Exploring AIM: A-Z Part 16

Possible Turnarounds, Profitable Tech and more Niche Companies

Welcome to part 16,

today we’ll reach ticker number 300. I want to make a slight change to the categorization of companies. Instead of only passing on many, I want to decide whether it’s a general ‘pass’ or just a ‘pass for now’. The goal of this is to build a database of companies worth checking over and over again in the coming years (e.g. due to elevated valuation, possible turnarounds, reaching profitability) without having to spend time on those that are not investable for me anyways (e.g commodities). So the watchlist companies remain those that are most interesting for me, while the ‘pass for now’ go to another list to go through again some day and see whether they deserve a downgrade to uninvestable or an upgrade to the watchlist.

Two for my watchlist in this part, various other profitable companies and five that deserve the new ‘pass for now’ tag. Let’s go.

Here you find the last part:

Here you find all other parts: https://increasingodds.substack.com/s/a-z-uk-aim

281) Huddled Group (Ticker: HUD)

13£m ‘e-commerce retail group specialising in surplus goods and operating a portfolio of socially and environmentally responsible businesses that serve customers across the UK’. Q1 trading update shows over 100% growth YoY and ‘solid progress made in the move towards operational profitability before head office costs’. Head office costs are >1£m on adj. EBITDA basis. New executive Chairman since July who owns 14% of shares.

Got three brands: Discount Dragon (food & drinks), Boop Beauty (beauty products) and Nutricircle (supplements, Protein bars etc), the first one accounts fot over 50% of revenue and saw a 18% decline, all are unprofitable so far. Shifting warehouse order processing capacities towards the two other growing brands. Nutricircle was acquired in April 2024, Boop Beauty was relaunched in September 2024. Another brand was shut down due to ‘lack of management bandwidth as well as the changing world of tariffs’. HUD seems focused on buying goods which would otherwise be waste, e.g. excess investories. So it buys these goods at discounts.

After a successful Q2, they partnered with an e-commerce solutions provider to accelerate growth plans and raised 1,5£m. This should remove capacity constraints and enable faster delivery. Transition to new facilities will be completed in Q4. Sounds like profitability before head office costs will be achieved by this move. Too early to tell if it works out and whether they can reach real profitability, therefore it’s a pass for now, but worth another look some day. @Myles McNulty wrote about HUD in February:

282) Hutchmed (China) (Ticker: HCM)

2,215£b drug discovery company from China focused on cancer drugs with own manufacturing capacities. Latest results show -10% revenue. Expects similar revenues to prior year for the full year. Operates on the edge of profitability, but got >50% of market cap in cash, also because of a 477$m cash inflow from a joint venture divestment. Conglomerate CK Hutchinson owns 38%. China + biotech makes it a pass.

283) HVIVO (Ticker: HVO)

67£m contract clinical development provider. Works with 7 out of the 10 largest biopharma companies. New chairman since 1 September. H1 TU shows -1/3 revenue and EBITDA margin cut in half to 12%and full year EBITDA margin will be negative. Order book of 40£m down from 71£m. Did two acqusitions for 10,5£m. Expects return to growth when ‘macro and sector-specific headwinds abate’. Did 16,4£m in EBITDA last year and 1,69p EPS (current share price of 9,7p). Seems like they benefited from covid and now suffer from tight R&D spending. Definitely a pass for now, but worth a look when industry recoveres. Write-up by @DeepValue Capital:

284) Idox (Ticker: IDOX)

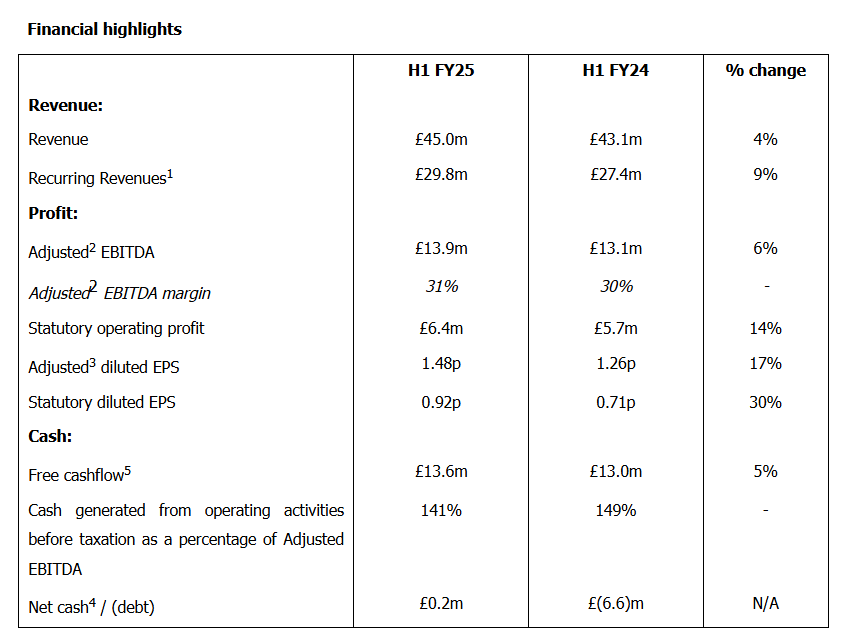

248£m supplier of software and geospatial data solutions, focused on public and asset-heavy industries. For example passenger information systems, fleet management, hospital inventory or facilitiy management solutions.

Just acquired Pilanz, provider of health care and social care solutions for 7,65£m in cash (3x revenue, 12x adj. EBITDA). M&A is part of the growth strategy, multiple acquisitions in last years. 60% of revenue is recurring, order intake higher than revenue growth. Aims for 35% adj. EBITDA margin and 10% share of the 300£m geospatial market by 2028. I’m not sure whether the higher growth in profits is achieved through scale or if there are certain programmes in place. EBIT adjusted for non-cash amortisation of intangibles was ~18£m last year. Net cash. Assuming ~20£m adj. EBIT this year it’s trading on EV/adj. EBIT of ~12,5.

Highlights good revenue visibility for H2 and 2026. Some share issues in the past, I assume for M&A. Small dividend. No insider ownerhsip, various asset managers own >60% of shares. CEO joined in 2018 from Nortgate Public Services, so he knows how handle public spending cycles I assume. Chairman also joined in 2018 from the same company. Seems like a slow grower with increasing margins and M&A experience. Watchlist.

285) IG Design Group (Ticker: IGR)

54£m consumer gift packaging business (‘the largest in the world’). Offering everything like gift cards, gift wraps, gift bags or partyware goods. Stock crashed in January as a big customer of IGR went bankrupt in the US, leading to -10% in expected revenue and expected profits around breakeven instead of 32£m. As we know today, operating profit for the full year was ~5£m. Was suffering from lower margins post-covid anyways and plans for margin recovery were delayed. Further highlights competitive retail environment and increased freight and material costs. It seems everything that could go wrong went wrong or still is going wrong here. Cost-savings programme and restructuring ongoing, e.g. exit manufacturing site in China or site consolidation in the US.

But the recent problems were only the last needed punch to push them into big trouble. Margins already peaked in 2019 and revenues in 2022 as the dividend got cancelled. CEO left in June. Retail is a tough game to play, especially when you sell such simple products. Pass for now, but depending one who will be the new CEO it may get interesting. Trading at 50% of net current assets, PP&E alone is worth the market cap (at least on paper). Founder and his family own 23% of shares, he is on the board. This could become a turnaround or liquidation play. Some of you may know Smoak Capital, IGR is part of their portfolio.

286) Ilika (Ticker: IKA)

65£m designer of micro batteries used in MedTech or IoT devices. Operates highly unprofitable since years with revenue between 1£m - 3£m a year. A US partner will start to manufacture their batteries soon, based on a ten-year manufacturing agreement signed in August 2023. Most costs accour in R&D and for their staff. Pass.

287) Image Scan Holdings (Ticker: IGE)

2£m provider of X-ray screening systems used for detection of explosives or industrial inspection. Expects a ‘positive second half’, but highlights problems in supply chains. Outcome for the year is ‘uncertain’ and market expectations will not be met. Revenues are flat since years with profits of 0,1£m - 0,2£m a year. Full year trading update in October. Pass.

288) ImmuPharma (Ticker: IMM)

58£m no-revenue biotech focused on peptide-based therapeutics. Share price just 7x on a new patent application. Commercialisation of product portfolio is the next step.

No FDA approvals so far, maybe worth a look for pharma people, pass for me.

289) Impact Asset Management (Ticker: IPX)

233£m asset manager with a focus on sustainable development. 10£m buyback announced in May. Assets under management of 26£b down 40%, 90% of that in listed equities. Revenues, margins and profits down accordingly. Still >25% operating margin and ~20£m operating profit. Founder is the CEO and owns 7% of shares. Not interesting for me, pass.

290) Indus Gas (Ticker: INDI)

20£m profitable O&G exploration and development company. Minimal reporting, revenues down 90% yoy, profits down 95%. Disruption of gas deliveries due to maintanance of a customers turbine, but I’m not sure whether that’s the main reason for the horrible numbers. Pass.

291) Ingenta (Ticker: ING)

10£m provider of software to manage distribution of digital content like book or research publishing. 88% of revenue recurring, revenue and profits down last year, probably due to switch to SaaS as ARR is growing? Revenue peaked in 2013. 1/3 of MC in cash, 1,3£m profits last year. Latest TU for H1 shows small increase in revenue and adj. profits up to 0,9£m (adj. for an exchange gain) for the first 6 months alone. Worth highlighting that ING accumulated tax losses, so these profit levels seem unsustainable. But it’s still cheap even if you include a tax charge, 6% dividend. Seems like a solid company staying in its niche with limited growth prospects, but expands its sales team and is confident to maintain momentum. Watchlist for the statistics, I can’t trade it anyways.

292) Insig AI (Ticker: INSG)

29£m ‘data science and machine learning company focused on providing solutions to the asset management industry’. Operates unprofitable since years, revenues crashed to just 0,37£m last year. Seems to recover from this as the latest TU shows 0,25£m for the quarter. Relaunched its website and appointed a ‘strategic & asset allocation advisor’ and a ‘business development director’. So it seems something is moving, pass nevertheless.

293) Inspecs Group (Ticker: SPEC)

44£m designer, manufacturer and distributor of eyewear frames. Recent TU shows a 1% decline in revenue due to tariffs impacts (not sure whether you really need a reason to explain -1% in revenue) and -20% in underlying EBITDA. Expects a stronger H2 and hopes for trade agreements. Is consolidating US, German and Swedish operations which should lead to higher margins in H2. Expect adj. EBITDA of ~17 - 18£m for the full year and growth for the next 5 years to be ~4% while doubling EBITDA margins and deleverage. Most of adj. EBITDA is eaten up my D&A and finance costs, leading to unprofitability last year and break-even in 2023.

Is looking for a buyer of an unprofitable subsidiary, which was acquired in 2020. Founder is executive director and owns 18% of shares. Units sold continues to grow (>11m) and production capacity was just expanded by 5m. Doubling margins seems like a stretch, but expanded capacity and deleveraging could be enough to at least grow profits faster than revenues, pass for now.

294) Inspiration Healthcare Group (Ticker: IHC)

19£m designer and manufacturer of neonatal intensive care medical devices. Latest H1 TU shows 41% revenue growth to 24£m (incl. a 6£m humanitarian aid contract, probably a one-off) and reduced debt levels. Expects positive momentum to continue in H2. New CEO since January after a tough FY25 with losses, COO also gone. Implemented cost saving programmes. Hard to tell whether IHC will operate profitable for FY26, but sales momentum + new management makes it interesting enough to look at it again some day: pass for now. ~8% net profit margin in 2021 and 2022.

295 - 296) Inspired (Ticker: INSE / INSA)

133£m commercial energy and sustainability advisor. Received a cash offer for 68,5p per share in April which was later lifted to 81p and represents the current share price. Shares will be cancelled from trading on 30 of September, the acquiring company received acceptances respresenting >97% of votes. Pass.

297) Inspirit Energy Holdings (Ticker: INSP)

0,16£m company which transformed into a cash shell in October 24 and was suspended from trading in April 25 as they didn’t acquire anything. Pass.

298) Intercede Group (Ticker: IGP)

101£m cybersecurity software company. Recent update for the full year shows -10% revenue, but the prior year included a bigger one-off license sale. Excluding this one, revenue grew 26%. Profits of 4,1£m, 97% gross margin, 23% net margin. 60% of revenue is recurring. Announces new contract wins all the time. Chairman is with IGP since 2002, CEO since 2018. One director owns 28% of shares and is CEO of a company which ‘provides corporate finance advisory services’. Fwd P/E of 31 (Koyfin). Cybersecurity is not for me, so it’s pass. I found a podcast by @Small/Mid Caps with Paul Scott with IGP’s CEO Klaas van der Leest for those interested:

299) Invinity Energy Systems (Ticker: IES)

95£m manufacturer of vanadium flow batteries, an alternative to lithium batteries. Positive newsflow of new orders and new partnerships. Operates highly unprofitable, but is debt free. Couple millions in revenue. Pass.

300) Iofina (Ticker: IOF)

45£m producer of iodine (2nd largest producer in the US) and specialty chemical products. Just reported its highest iodine production volumes in history. Also got an exploration team to find iodine sources. FY24 results show 9% revenue growth (7th year seccessive year of growth), but 40% reduced EBIT. Exposed to iodine world-market prices. Chairman is Co-Founder, CEO is with IOF since 2010. 13x Fwd. P/E (Koyfin). Considering increased production volume, consistency of growth and management expertise this is likely worth a look for materials/chemicals people. Pass for me.

Wrap-up

300/669 companies covered so far.

Watchlist: 43/300.

Pass: 257/300.

No-Revenue counter: 68/300.

Feel free to provide opinions or sources on any of the stocks. Cheers.

Interesting fact about Infinity - UK government owns 25% through national wealth fund.