Exploring AIM: A-Z Part 3

Buy-Build-Exit strategies, Ashtead spin-off and the usual mining ShitCos

Welcome to part 3 of my A-Z journey.

4 more companies made it on the watchlist this time. I came across the first bank, interesting PE companies and the usual no revenue ShitCos. I probably should add a no-revenue-counter.

Here you find the other parts in case you want to take a look:

Let’s go!

40) Animalcare Group (Ticker: ANCR)

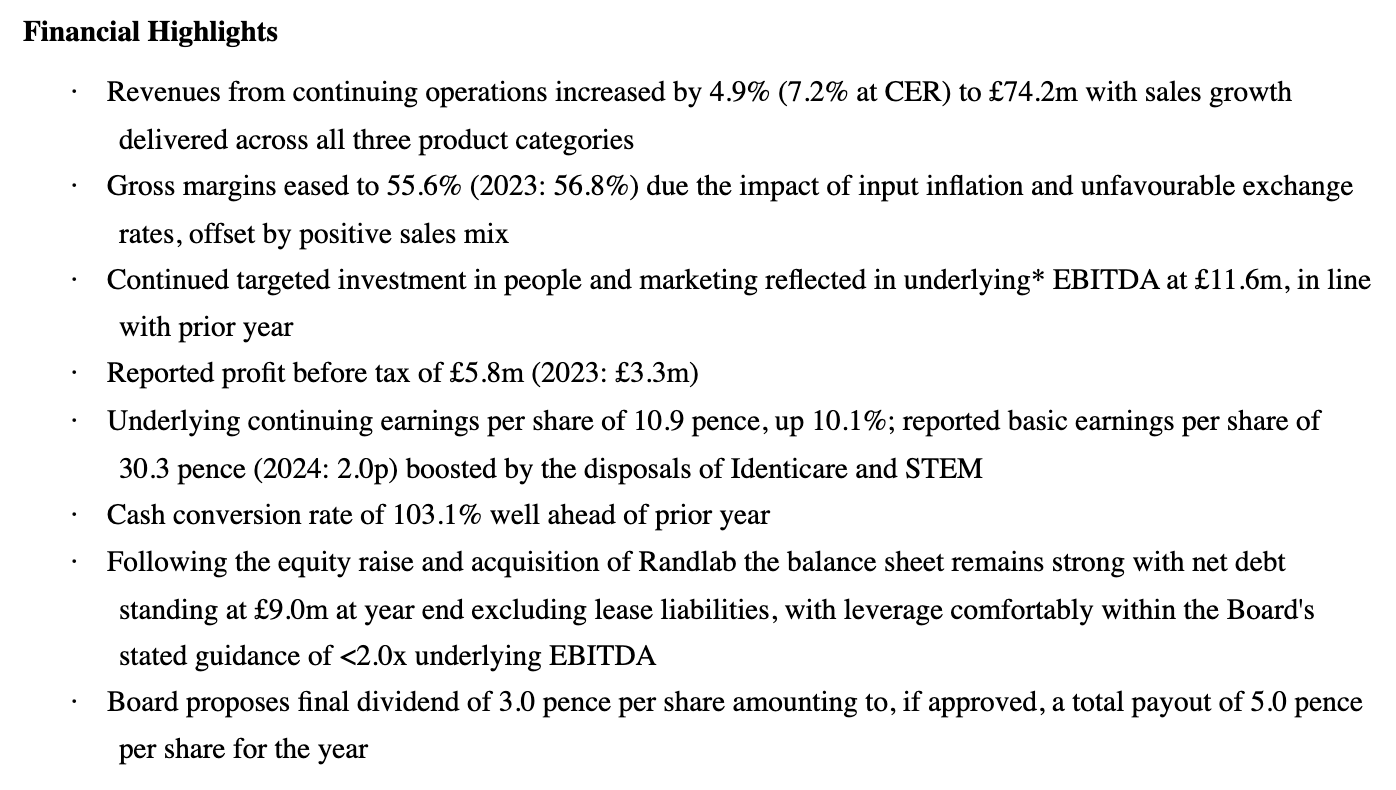

162£m veterinary pharmaceutical company. Operates in 7 European countries as well as Australia and New Zealand and exports to approximately 40 countries worldwide. Last weeks trading preliminary results:

Disposal of Identicare for 17x EBITDA, delivering £25m to the Group. Exited STEM JV at c.2x of original investment. Mentioned Randlab bought for 60£m (11x EBITDA). 2% dividend. 70% of revenues from own IPs or from long-term license agreements. 30% from distribution. Rationalised portfolio from 300 to 150 brands.

22% of shares owned by Marc Coucke, director and founder of a pharma company he exited later on. Chairman spent his whole career on animal healthcare. CEO is in her role since 2018, CFO since 2012. Fwd. P/E of 15 (Koyfin).

Watchlist: I definitely prefer animal pharma over human pharma from a sales/marketing perspective as people probably care more about their pets health than their own. Management is experienced and it seems a lot is going on here. But of course, pharma always bears the regulatory and patent risk.

41) Anpario (Ticker: ANP)

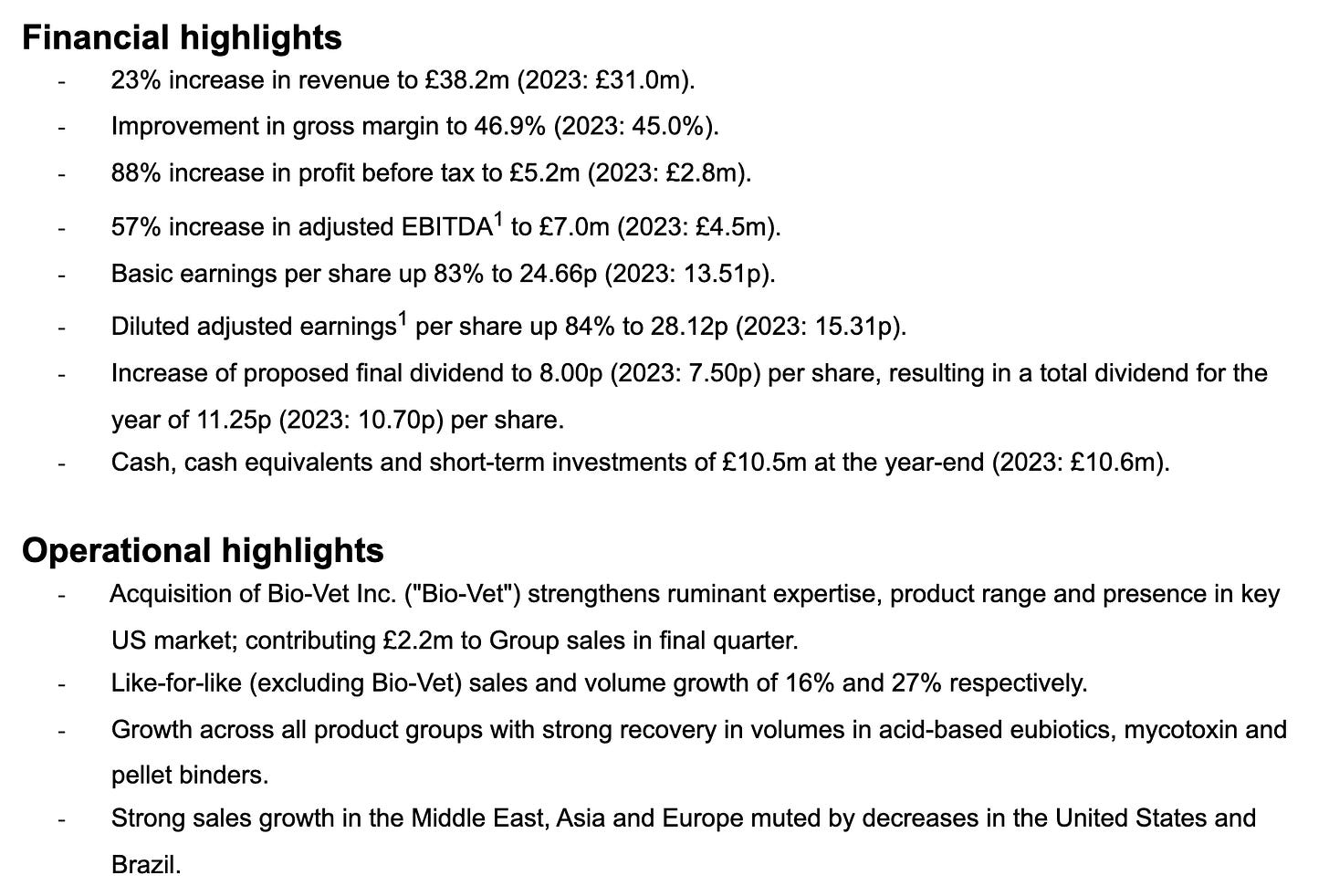

87£m manufacturer of natural sustainable animal feed additives for health, nutrition and biosecurity. Seems to be focused on livestock. Just launched a new 1£m buyback programme, returned 9£m to shareholder in 2023 by a tender offer. 2% dividend. Recent results show a strong performance:

Single digit growth expected going forward. Fwd. P/E of 14 (Koyfin). 40% exposure to asian markets, got hit by raw material inflation after covid. So the numbers above seem to reflect some overall recovery.

Describes that demand is closely linked to market conditions for farmers. Also reports competitive landscape and customers switching to cheaper alternatives. Pass.

42) Aoti (Ticker: AOTI)

85£m US-based medical technology group focused on the durable healing of wounds and prevention of amputations. IPO’d in July 2024. 88% gross margin but unprofitable. SBC 8% of revenue (maybe a one-off effect for the IPO). Net cash on balance sheet. Pass.

43) Aptamer Group (Ticker: APTA)

8£m unprofitable biotech company. Just signed a licensing agreement with the University of Glasgow to receive a 10% royalty on all future revenues from any vaccines incorporating the licensed optimers. Pass for me, maybe worth a look for those who understand what they do.

44) Aquis Exchange (Ticker: AQX)

Probably the best known company so far. 200£m operator of stock exchanges. But not much attention needed, will likely be acquired by SIX, a swiss market operator, for 727 pence per share, currently trading for 717,50 pence. AQX shareholder already voted in favor of the deal. Low spread to acquisition price, pass.

45) Arbuthnot Banking Group (Ticker: ARBB)

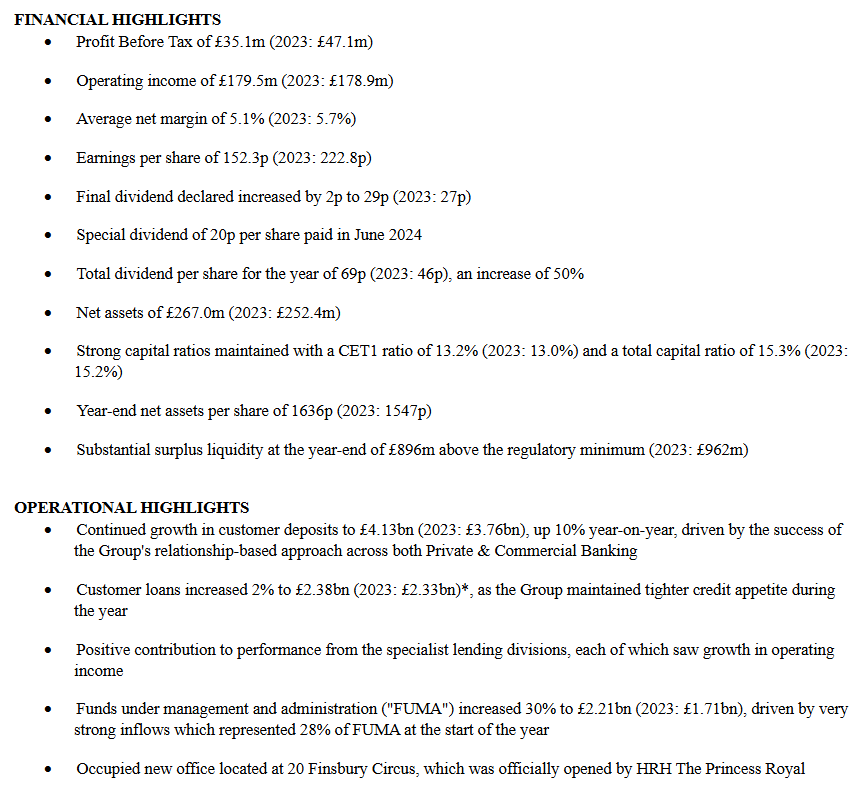

The first bank. 150£m market cap. Here you see the latest update:

CEO is with the bank since 2004. President since 1994 who owns 65% of shares. CFO since 2008. Fwd. P/E of 7 (Koyfin). Some dilution in 2023. 5% dividend.

Banks are usually more complicated to value and closely linked to economic cycles and I generally have no clue about banks, e.g. which KIPs to look at. Pass for me.

46) ARC Minerals (Ticker: ARCM)

21£m copper exploration company with projects in Africa. No revenue. Pass.

47) Arcontech Group (Ticker: ARC)

10£m provider of products and services for real-time financial market data. 97% of revenues are recurring, but seeing margin pressure. 7£m net cash. 10x P/E. 5% dividend. CEO owns 7% of shares. Operational performance basically the same as in 2019, cash is stacking up on the balance sheet.

Pass: Sleepy little company. Cash is worthless if it’s kept on the balance sheet. Probably a negative EV company in a couple years. No signs of improved capital allocation.

48) Arecor Therapeutics (Ticker: AREC)

14£m biotech company developing diabetes drugs (GLP-1 stuff). Revenues are growing, but so are losses. Pass.

49) Argentex Group (Ticker: AGFX)

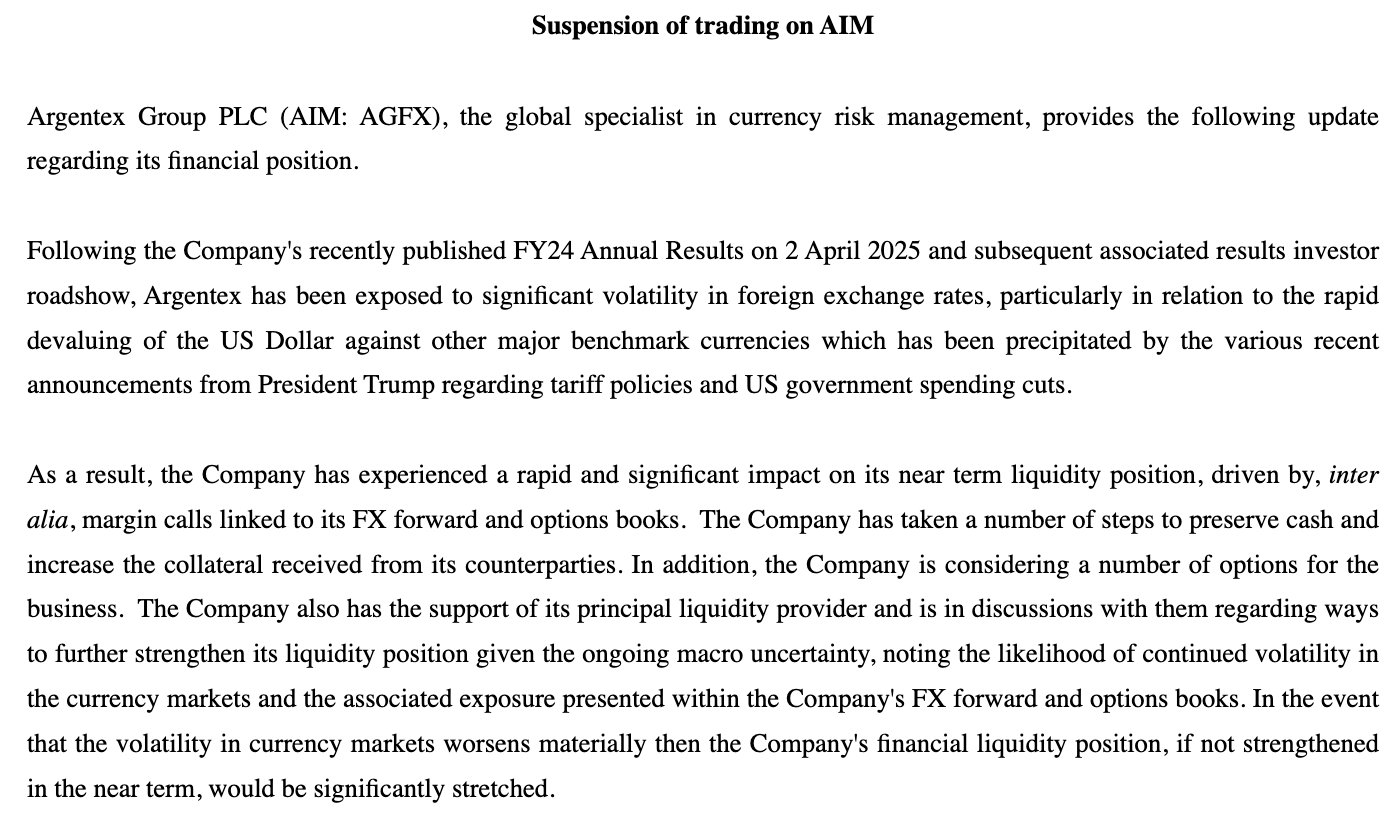

This story is somewhat funny. A currency risk manager fails to manage currency risk and is close to bankrupt.

IFX Payments is offering 3£m for all shares, or 2,49 pence per share. Last stock price was 43,20 pence. CEO has been fired immediately. Pass.

50) Ariana Resources (Ticker: AAU)

26£m mineral exploration and development company. Its current interests include being a gold producer in Türkiye, a gold development project in Zimbabwe and copper-gold exploration and development projects across the portfolio. 0,66£m profits in H1 24. No liabilities. Pass for me.

51) Arkle Resources (Ticker: ARK)

1,5£m exploration company with principal assets in gold and zinc exploration licenses across Ireland. Unprofitable. Pass.

52) Arrow Exploration (Ticker: AXL)

44£m aim-listed, canada-registered, oil producer operating in Colombia. Interesting mix. Was unprofitable in 2023. Highly profitable in 2024. 4x P/E. Maybe interesting for O&G investors. Pass.

53) Artemis Resources (Ticker: ARV)

9£m gold, copper and lithium focused resources company with projects in Australia. Unprofitable. Pass.

54) Ascent Resources (Ticker: AST)

3£m O&G exploration company with operations in Slovenia. Joint venture partner went bankrupt. No revenue. Pass.

55) Ashtead Technology (Ticker: AT.)

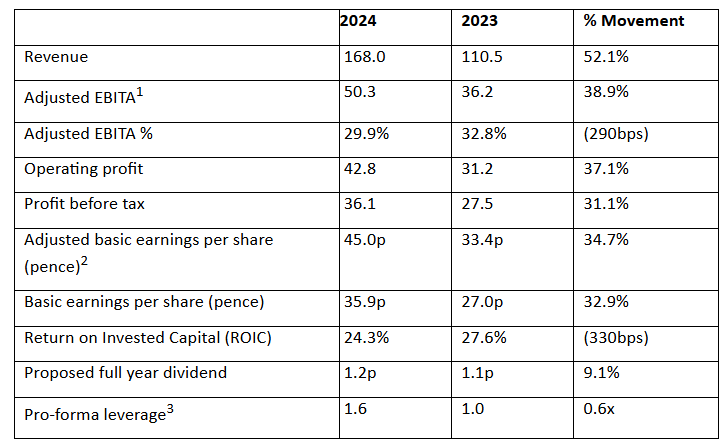

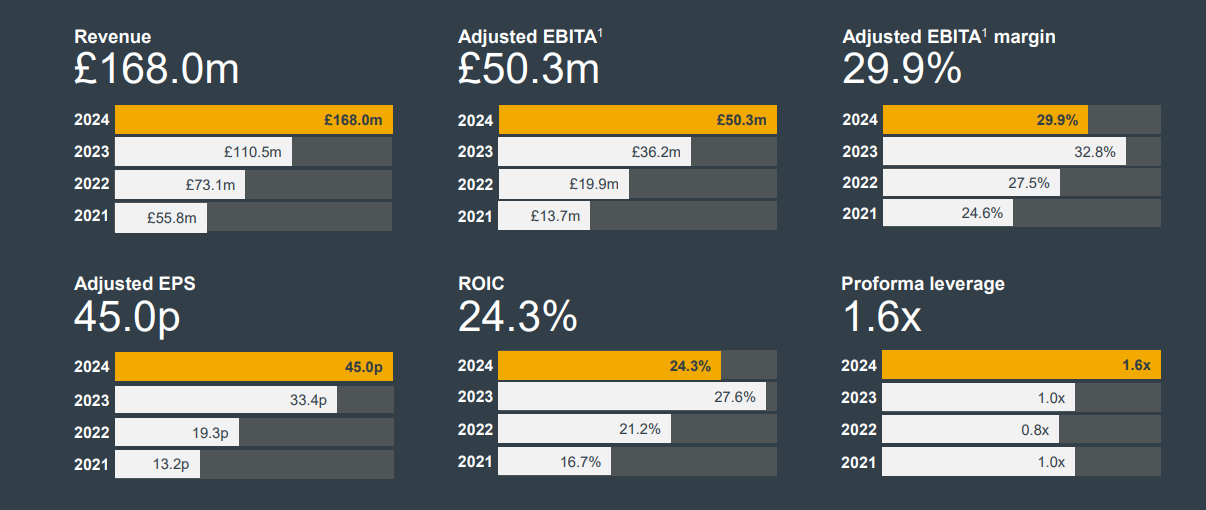

400£m spin-off of the better known rental giant Ashtead Group. Ashtead Technology focuses on subsea equipment rental and is a solutions provider for the global offshore energy sector. Recent FY24 numbers looking strong:

Most of this is inorganic growth. Sees further M&A opportunities. Is confident to deliver double-digit growth and adj. EBITA margins in high-twenties in the medium-term. Expects no direct impact from tariffs. 120£m net long-term debt.

I looked at this company before and avoided it due to a higher valuation, O&G exposure and high capex. The valuation came down with fwd. EV/EBIT of 9, capex will be ~20% of revenue but FCF is positive and O&G exposure remains of course, but decreases as offshore wind grows.

Backlog of their customers looking strong and the offshore energy market is expected to grow 9% until 2028. My main problem is that if we see a slowdown for whatever reason, they’ll sit on their fleet of machines that nobody wants to rent and we’ll likely see ROIC and margins come down a lot.

For me it’s a company to keep an eye on for when the underlying market looks ugly as they easily participate in an upswing, but I want to avoid the risk of participating in a downswing as the energy markets are out of my comfort zone. Watchlist (has always been there anyways).

56) Asiamet Resources (Ticker: ARS)

30£m Australian-based developer of copper, copper-gold and polymetallic deposits in Indonesia. No revenue. Pass.

57) Atlantic Lithium (Ticker: ALL)

50£m lithium project developer from Ghana. Also OTC-listed in the US and in Australia.

The Project was awarded a Mining Lease in October 2023, an Environmental Protection Agency ("EPA") Permit in September 2024, and a Mine Operating Permit in October 2024 and is being developed under an earn-in agreement with Piedmont Lithium Inc.

No revenue. Pass.

58) Atome (Ticker: ATOM)

19£m green fertiliser production company. Recently signed an agreement to build its fertiliser plant. No revenue. Pass.

59) Audioboom Group (Ticker: BOOM)

55£m ad-tech and monetisation platform for podcasts. Seems to be the fourth largest podcast publisher.

Q1 adjusted EBITDA of US$0.7 million (US$0.07 million), highlighting the continued strong performance of the business model.

Q1 revenue of US$17.3 million, up 1%. The Company continues to focus on high-quality revenue generation, relinquishing and replacing low performing contracts with higher quality revenue that is driving higher adjusted EBITDA.

They sell ad-spaces to advertisers. Therefore, it does not compete with Spotify, Deezer and so on. Chairman owns 5% and just bought some shares in the open market. CEO is with the company since 2014 and is responsible for the successful US launch.

Expected to grow single digits. Fwd. P/E of 20 (Koyfin). Some dilution. I guess the focus on higher-margin contracts is an interesting shift, but raises the question if they can keep these customers as there are far bigger ad-tech platforms out there, which will be able to offer lower prices. Also, what stops Spotify to build an ad-tech platform for example? Pass for me.

60) Aura Energy (Ticker: Aura)

55£m Australian-based mineral exploration company focused on uranium and polymetallic projects across Africa and Europe. No revenue. Pass.

61) Aurrigo International (Ticker: AURR)

48£m self-driving technology company. Last mile transportation for airports and automotive services. For exmaple a baggage transportation vehicle, cargo transportation or little self-driving busses. I think it’s an interesting field as you have a clean and organized traffic situation at airports and a lot of little repetitive routes.

Chair is CEO of Liverpool’s Airport and has automotive experience too. Both founders involved and own 23,2% each. One is CEO. For some reason the share price jumped 80% a couple days ago and I can’t find a reason why. Operates highly unprofitable so it’s a pass, but I could see this one work out in the long-run. Here is a recent video for entertainment purposes.

62) Autins Group (Ticker: AUTG)

4£m company which specialises in the design, manufacture and supply of acoustic and thermal insulation solutions primarily in the automotive sector but with an increasing focus on other sectors. Currently undergoing cost control and efficiency initiatives. Unprofitable. Net debt 1x EBITDA. New project wins are supposed to bring growth in H2 2026. Highlights tariff impacts. Highly illiquid, share priced moved on one single day this year. Pass.

63) Avacta Group (Ticker: AVCT)

128£m clinical stage biopharmaceutical company focused on cancer therapeutics. Unprofitable. RNS announcements consist of ‘issue of equity’ and ‘Avacta to present at XY conference’. Pass.

64) Avingtrans (Ticker: AVG)

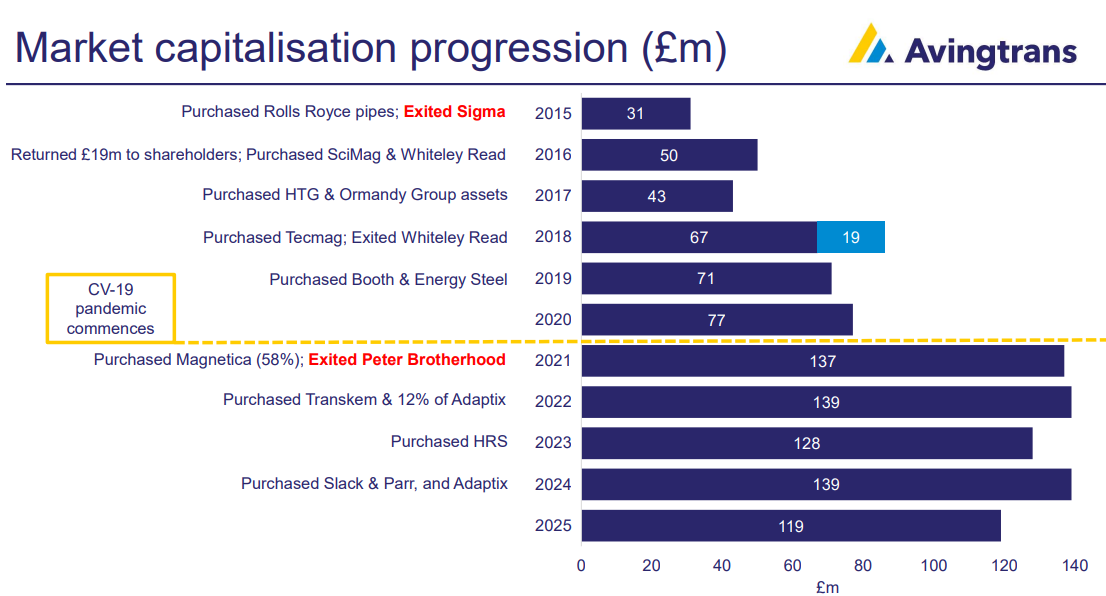

‘Avingtrans has a proven strategy of “buy and build” in highly regulated engineering markets’. 119£m market cap. Some sort of PE/serial acquirer mix as they buy, improve, sell companies.

I have looked at them before, but passed due to high complexity. 23% of sales related to nuclear. 22% to China. 1x Net debt/adj. EBITDA.

Fwd. P/E of 18 (Koyfin) with expected growth >10%. 1% dividend. Chairman is with the company since 2008. Same for the CEO. CFO since 2002. I looked at many serial acquirers in the past and if I learned one thing: it’s a people business. You need the network and establish yourself as a trusted buyer. So I like to see long tenures.

This one comes on my watchlist again. Complexity kept me away from it, I wanna see if things improved and maybe I can wrap my head around. But in the end, there are no bonus points for complexity.

65) B.P. Marsh & Partners (Ticker: BPM)

B.P. Marsh & Partners PLC is a venture capital / PE investor in early stage and SME financial services businesses, operating in niche segment where funding difficult to obtain. 264£m market cap. Launched a new buyback programme for 2£m and announced a special dividend for 3£m in total. Prior buyback was 2£m permitting purchases up to a 15% discount to diluted NAV. Great to see buybacks linked to some sort of valuation metric. Aims to pay out at least 5£m in dividends for the next years.

Also announced a 10£m investment in iO Partners, a finanical services provider within the alternative financing market (whatever that exactly means). Only looking for minority investments.

Chairman is the founder, CFO there since 2013. Overall, many director are with the company since >10 years. NAV has grown steadily with 9,7% cagr since 2005. Market cap/NAV is roughly 1x. I never invested in a buy-build-exit company, especially not with an early stage focus, because it’s so hard to value them and you really have to trust its management. I’ll put this one on the watchlist as it’s an interesting niche focus and management has a solid track record.

Wrap-up

65/669 companies covered so far.

Watchlist: 13/65.

Pass: 52/65.

Feel free to provide opinions on any of the stocks. Cheers.

Thanks for the post. I totally missed the acquisition of Aquis Exchange. The Argentex story is wild.