Exploring AIM: A-Z Part 4

High-tech anklets, stacked clay and learning about the Brave Bison.

This is part 4 of my A-Z journey on AIM.

First of all, I want to thank everyone for the feedback and comments on the covered tickers. For those who only know me from Substack, I’m also on X: https://x.com/SaeschInv, where I occasionally give updates on tickers.

Here you find the others parts:

Let’s dive into the B-tickers.

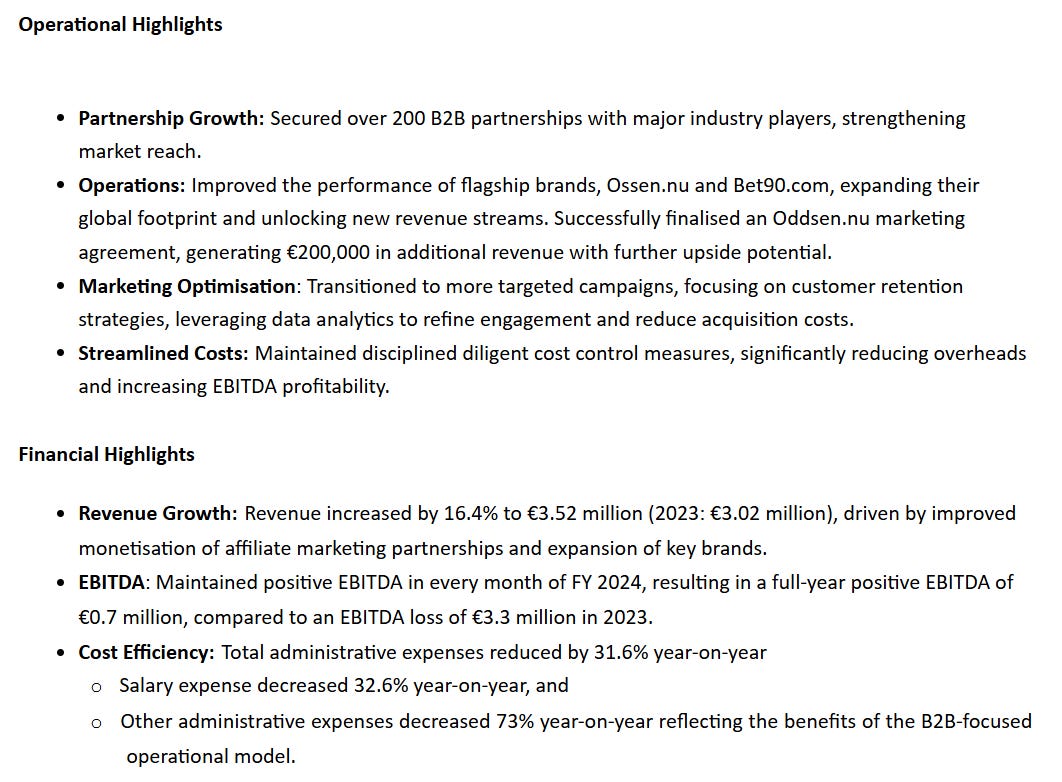

66) B90 Holdings (Ticker: B90)

9£m online marketing company for the gaming industry. Gaming is a friendly description here, they are operating sport betting sites. Shifted to a B2B business model.

Not operating on net profitability yet, but probably on a good way. Pass for me as I avoid gambling related business due to regulatory risks, but maybe worth a look for others.

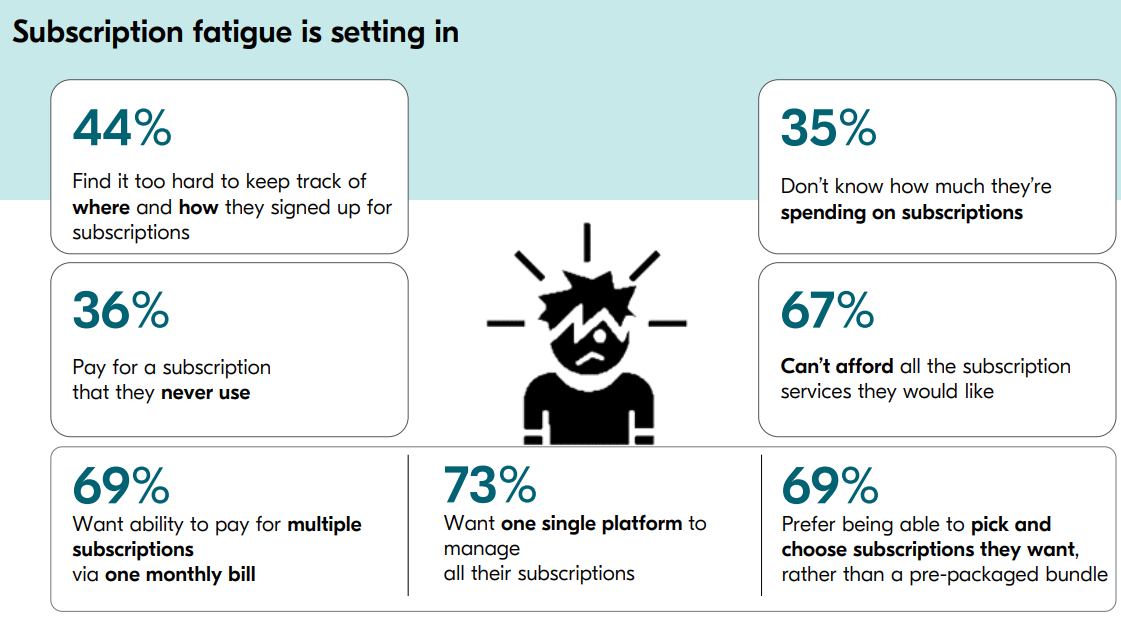

67) Bango (Ticker: BGO)

73£m technology company providing subscription bundling and digital payments solutions. Big tech are customers. 50% of revenue is recurring. Growing with ~100%. Net revenue retention rate >100%. Seems like ARR model is rolling out currently.

I can absolutely understand the problem they are trying to solve. Just questionable if large payment providers such as Paypal couldn’t easily copy this business.

Operating unprofitable. Both founders involved. 12% insider ownership. Goes on the watchlist as their service is definitely gaining traction.

68) Beacon Energy (Ticker: BCE)

0,76£m O&G company with projects in Germany. Unprofitable. Pass.

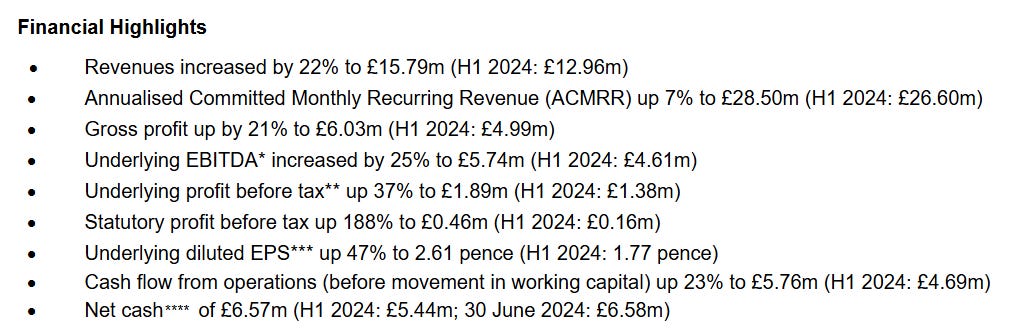

69) Beeks Financial Cloud Group (Ticker: BKS)

146£m managed cloud provider. Infrastructure-as-a-service business for capital markets. Just announced a contract with Kraken, crypto exchange platform.

30% dilution since 2021. Fwd. P/E of 28 (Koyfin). Net cash. CEO & Founder owns 32%. Operates on data centers from data center providers such as Equinix. Growth tech valued for growth tech, therefore not really interesting for me, pass.

70) Begbies Traynor Group (Ticker: BEG)

150£m business recovery, financial advisory and property services consultancy. Generally, an interesting field as it’s somewhat counter cyclical.

Reports that the number of businesses in 'critical' financial distress rose 13.1% year-on-year in Q1 2025, with 45,416 companies now affected (Q1 2024: 40,174). Fwd. P/E of 9 (Koyfin). Low debt levels. 4% dividend.

CEO, who owns 17%, established Traynor & Co. in 1989, which later became Begbies & Traynor. Watchlist: Experienced management, insider ownership, cheap, good operating performance. Recent write up by @

:and by @

in Feb 2024:71) Belluscura (Ticker: BELL)

3£m medtech company developing oxygen enrichment technology. Withdrawed guidance due to tariffs, as they manufacture in China and export to the US. But recent trading update says that tariffs for their products are currently at 0%. Can’t access their IR page, but operates highly unprofitable. Pass.

72) Benchmark Holdings (Ticker: BMK)

168£m aquaculture biotech company. Just sold its genetics business, redeemed its green bond and is now debt free. The sale got them about 194£m in cash + an earn-out option.

As far as I understand they sell nutrition for shrimps, fishes and also healthcare products. Kinda reminds me of the livestock nutrition business I came across too. Pass.

73) Beowulf Mining (Ticker: BEM)

5£m mineral exploration and development company with projects in Sweden, Finland and Kosovo. Just raised 1£m. No revenue, pass.

74) Bexmico Pharmaceuticals (Ticker: BXP)

160£m manufacturer of generic pharmaceutical products and active pharmaceutical ingredients in Bangladesh. Delayed its Q3 results due to allegations of corruption in Covid-19 vaccine procurement. Pass.

75) Bezant Resources (Ticker: BZT)

4£m copper-gold exploration and development company with worldwide projects. No revenue, pass. Selling projects in Argentinia:

76) Big Technologies (Ticker: BIG)

294£m providing tech for remote monitoring of individuals (e.g. criminal GPS tags). Recently, CEO and Founder Sara Murray has been fired:

She owns about ~27% now. We’ll see if this has any further impacts. Financially, the business is highly profiable.

Somewhat of a red flag is the SBC charge of ~20% of revenue. Current buyback programme is approved for <2% of shares. They seem to be operating in a great niche, but the valuation is not exciting. New CEO has a Microbiology background. COO is with them since 2012. CFO is ex-CFO of Volex PLC (a company I own shares of) who is partly responsible for the great turnaround of Volex pre-covid. I’ll put this on my watchlist to see how the case progresses. Could be interesting as dust settles. Write up by @

:77) Bigblu Braodband (Ticker: BBB)

11£m provider delivering broadband using alternative technologies to homes and businesses that are unserved or underserved by fibre. Authorized reseller for Starlink services. Prior to the partnership, BBB was struggled due to Starlinks competition. Operates unprofitable, but managed to repurchase 25% of outstanding shares via a tender offer for 40p per share recently, while shares have been trading below 40p ytd. Financed this move with a disposal of its Australian subsidiary. Pass.

78) Billington Holdings (Ticker: BILN)

51£m steelwork constructor. FY24 results show -15% revenue, -20% profits, decreased dividend. 6x P/E. That’s why avoid companies like this. High capex, exposed to material prices, project-based/cyclical. Maybe they benefit from rate cuts. Pass.

79) Bioventix (Ticker: BILN)

145£m biotech specialising in the development and commercial supply of high-affinity monoclonal antibodies for applications in clinical diagnostics. Currently focused an Alzheimer biomarkers. CEO owns 5,7%. Recent update:

Revenue up 1% to £6.73 million (2023: £6.68 million). Profit before tax £5.05 million down 4% (2023: £5.24 million) due to increased R&D spend

Numbers roughly in line with last year. The company is operating with insane margins: 75% PBT margin. Expects H1 25 to be flat too, but growth returning in 2026. Trading on fwd. P/E of 25. Chair and CEO are with company since inception (Bioventix was formed through a management buyout).

It’s hard no to be interested in a company like this. But no matter how high the quality this business is, it would eat up a lot of time digging into their product to understand the basics for me. So it’s a pass, valuation leaves no room for misunderstanding the technology.

80) Blackbird (Ticker: BIRD)

15£m tech company offering cloud-based video editing platforms. Operates highly unprofitable. Pass.

81) Block Energy (Ticker: BLOE)

8£m O&G company with projects in Georgia. Just acquired 10% interest in a new project. Unprofitable, pass.

82) Blue Star Capital (Ticker: BLU)

8£m investing company with a focus on blockchain, esports and payments. 3x shares since 2019. Valuation of their investments decreased by a stunning 80% YoY. Seems like junk. Pass.

83) Boku (Ticker: BOKU)

494£m global provider of mobile payment solutions. Bought back 2,5% of shares and extended its buyback programme. Fwd P/E of 26 (Koyfin, adj. profits). 6% insider ownership. New CEO is old CFO, payments background.

Growing with 20% revenues. Payment volume up 18%. Monthly active users up 29%. SBC 10% of revenue (likely elevated, but was 9% in 2023 too). Expects >20% growth in the medium-term while maintaining adj. 30% margins. Real operating profit margins are rather 10%. Uninteresting for me, pass.

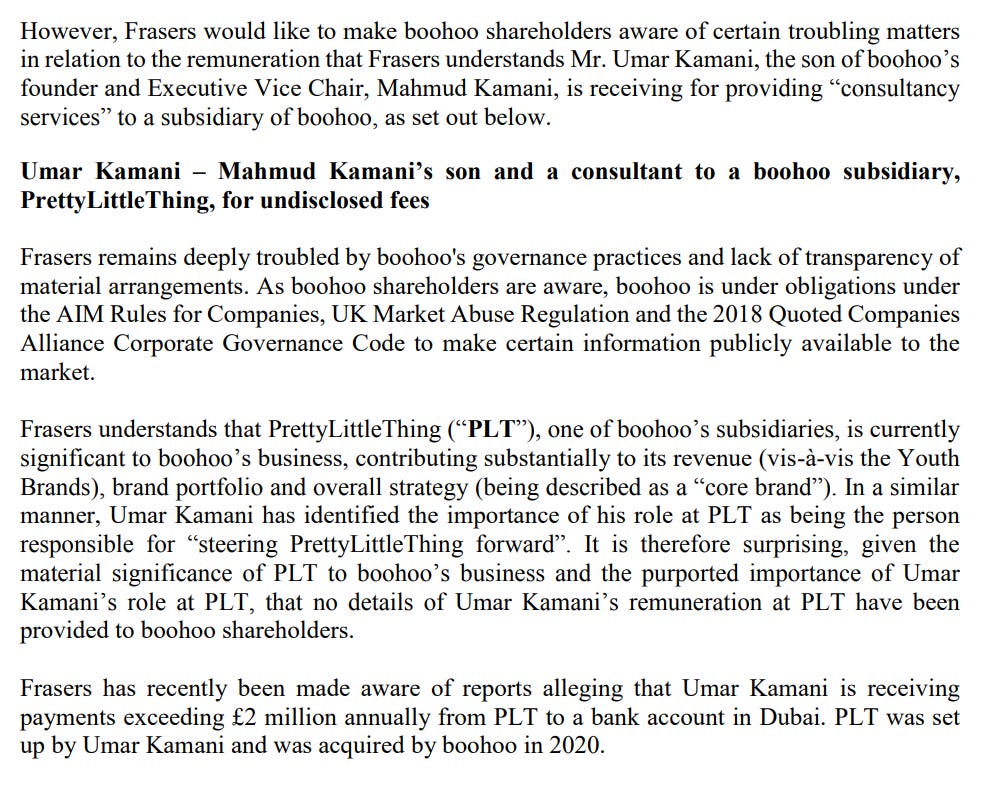

84) Boohoo Group (Ticker: DEBS)

494£m portfolio of fashion brands targeting style and quality conscious consumers. Highlights successful turnaround of Debenhams, one of its brands, and considers this to be a blueprint for the whole group.

30% is owned by Frasers Group plc, retail group. 20% owned by founder family members. Revenues -15%. As indicated before, Debenhams is growing >60% and represents 25% of revenues. Group is operating unprofitable.

Edit: Frasers Group is publicly criticizing governance practices and lack of transparency by the founder family (Thanks to @

for pointing it out):

I am not a fan of fashion companies anyways as they either have to establish themselve as a brand known for XY or they have to ride each wave of trends. If they are not able to achieve that, the business looks like this one. Pass.

85) Borders & Southern Petroleum (Ticker: BOR)

42£m O&G exploration company operating in South America. Shares are up 100% Ytd for no obvious reason. No revenue, pass.

86) Botswana Diamonds (Ticker: BOD)

2£m diamond exploration company with projects in Africa. No revenue, pass.

87) Bradda Head Lithium (Ticker: BHL)

4£m lithium project developer with project in the US. High insider ownership. No revenue, pass.

88) & 89) Braime Group (Ticker: BMT / BMTO)

Seems like a unique share structure here. 7£m company involved in the manufacture of metal presswork and the distribution of bulk material handling components. A flat year 2024. Paying a small dividend. Most cash is used to pay leases and interests. Chairman with them since 1972. Two joint CEOs since 2003 and 2010. 9x P/E.

Rather a pass. Valuation is low, but company is exposed to usual industry cycles and I find nothing that sparks my interest.

90) Brave Bison Group (Ticker: BBSN)

33£m company that describes itself like this:

A world where complexity is the only constant demands a new breed of company. Brave Bison is a different beast: a media, marketing and technology company purpose built for the digital era.

After reading this, I expected nothing but junk. But it’s actually an at least mediocre company operating in the media/marketing space e.g. search optimisation, media strategy, influencer marketing, consultancy.

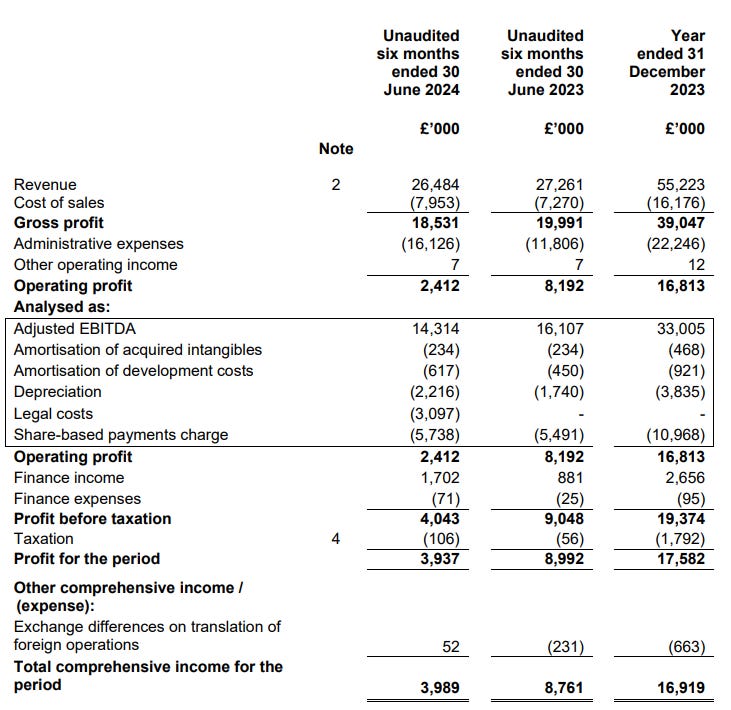

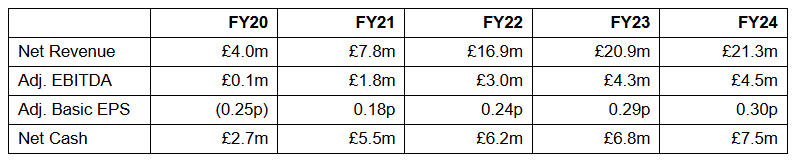

As you can see, consistently growing and profitable post-covid. Acquired 4 businesses ytd. There are two possible acquisition ongoing: once BBSN responded to press speculation admitting they may buy a business, secondly there is a ‘possible offer presentation’ for another public company, The Mission Group. This definitely seems chaotic. They nearly paid their own market cap for acquisitions in recent months.

Trading on fwd. P/E of 9 (Koyfin). CEO owns 24% directly and 8% via Tangent, another company he is Chairman of which is providing strategic consulting. He was CEO of both companies for 3 years. With all the M&A, this connection and the promotive description, this seems somewhat fishy, pass. @

wrote about BBSN a couple weeks ago and provides a more positive view:91) Braveheart Investment Group (Ticker: BRH)

2£m investment group investing in public and private companies. CEO owns 26%. 20% discount to NAV (as of 30th September 2024). No thematic focus. From cancer biotechs, architect offices to supercomputing and automotive suppliers. Pass.

92) Brickability Group (Ticker: BRCK)

225£m distributor and provider of specialist products and services to the UK construction industry. Recent trading update shows 7% growth in sales and 11% in adj. EBITDA. Considers itself well positioned for a market recovery.

Seem to have a contracting business providing more services. Also acquired businesses with own products in the past. As the names suggests, focussed on Bricks which can’t be considered a growth market.

New CEO since 2024 with a ‘bricks’ background. Fwd. P/E of 8. 5% dividend. Kind of interesting, brick market is depressed and new contracting division growing strongly due to M&A. I am not sure if that’s the strategy yet, but transitioning to higher margin contracting business could be an interesting setup. Watchlist.

93) Built Cybernetics (Ticker: BUC)

6£m group of businesses delivering smart buildings and related services. Just changed its name with a lot of AI bla bla buzzwords. Lot of M&A to get into this smart building market. Was just an architectural design studio prior to that. Unprofitable, pass.

94) Burford Capital (Ticker: BUR)

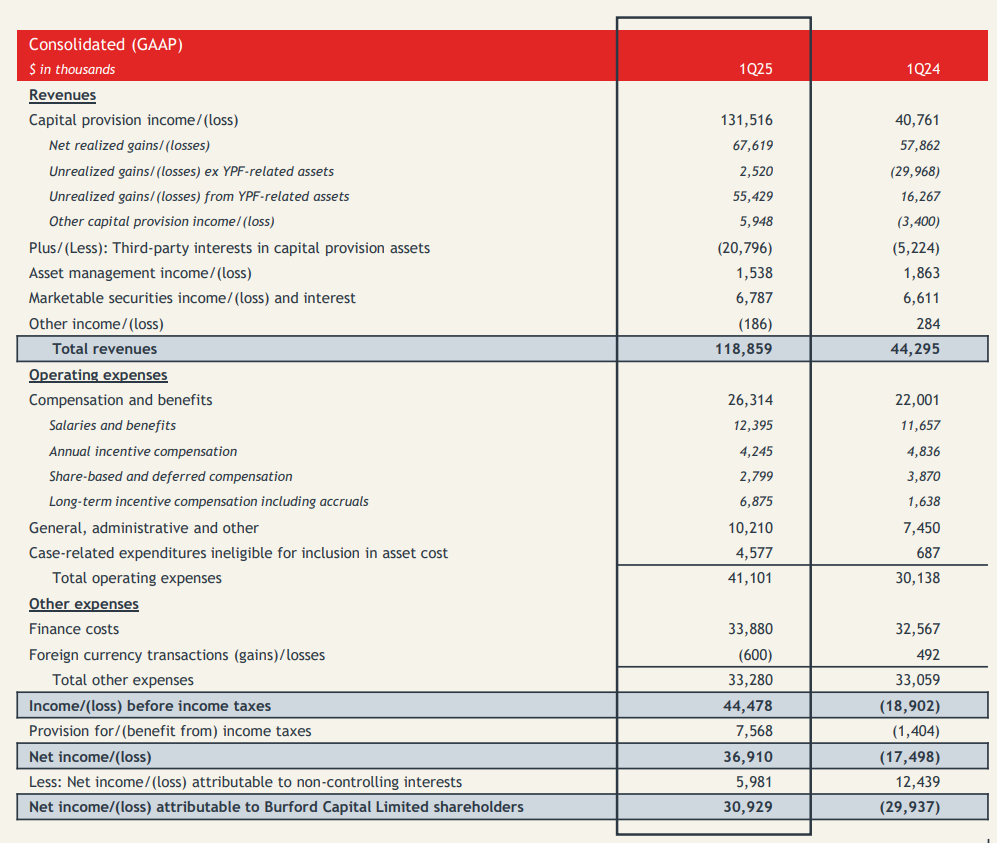

2,3£b global finance and asset management firm focused on law. The 2nd largest company on AIM, IPO’d on NYSE in 2020. Provides funding for legal cases, helping businesses and law firms manage the costs and risks associated with commercial litigation and arbitration. In exchange for financing legal expenses, Burford receives a portion of any financial recovery if the case is successful.

Financials look messy as they rely on cases to settle. Pass for me, maybe worth a look for people with expertise.

Wrap-up

94/669 companies covered so far.

Watchlist: 17/94.

Pass: 68/94.

No-Revenue counter: 22/94.

Feel free to provide opinions and sources on any of the stocks. Cheers.

Good writeup on BVXP

https://mahadahmed185.substack.com/p/bioventix-lonbvxp?triedRedirect=true

Big Technologies is a nice little company. I do have a write-up on them if you want to include it in your post