no certainty how stock prices develop or how fundamentals evolve. Instead, we think in scenarios considering the risks of each investment and decide if we are willing to take the risk expecting a certain return for the risk we took.

In poker, it’s somewhat similar. You don’t know how the flop (the first 3 cards) will turn out, nor do you know your opponents’ cards. However, you can think in odds and expected values taking the size of the pot into account. Of course, in Poker, the odds are more concrete. But even so, the human behavior distorts odds in poker and investing.

For example, if you already won a big chunk of money in a tournament, your risk tolerance may increase despite the odds not having changed. You could say the same about investors who achieve huge returns in a short time, leading developing overconfidence and biased disadvantageous decision-making.

If you lost several hands against a specific player, you might fold more often against them to avoid further losses, despite knowing that the personal history between you doesn’t impact the odds. In investing, the same logic applies: losing money on mining stocks doesn’t alter the likelihood of future success with another mining stock. Yet, you may avoid them anyway from now on.

Of course, nobody can completely eliminate their biases or play entirely based on probabilities. That’s part of what makes poker enjoyable and the same applies to investing. However, we can take steps to avoid or reduce behaviors that decrease the odds of success and instead lean towards strategies that increase those odds.

Index funds

Going into 2024 I was aware that I needed to put the cash to work. The best places for money that is supposed to be invested without having to actually think about where to allocate it are index funds. Buy, close the broker’s app and come back in 30 years. The theory behind that is more complicated, but it’s simple to execute and the odds for success are definitely on your side.

That’s one reason why I bought index funds throughout the whole year, starting in April. More specifically, I bought a multifactor fund (JPGL, ISIN: IE00BJRCLL96) complemented by a developed world market cap fund to build a factor-tilted portfolio. The asset manager Avantis launched some products in November in Europe that allowed me to add an factor-tilted Emerging Market (AVEM, ISIN: IE000K975W13) and a small-cap fund (AVWS, ISIN: IE0003R87OG3).

Owning index funds or funds that are close to usual indexes have two advantages for me: First of all I don’t have to pick stocks if I don’t want to. Secondly, I avoid bad decision-making based on fear of missing out (FOMO).

FOMO

Someone could argue buying index funds after not fully participating in the bull market due to a cash position is some kind of FOMO. I wouldn’t say FOMO is the main reason but I also can’t argue against it, so it’s part of the reason probably. But what I meant with bad decision-making based on FOMO is that this fear may lead to pushing myself into making decisions on certain stocks just because I have the cash position, even though I may not have the needed information. Having funds in my portfolio prevents me from exposing me to this risk as I can simply buy the funds when I have cash.

Of course, buying funds may be a bad decision in the short-term as well. Nobody knows how the market will perform this year or if value will ever outperform again. But if buying the market turns out to be a bad decision, I can justify it for myself with the science around expected returns. If sitting on a big cash pile or my decisions in stock picking turn out to be a bad decision, I can’t justify it, at least not based on rational thinking.

Stock picking

In addition to that - and I don’t have an answer to the why - I am not the one turning over the most rocks. I am not the one digging through stock screeners or going A-Z. I am not checking for new regulatory filings or reading stock pitches on a daily basis.

That’s probably the biggest learning of 2024. I told myself I would be someone with a portfolio of his favorite stocks he tracks closely, willing to do all the work, researching stocks regularly. But that’s simply not true.

Don’t get me wrong: I enjoy following businesses, listening to earnings calls, reading reports and occasionally write about all that. Picking stocks will remain a part of my investing journey. But I don’t want to limit myself to stock picking as it can be a lot of work and sometimes I simply don’t want to spend time with that. Thinking I would want to only pick stocks led to sitting on a big cash pile in one of the biggest bull markets in history.

Currently I own 6 stocks (write ups):

Norbit: NORBT.OL (Mathias from Learning to grow)

Simply Better Brands: SBBV.C (Christian from Trident Opportunities)

Defama: DEF.DE

Kri-Kri: KRI.AT (Eurobank Coverage)

Volex: VLX.L (Own write-ups: Pitch, Update)

Macfarlane: MACF.L (Own write-ups: FY2023 Recap, H1 2024 Recap)

Finding the sweet spot

If stock picking is decreasing the odds for succesfull investing (at least on average), why do I stick to it? Why don’t I go 100% funds? Well, I guess that goes into the category of behavioral finance. I stick to it because I am willing to take the risk of making bad decisions, at least to some extent. I like to learn about businesses, listen to experienced CEOs or pull out an excel sheet and play with numbers. With buying funds and making them a substantial part of my portfolio, I change the distribution of possible outcomes and therefore increase the odds for successful investing compared to not buying them and sitting on the cash as the expected returns of market cap or factor investing are higher than for cash. My expected return when mixing stock picking and funds may be lower compared to only buying funds in theory, but that’s the irrational risk I am willing to keep in my portfolio betting on the better outcomes of the distribution. Everyone has to find the personal sweet spot between science-based theory and individual preferences.

That said I wish everyone the best for 2025. Stay humble.

Cheers.

Merci, c'était une très bonne lecture.