Macfarlane Group (LSE:MACF) showed top-line weakness as the tough economic environment and post-covid normalization puts pressure on their customers leading to decreased demand for packaging solutions. Nevertheless management proved their excellent cost control and execution on M&A opportunities by still growing gross and profit margins which more than offsets effects from volume decline and price deflation.

If you are not familiar with Macfarlane yet I recommend checking out Lewis Robinsion’s work.

The numbers

Looking at the numbers we see a weak top-line, while gross profit and profits increased if adjusted for amortisation of acquired intangibles and an increase in contingent consideration for the PackMann acquisition, which is performing above expectations. The ‘expenses’ are non-operating and so hide the underlying profitability.

Organic revenues declined by 8% mainly due to declining volumes and some pricing deflation. Other player in the industry showed similiar trends.

partially offset by M&A activies (4 deals in 22&23)

Gross margin increased from 33,8% to 37,6%, mainly driven by effective cost management by showing pricing power vs. suppliers, adding new suppliers to their supplier base and in-house supply between their manufacturing and distribution segments

Macfarlane is mainly exposed to polymer and paper prices, which have been volatile in recent years. Nevertheless gross margins didn’t even decrease once, showing effective cost management, pricing power and great supplier relations.

Reported profits have been hurt by the named increase in contingent consideration, but adjusted numbers confirm the thesis of increasing profitability due to site consolidation, industry consolidation and cost management.

M&A

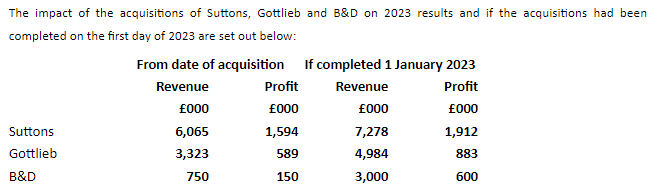

In 2023 we saw 3 acquisitions. All together Macfarlane acquired £15,3m in revenue and £3,4m in profits for an initial consideration of £11,55m. £1,75m arises in contingent consideration. All acquired businesses have higher profit margins than the group, this should further increase profit margins in 2024.

£2,9m in contingent consideration have been paid for acquisitions made in 2021, so these are performing in line with expectations.

For 2024, management is confident to close more M&A deals. With £7,7m in cash and Debt/EBITDA <1 there is a lot of room to execute here. In the first 2 month of 2024 alone, 10 owners of private businesses have approached Macfarlane to be acquired. Especially increasing regulation and the tough economic environment is motivating owners to exit according to management. If we also consider that Macfarlane acquired their first business outside of the UK in 2022 and plans to expand in Europe in general by their ‘Follow the customer’ program, we shouldn’t be worried about missing targets for M&A deals here.

Outlook

Management expects 2024 to remain challenging. The start of the year showed ongoing weak demand, but margins are expected to be sustainable. Especially demand from e-commerce businesses (20% of revenues) is expected to normalize throughout the year and reaccelerate in 2025.

The things above are points to focus on from management. A key point will be the side consolidation and relocation of a distribution center, which all together should lead to annual cost savings of £0,4m. But for 2024 we will see some one-off costs for these projects.

So 2024 could be a flat year for Macfarlane, highly depended on M&A deals and overall economic conditions.

But in the medium-term we can expect return of growth mainly from ex-UK activities and further increase in profitability due to M&A and consolidation.

Valuation

We currently have an EV of £223m, so based on the adj. EBIT of £27,6m in FY23 Macfarlane trades on 8x EV/adj. EBIT. Expecting a flat year means that this is also the FY24e number.

On a FCF basis it’s trading on 7x EV/FCF. But FCF is elevated due to working capital effects, normalizing these leads to £25m in FCF and so, a 11% FCF yield.

Macfarlane is definitely not a ‘no-brainer’ or a deep value play at this levels. If we organically expect low single digit top line growth going forward and mid single digit profit growth + M&A activities + 3% dividend yield, then we end up somewhere in the range of a 10% irr. That’s not overwhelming for sure, but in my view the risk profile of this investment case is fairly low, so a 10% irr with the possibility of some multiple expansion if sentiment for small caps and the UK turns more positive is fine for me.

Things good to know

The new innovation lab is performing well, proved to be important for customer retention rate.

DS smith, one of Macfarlane’s suppliers, is currently merging with Mondi to create a ‘paper giant’.

Utility price inflation is not a problem anymore

Net promoter score improved from 50 to 60

Plans to re-launch their website to improve online presence