Macfarlane Group (LSE:MACF), designing, manufacturing and distributing protective packaging solutions throughout the UK and Europe, recently reported H1 FY24 numbers, showing continued weak demand from customers and price deflation as guided by management, but inorganic growth and cost control could not offset top-line weakness this time.

If you are not familiar with Macfarlane yet I recommend checking out Lewis Robinson’s work.

In March I wrote an earnings recap for FY 2023, you can check it out here.

The numbers

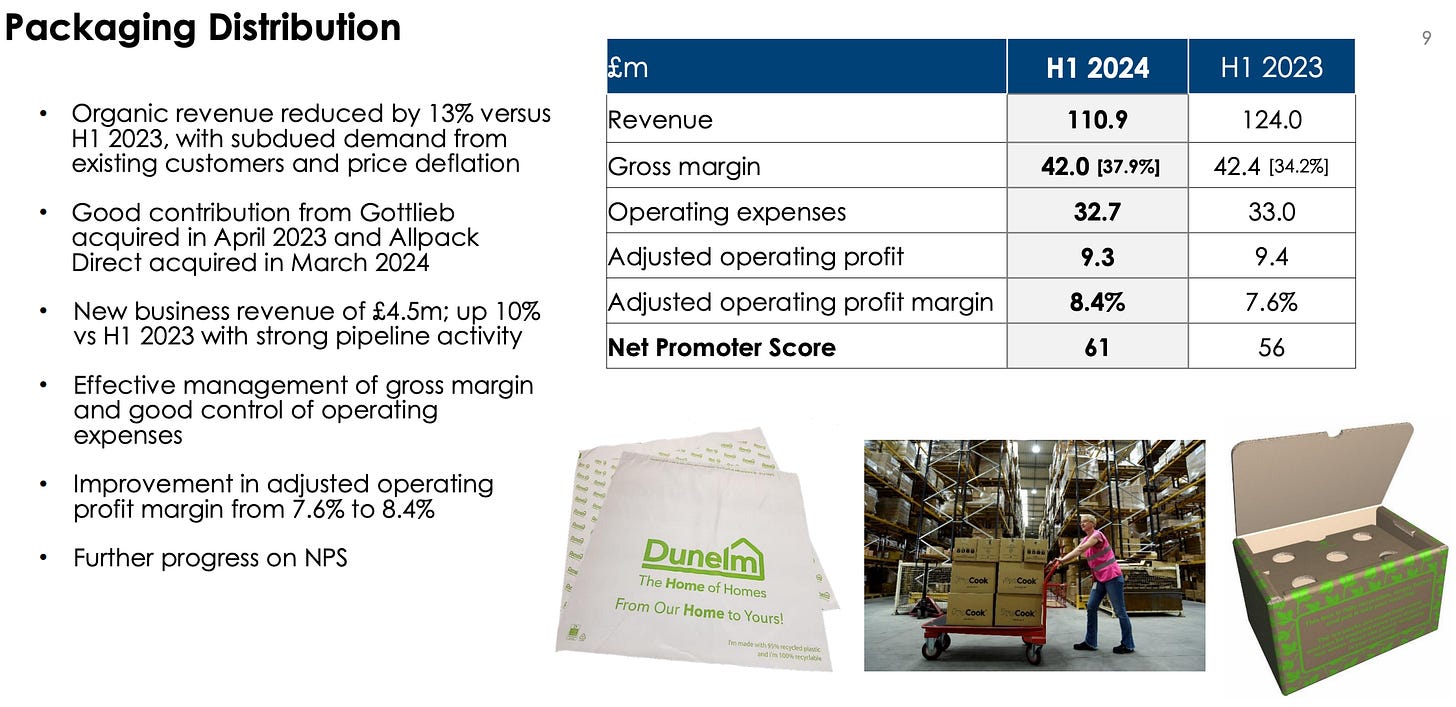

As in FY23, sales continued to decrease. Main reason is that the distribution division, which accounts for 85% of sales, continues to struggle with -13% organic revenue or -10,6% if M&A included. Price deflation and lower volumes show their impact here.

What’s interesting is that profits are roughly flat, achieved by a higher gross margin due to a more favourable customer mix and better sourcing. Numbers are adjusted for amortisation of acquired intangibles and change in contingent consideration from M&A activites (I consider these adjustments to be useful to reflect underlying profitability). Recent M&A deals also supported profits, both Gottlieb and Allpack have higher margins than the group. Further employee costs has been reduced as volumes shrink.

The manufacturing division showed weakness too with organic revenue change of -3%, which has been offset by inorganic growth, and lower profit margins. According to management a 15% adj. EBIT margin is sustainable here.

Operating cash flow came in 20% lower than in H1 2023, especially due to inventory building up compared to destocking before. Capex was £1.4m in line with last year.

Historically adj. EBIT and FCF are roughly the same over 10 years, in the last 5 year FCF was 20% above adj. EBIT and I see nothing to be concerned about regarding cash generation here.

M&A

Part of the investment case for Macfarlane is based on execution on their M&A strategy. In 2024 they acquired two businesses:

Allpack Packaging (distribution) in March:

£2.5m + max. £0.75m earn-outs based on agreed profit growth targets over one year, net of cash.

In 2023 Allpack had sales of £3.0m, with EBITDA and pre-tax profits of £0.6m.

Polyformes (manufacturing) in July:

£6.7m + max £4.8m based on agreed profit growth targets over two years, net of cash.

In 2023 Polyformes had sales of £9.3m, with EBITDA of £1.5m and pre-tax profits of £1.4m.

All directors of both businesses remain within the group. Both acquisitions are financed with existing bank facilities.

Overall their M&A pipeline remains strong. They turned down 20 possible acquisitions in H1 2024. Nevertheless it’s unlikely to see more deals going through in 2024 according to management.

In the Q&A session CEO Peter Atkinson has been asked if companies acquired in recent years are performing in line with expectations: all but one (B&D, acquired last year) are performing. B&D is behind expectations as they supply the defense sector which relies on government spending. Due to the recent changes in Ministry of Defence, revenues seem to be postponed here. But B&D is one of the smallest companies they have acquired in the last decade, so no matter how it performs, the impact should be small. We can see other recent acquisitions are performing, as earn-outs are paid:

H2 and beyond

Management states that they see first signs of price inflation to return soon. Most of their distribution business is exposed to paper prices. Here we’ve seen ongoing price deflation since Q4 2022. The 2nd quarter was the first one with price inflation since then. Polymer prices are already on the rise since their lows in Q3 2023.

In the past management showed excellent cost control, gross margins did even climb despite the price volatility. Cost increases will be passed to customers.

Regarding operating margins we can expect organic improvements. Further cost savings have been implemented in H1 that should have an effect in H2 and their ongoing site consolidation (4 sites are merged into 1) should be done in H1 2025 with estimated savings of £0.4m / year. The two acquired companies with margins above the group level will improve margins further.

Only thing that could have a negative impact is the elevated gross margin. ~38% in the distribution segment is unlikely to be sustainable.

In terms of M&A management is in search for a manufacturing business in Europe, as customers request Macfarlane to supply them directly instead of exporting from the UK. European acquisitions take more time since Management is aiming for larger acquisitions compared to the ones in UK, because they need to build up a footprint in Europe.

EDIT: Macfarlane did not have £9.8m cash on hand as I wrote this in August 2024 as the Polyformes acquisition happened after H1. So the numbers in the following paragraph are not correct/not adjusted for the M&A deal.

Currently they have £9.8m cash on hand. The last time they had a lot of cash was at the end of 2021 and we saw the important Packmann acquisition some months later. So as they say, they are preparing for a larger acquisition in Europe and the balance sheet is preparing too, looking at the cash pile and debt/ebitda of ~1 (only leases, no long-term debt).

Valuation / IRR

In my FY 2023 recap I expected FY 2024 to be a flat year for profits and I would hold on to that assumption. Profits are slightly down so far, but in H2 acquisitions will contribute £1.7m pre-tax profits (assuming no seasonality, ignoring the struggling B&D business acquired in Oct 2023), we should see cost saving effects and price deflation to be less impactful.

EDIT: Cash position was lower than £9.8m, but impact on valuation numbers is not significant if adjusting for the Polyformes acquisition.

So assuming similar adj. EBIT to 2023 of ~£27m, Macfarlane trades on ~8x EV/adj. EBIT. Also leading to a FCF yield > 10%.

Taking off £2m in financing costs and a 25% tax rate would show profits of £18.75m or a P/E of ~10.

I said in my last recap as well: Macfarlane is definitely not a ‘no-brainer’ or a deep value play. I guess it’s cheap, but I don’t want to bet on multiple expansion for a solid IRR so here is how I see a path to 8%+ IRR in the business:

top-line growing low single digits organically with inflation medium-term + expansion in Europe

profits growing mid-single digits organically as the higher margin, manufacturing division becomes more important and costs are controlled successfully as in the past

continue to execute on M&A strategy, this typically enhances margin expansion because acquired companies have higher margins than the group

dividend yield of ~3%

3% dividend + 4-6% organic profit growth + M&A should get us there, only to get an idea. Any multiple expansion comes on top

Probably the main risk beside overall weak economic conditions and price fluctuations is Peter Atkinson’s age. He should be around 70 years old and is with Macfarlane since over 20 years. The board was already working on succession plans in H1 2023, even though he said he has no intention to leave.

Things good to know

Ex-UK sales now account for 10% of total sales

Relaunch of their website / webshop in Q4, which is especially important for smaller customers (small customers spend less than £10k and account for 10% of sales)

Currently implementing solar panels on one of their manufacturing sites, should lead to decreased energy costs

DS smith, one of Macfarlane’s suppliers, will likely merge with International Paper (US based, $17b market cap), which may have an impact on paper prices.

Wrap up

Macfarlane won’t make you rich, it’s boring, but considering that the business and its management team have such a great track record, operate in an industry that does not face any obvious risks of disruption and we have a low valuation that leaves some room for multiple expansion/offers downside protection I see Macfarlane as an interesting pick.

I hope I could provide some useful information on Macfarlane and it might serve as a starting point for further research and discussions. Feedback is always welcomed.

Cheers.