Exploring AIM: A-Z Part 2

Commodities, tenders offers & a retailer buying back 15% of shares

Hey there,

this is the second part of my A-Z journey on the AIM exchange in London. Out of the following 21 companies, 9 are commodity businesses, 4 have zero revenue and one has an amusing ticker. 4 others made it to my watchlist.

Here you find the first part, where I provided an overview of the structure of this series:

Let’s go!

19) AFC Energy (Ticker: AFC)

55£m provider of hydrogen fuel cell power systems used for rapid EV charging or temporary power applications. Currently focused on product development and lowering production costs to penetrate markets. New CFO since December. CEO can earn up to 2£m with bonuses while they reported 4£m in sales last FY. Negative gross margin. 15£m net cash on the balance sheet. Pass.

20) Afentra (Ticker: AET)

89£m upstream O&G company focused on acquiring production and development assets in Africa. Profit before tax were 49£m last FY. FCF about 30£m. Low debt levels. They have minority interests in most of their assets. Next FY PBT is expected to be around 30£m by sell-side. Therefore, it trades at 3x fwd. P/E. Of course the projected earnings depend on energy prices. That’s why I usually avoid this industry no matter how cheap a business seems. Pass for me, but probably worth a look for O&G investors. Chairman just changed.

21) Aferian (Ticker: AFRN)

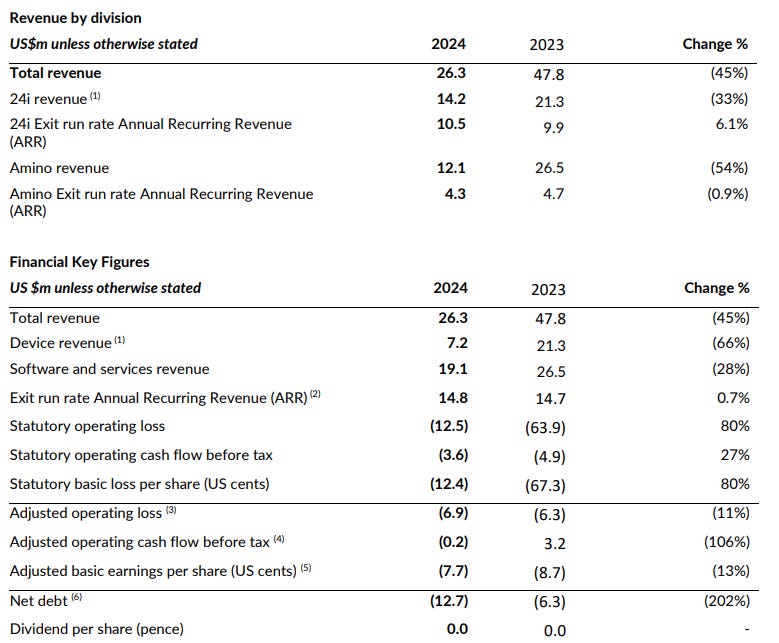

4£m provider of B2B video streaming solutions, enabling media companies, broadcasters, Pay TV operators, and enterprises to deliver live and on-demand video to any screen. The financials looks absolutely horrible:

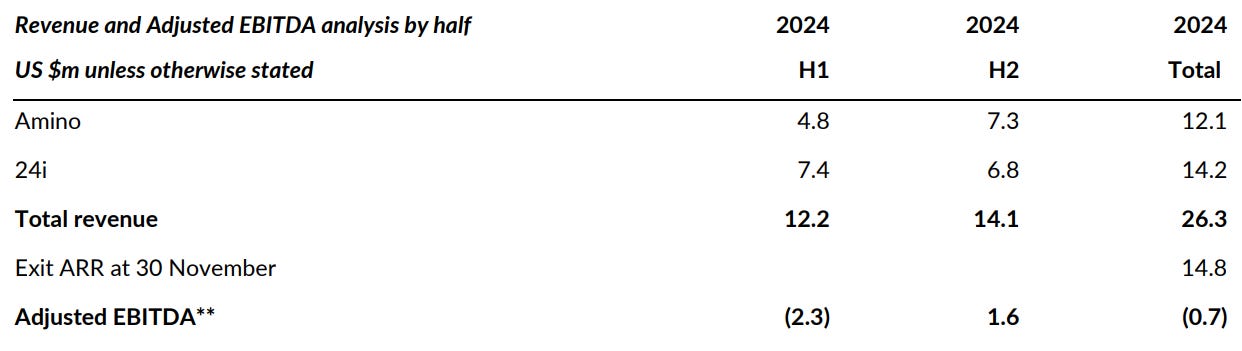

There was a similar development from 2022 to 2023. Big impairment in 2023. The CFO of those financials is now the CEO. It’s worth mentioning that H2 2024 showed positive adjusted EBITDA:

‘That strong second-half performance reflects both the dedication of our teams to delivering for our customers and increasing demand for our products. As a result of new customer wins and an increase in sales orders in the second half of 2024, we expect this strong momentum to continue into 2025.’

A lot of restructuring and cost reduction going on. You could argue this may be a turnaround story. But debt burden could kill this company if the turnaround is not successful. Still far from real profitability. Pass.

22) Agronomics (Ticker: ANIC)

57£m company active in cellular agriculture and biomanufacturing. No revenue. Pass.

Edit: Agronomics has an established portfolio with over 20 investments within cellular agriculture covering beef, pork, chicken, egg proteins, dairy, palm oil, cocoa, cotton, leather and a contract manufacturer for fermentation commercialisation.

‘Looking forward, Agronomics’ investment strategy will focus on continuing to assist our portfolio companies with expanding and supporting revenue generation opportunities, as more of them receive regulatory approval for the commercial sale of their products in their respective target markets and bring new products to market.’

It seems to be some sort of venture capital vehicle. Co-Founder and executive chair is the british billionaire Jim Mellon. Thanks to @

for pointing it out.23) AIREA (Ticker: AIEA)

11£m company focused on design, manufacturing and marketing of floor covering like carpet tiles via their own brand Burmatex. 4,5% market share in Europe. Flat revenue in 2024. Profitability far below pre-covid levels.

Just opened a new showroom in Dubai and sees the Middle East as a growth opportunity. Investing in their own facility: ‘Business transformation completion in third quarter 2025, with enhanced Group capabilities and market profile.’ EV/adj. EBIT of 7.

Probably not a bad business but I see nothing that sparks my interest. Pass.

24) Alba Mineral Resources (Ticker: ALBA)

3£m mining company with projects in the UK and Greenland. No revenue. Pass.

25) Alien Metals (Ticker: UFO) (yes, really)

7£m mining company with projects in Australia. No revenue. Pass.

26) Allergy Therapeutics (Ticker: AGY)

7£m unprofitable biotech focused on allergy vaccines.Growing strongly but so are losses. Pass.

27) Alliance Pharma (Ticker: APH)

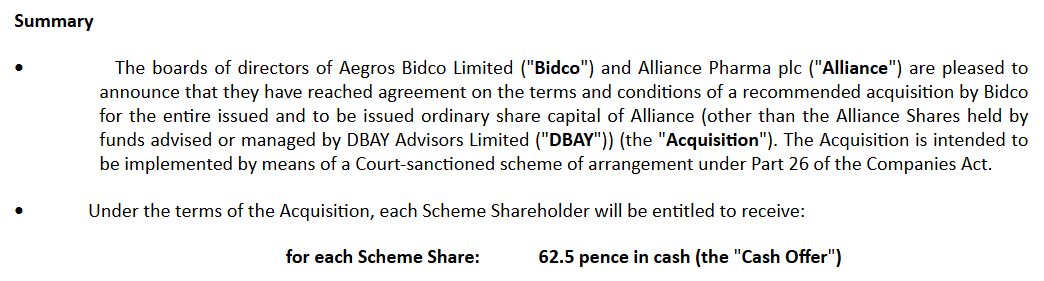

349£m healthcare company with marketing rights to 80 consumer brands. Will likely be acquired:

The offer has been increased to 64,75 pence. Today the shares trade at 64,4 pence. As the spread is so small, it seems the market is expecting this deal to go through. Pass.

28) Altitude Group (Ticker: ALT)

End-to-end solutions provider for branded merchandise across a variety of sectors. More than doubled revenues in the last years. Also showed strong growth pre-covid. Expects at least 12% growth in the current FY and stable margins. Confident despite possible tariff impacts.

With market cap of 17£m (no debt) it’s trading on 6x EV/adj. EBITDA. But breaking it down to profits shows low single digit margins. They make money by providing services such as marketing programms and supplier relation management, transaction fees, the sale of promotional products, merchanting and operating a marketplace and ERP systems. Have some sort of focus on universities:

‘In November last year we reported a robust pipeline of new University tenders. We are delighted to announce the award of a further seven new University contracts with additional aggregate annual expected average revenues of c.$6.5 million across the full academic year. The most recent of these awarded contracts has an annualised value of $4.0 million across multiple locations over a 5 year contract with an option to renew for an additional year. This award represents the largest collegiate market win since the Gear Shop division's launch. These awards, when fully operational, bring the total expected annualised average revenues to $16.7m from operating 28 contracts at 45 locations (an increase of 75.8% from our November trading update).’

Chairman joined in March. COO is with Altitude since 2014. CEO since 8 years. Founder owns 10% and is non-executive director. SBC 3% of revenue. Recent presentations states the market is highly fragmented. Therefore, I assume growing by consolidating (rather by bringing suppliers and customers together with one end-to-end solution than M&A) is fairly easy.

Watchlist: Easy to understand business that seems to gain a lot of traction. Experienced management team advised by founder. Low unadjusted margins are tricky during these tariff chaos times, so I am cautious but interested.

29) Alumasc Group (Ticker: ALU)

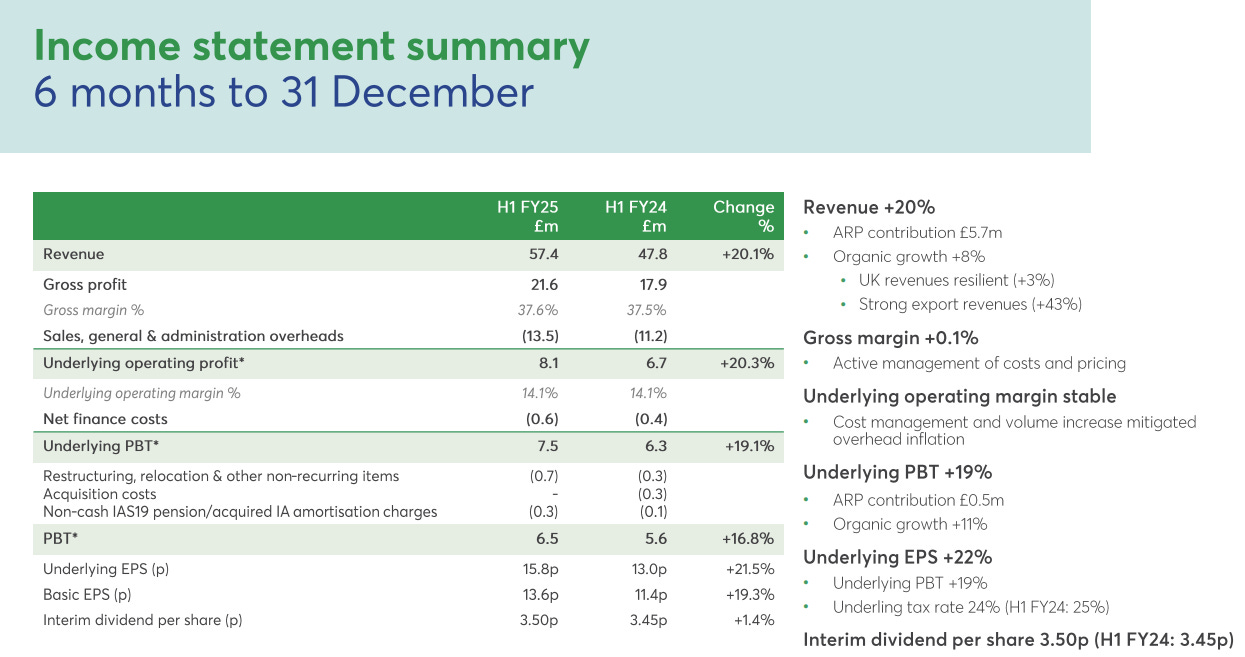

125£m supplier of premium building products, systems and solutions like water management solutions roofing products. Recent H1 update shows a solid performance:

Low debt levels and outperformed the UK housing market in recent years. 80% of revenues are generated with products that are subject to regulation. More than 80% of revenues from products that are related to environmental solutions. Currently investing in overseas sales force to increase exports.

Targets margin increases after a site in Dover has been closed (0,8£m cost savings), synergies with ARP (acquired late 2023) and operating leverage. Trades on 8x fwd. EV/EBIT, higher end of valuation range since IPO. 3% Dividend. No buybacks.

Watchlist: Seems like a less cyclical company in a usually cyclical industry and focus on exports is a somewhat easy growth case. Nevertheless, valuation makes it rather uninteresting for now but seems solid enough to keep an eye on.

30) Amaroq Minerals (Ticker: AMRQ)

353£m gold mining company focused on the identification, acquisition, exploration and development of gold properties in Greenland. 5x shares outstanding since 2020. No revenue but first gold pour in Nov 2024. Pass.

31) Amcomri Group (Ticker: AMCO)

36£m serial acquirer with a typical buy & build strategy. Ipo’d in Dezember 2024. Acquired a business in April 2025 for max. 4,84£m or 5,4x profits before tax. One Co-Founder is CEO with an engineering background. Other Co-Founder is non-executive board member. CFO has PE experience.

Currently the group consists of 12 operating businesses in embedded engineering services and B2B manufacturing with 100% ownership in all of them.

‘Amcomri’s rigorous and proven acquisition and ownership transition processes provide a low-risk solution for SME owner managers to achieve and achieve their personal and financial goals. Post-acquisition, our team brings experienced and high-quality operational, commercial and business process support to our businesses.

Our goal is to ensure stable and robust operating company platforms are created from which we can further improve and progressively build profitable, cash-generative businesses led by highly professional, well-trained and capable independent management teams.’

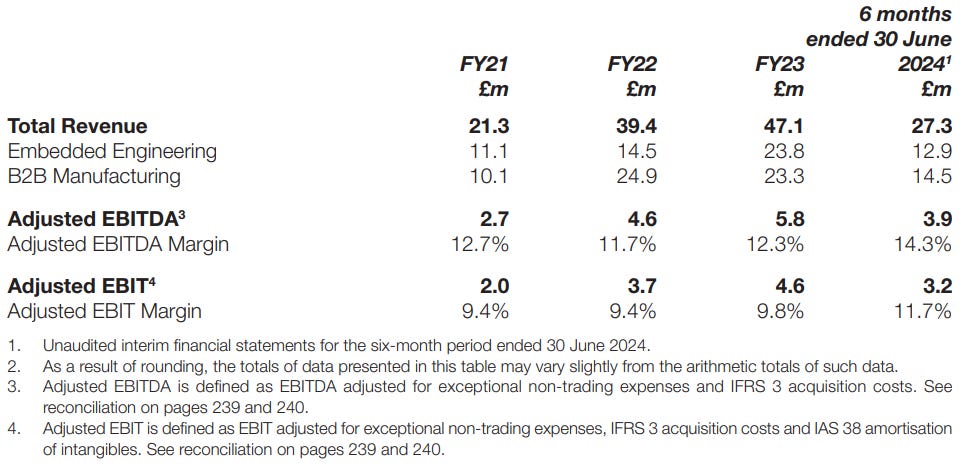

Raised about 12£m at IPO. Therefore, free float should be about 30%. Below you see numbers according to the IPO documents:

Watchlist: Valuation seems not demanding. Nevertheless it is important to give them time to prove their strategy. Everybody can grow quickly closing one M&A after the other. Therefore, I likely will not touch this stock in the near future but keep an eye on it.

32) Andrada Mining (Ticker: ATM)

Unprofitable tin, tantalum and lithium producer based in Namibia. At least got some revenues. 2x shares outstanding since IPO 2021. Pass.

33) Andrews Sykes Group (Ticker: ASY)

210£m focused on the hire, sale and installation of a range of equipment, including pumping, portable heating, air conditioning, drying and ventilation.

87% of shares are owned bei EOI. 6 directors are associated with EOI. CEO was director since 2007 and is in his new role since Feb 2024. Seems like a family controlled company. Not much RNS communication. No long-term debt. No sell-side coverage. Revenues flat since 2019. 3% dividend. Paid a ~10% special dividend in 2023.

Pass for me. With that high insider ownership and limited communication I ask myself why they are even public. Could easily take the company private.

34) Anexo Group (Ticker: ANX)

Anexo is a specialist integrated credit hire and legal services provider acting for the Non Fault Motorist.

Currently a tender offer by 2 insiders who own more than 50% ongoing. Read the article below by @

, you’ll find everything you need in case you are interesting in this special situation:Update by @

:35) Angle (Ticker: AGL)

29£m liquid biopsy company with circulating tumour cell solutions for use in research, drug development and clinical oncology. 2£m revenues with 20£m losses. Seems to work with AstraZeneca. Pass.

36) Anglesey Mining (Ticker: AYM)

Another 4£m mining company with projects in the UK, Sweden and Canada without revenue. Pass.

37) Angling Direct (Ticker: ANG)

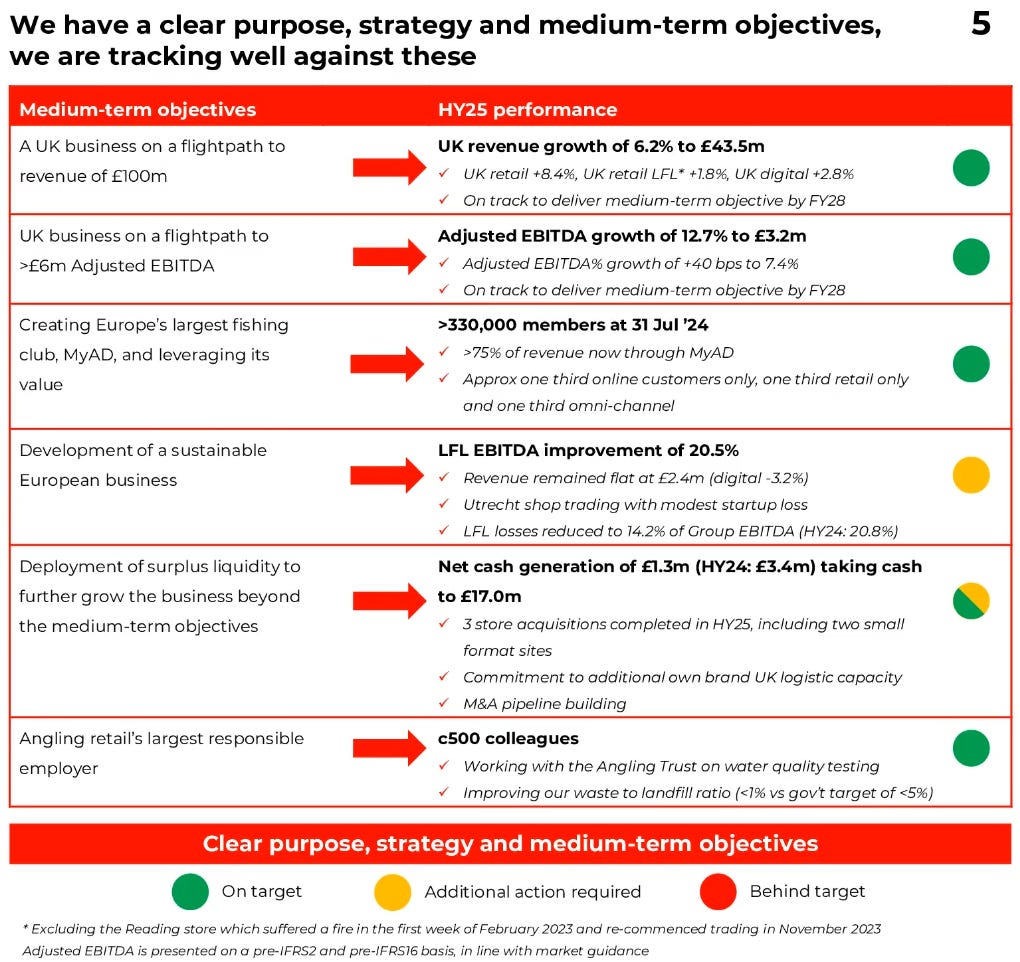

26£m omni-channel specialist fishing tackle retailer who bought back 5% of outstanding shares since Dezember. Got 54 stores and 2 distribution centers. Most revenues are generated through their own fishing club MyAD. Seem to be going into M&A by acquiring other stores. Aiming to expand in Europe, currently making losses there. Medium-term targets:

Updated their capital allocation policy in Dezember, music to investors ears:

‘The Board has evaluated the Group's existing net cash balance in light of its new Capital Allocation Policy, taking into account feedback from its major shareholders. The Board is also of the view that the current value of the Group's equity represents an attractive opportunity for deployment of surplus capital. The Company is therefore commencing a share buyback programme with a buyback of up to £4.0m.’

The share prices jumped 10% after the announcement, but is now back to old levels. 4£m represents 15% of shares currently and they are buying back shares daily. There was 12£m in cash on the balance sheet at 31st of January. Only long-term liabilities are leases (I guess for the stores).

Low profit margin of 3,5% which is typical for retailers. Seems like profits are mainly generated during summer season. Also selling products of their own brand, lifting margins. Secured a new logistics facility for further scale.

Current CEO was the prior CFO, maybe that explains the updated capital allocation policy. Co-Founders is still involved as non-executive director and owns 14% of shares. The other Co-Founder owns 5% but is not a board member.

For FY25 revenue grew 12% to 91£m and adj. EBITDA (pre-IFRS 16 and pre-IFRS 2) is said the be above 3,15£m. UK same store sales were up 6%. Keeping it simple (profits are roughly 50% of their adj. EBITDA) it’s trading on 15x P/E (ignoring buybacks).

Watchlist/Buy: Easy to understand business, straightforward growth strategy, founders involved, the fishing club should lead to high customer loyalty. Assuming they grow sales mid single digits, increase margins in the UK and reduce losses in Europe (which was the case comparing FY25 and FY24) in combination with buybacks this seems to be the most interesting setup so far. Would be in the buy category without question if the valuation would be lower.

38) Anglo Asian Mining (Ticker: AAZ)

140£m gold and copper miner. Expects EBITDA to be 45£m to 55£m in 2025. Environmental shutdown in 2023. First ore extracted from a new mine in March, with full production starting in May. Commodities are not my field, pass.

39) Angus Energy (Ticker: ANGS)

12£m onshore O&G producer in the UK. Seems to be operating profitable. 5£m revenue in Q1. Pass for me as I avoid O&G.

Wrap-up

39/669 companies covered so far.

Watchlist: 9/39.

Pass: 30/39.

Feel free to provide opinions on any of the stocks and feedback on the structure of this article. Cheers.

Soon you will reach AS...

Very good series about the AIM, thanks. From this one, I take Alumasc and Angling Direct, but the valuation in Alumasc not very compelling, the easy money was already made. As for Angling Direct, in first sight not super cheap, but with the buybacks and so on not so bad.