I’ve written about Volex (Ticker: VLX.L) in March this year and laid out my basic thoughts about an investment. I recommend to read that article first to understand what kind of company Volex is and what’s the thesis, you can find it here.

Since back then Volex reported their FY24 numbers, including more details on the important Murat Ticaret (M.T.) acquisition and the share price jumped 25%, so it’s time to give an update on the thesis and expected IRR. Note that Volex is reporting in $, so all the numbers I provide are in $.

Murat Ticaret (M.T.) acquisition

M.T. has been acquired for a total consideration of $196m in September 2023 (H1 FY 2024) and had ~$170m in sales, with a 20% EBITDA margin. Volex FY ends in April, so I expected M.T. to contribute 55% ($93,5m sales with a 15% EBIT margin). I underestimated the growth of M.T.:

In FY2024, the Murat Ticaret businesses contributed $132.4m to Group revenue, $20.6m to adjusted operating profit and $10.5m to operating profit. Associated acquisition-related costs of $3.7m, acquisition-related remuneration of $0.7m and intangible asset amortisation of $7.4m have all been expensed as adjusting items in the period. If these entities had been acquired at the beginning of the year, they would have contributed revenues of $216.7m and operating profit of $24.6m to the results of the Group. - Volex Annual Report 2024

It contributed more than 60% in these 7 months it was part of the group, so it doesn’t seem to have notable seasonality and adj. for the intangible asset amortisation hit the ~15% EBIT margin, but showed a lot of growth vs. my simplified expectation of no organic growth.

FY 2024

Above you see my FY24 expectations back in March, if you want to get behind the math please check out the old article. The actual FY24 numbers came in mixed compared to my numbers:

Sales of $912.8m, the difference is mainly attributable to the M.T. growth

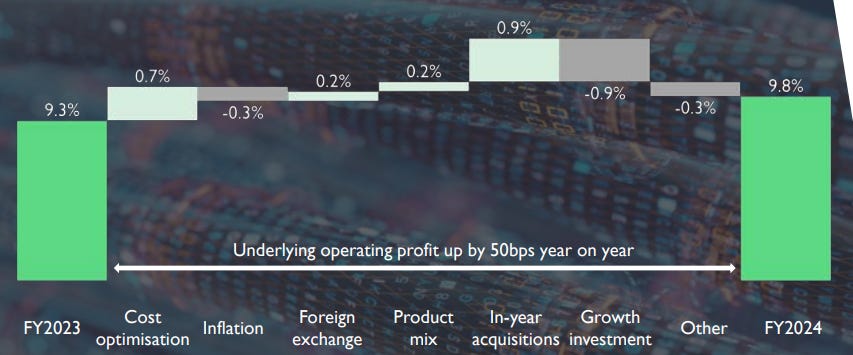

Adj. EBIT margin of 8,7% (adj. for amortization of acquired intangibles and a cyber incident that cost them about $2m), exactly in line with last year. The positive impact of M.T. got wiped out by growth investments and we have seen higher SBC. You see different margin levels below as Volex further adjusts EBIT for SBC and acquisition costs, but I just want to give an idea of what impacted margins here.

Looking forward

FY24 suprised to the up- and downside but has been a solid year overall. The recent trading update showed that their growth investments are leading to more organic growth:

The Group has delivered an encouraging start to the new financial year with year-on-year constant currency organic revenue growth of 9.0% driven by particularly strong performances in the EV and Data Centre sectors. Murat Ticaret is trading well year to date in its first full year of ownership, supplementing strong year-on-year organic growth in the Off-Highway market.

Site expansions in Mexiko, India and Indonesia are completed, expansion in Turkiye is ongoing. Expansion in Poland was completed in H2 FY24. All of them increase their footprint in terms of squaremeter of production space by 25%. We will see further growth investments in FY25, capex is expected to be ~5% of sales compared to ~3,5% before + $18m in operational investments compared to $8m in FY24.

Management says we will see margins in FY25 more or less in line with those seen in the last years. Depending if we see M&A and how quickly the now completed site expansions turn into sales and profits, that seems like a reasonable expectation.

To provide FY25 expectations I took the FY24 sales as a baseline. We got the TU showing 9% organic growth, so I expect 6% organic growth, I think that’s really conservative, for FY25. The $10m of investments are the difference to last year. ~$83,4m of revenue will be contributed from M.T. with a 15% EBIT margin, ignoring any further growth.

It’s hard to say what margins we see due to the organic investments. You could say that no big M&A deal would increases the margin as we don’t have M&A costs which were ~$4m in 24 or that the site expansions lead to some kind of opearting leverage and so we would see margins towards 9%. But as the Volex investments case rather aims for the FY27 targets let’s take a look at these.

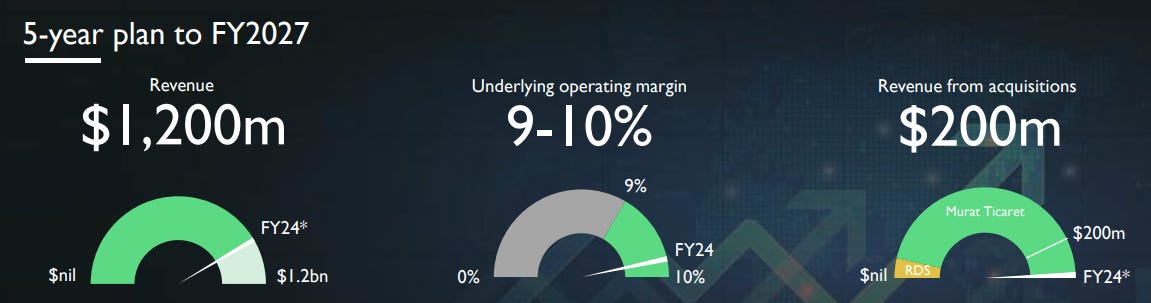

FY 2027 targets

The *underlying operating margin* is an adj. EBIT margin for sbc, amortisation of acquired and intangibles and acquisition costs. My adj. EBIT above is not adj. for sbc and acquisition costs as sbc is a real expense and acquistion costs are not one-offs if M&A is part of the strategy, so my adj. EBIT, which is more conversative, will be in the 8-9% range in FY25, so it’s likely they achieve 10%+ in FY27 when adjusting for more expenses and when growth investments are completed going forward.

The revenue from acquisition target is already achieved by the M.T. acquisition alone. So the main question here is how they take the business from $1b+ in FY25 to $1.2b in FY27: Management says their focus are organic opportunities as site expansions and projects with existing or new customers, especially in the EV and Data Center market, so they are confident to achieve the sales target organically. If we see msd organic growth rates and an M&A deal we easily achieve that as target as well.

Expected IRR

Volex is paying ~1% in dividends, but as mentioned is also diluting via sbc. So to keep it simple I would assume that sbc offsets the dividend return.

As I said it’s tough to say where we see margins exactly, but if we don’t see bigger M&A deals and therefore low M&A costs and organic growth investments normalize to FY24 levels after this year, they’ll achieve ~ 9,5% adj. EBIT margin only adj. for amortization of acquired intangibles.

Keeping it straightforward, expecting $1.200m in sales with my more conservative adj. 9,5% EBIT margin would give us $114m in adj. EBIT or a <8,5x EV/adj. EBIT in FY27. Using a 6,5% profit margin leads to a P/Ee27 of 10,5.

The current fwd. EV/adj. EBIT is ~11 based on my estimates.

In my old article I calculated with a 10x exit EV/adj. EBIT:

10x $114m = $1,140B enterprise value at the end of FY27 (April 2027).

This implies a 20% increase from current levels in ~2,75 years or a 7% irr. That’s way below my ~12% irr back in march, due to the decreased margin and the stock priced already jumped 25%.

As we know calculations like this are really sensitive to changes, e.g. taking the exit multiple to 11 would change the irr to above 10%. Using the old 10% margin would get us to 9%.

Risks

The largest customer operates in the EV sector and accounts for 11.4% (2023: 15.8%) of revenues. This should decrease to <10% in FY25 due to M.T.

Large M&A deals always have the risk of not delivering what’s promised, so it’s important to keep an eye on the M.T. integration, cross selling, … . For now I don’t see an alarming development here.

The EV and Consumer Electronics markets are still weak, even though Volex sees signs of recovery going forward.

Tensions between USA and China/Trade war: I can’t really specify that risk, but Volex is shipping from Asia to the USA and has facilities in China, so that’s something to keep in mind.

Good to know

Tensions in the Red Sea are not impacting Volex as they mostly ship from Asia to the US. Rising shipping costs would even benefit their businesses in Türkiye according to their CEO.

More of a fun fact, some would say a red flag: Next to supplying Tesla, Volex also works with Tesla Solar and SpaceX.

Wrap up

Overall I believe the thesis is on track. In my old article I was more bullish on the margin as I expected more M&A and less organic investments, but this doesn’t change the view on Volex, it only adjusts the path they take. I’m confident they’ll achieve their targets and due to their investments, have potential to surprise to the upside if we see M&A deals.

The IRR is not as attractive as before, but as I only use this to have a rough idea how this could turn out and being aware of the variety of outcomes, I think Volex remains interesting.

I hope I could provide some further information on Volex and my work might serve as a starting point for further research and discussions. Feedback is always welcomed.

Cheers.