Welcome to part 15,

I think we never saw that many mining businesses in one part. Two of them are actually profitable. Most interesting one for me is a founder-led labour supply company with a 4% dividend. You’ll also find three companies with NAV > Market Cap: a renewable energy asset manager, a small pub operator and a designer of luxury bathroom interior. Let’s look at the 20 tickers.

Here you find the last part:

Here you find all other parts: https://increasingodds.substack.com/s/a-z-uk-aim

I recently wrote about an AIM listed company I personally own:

261) Great Western Mining Corporation (Ticker: GWMO)

2£m no-revenue gold and silver exploration and development company with projects in the US. Test drilling in October. Pass.

262) Greatland Resources (Ticker: GGP)

2,059£b cold and copper mining company from Australia. 8 exploration projects, 1 in development stage and 1 active mine. IPO’d in June. About 1$b in revenue, 0,337£b profits, no debt. Seems interesting for mining people, pass for me.

263) Greencoat Renewables (Ticker: GRP)

708£m renewable energy infrastructure company owning 40 projects in Ireland, Germany, Sweden, France and Spain. 35 onshore wind projects. Other 5 are offshore, solar and storage. NAV of 158% of market cap. Pays a dividend. Just sold 4 Irish assets with a 4% premium to NAV and listed on the Johannesburg Stock Exchange. Did a buyback last year for ~2,5% of shares, but issued shares regularly before. Share price in a downtrend since 3 years. Pass for me, I’m simply not really interested in asset managers.

264) Greenroc Strategic Materials (Ticker: GROC)

6£m no-revenue exploration and development company from Greenland focused on ‘high-grade critical minerals’. Seems to be mainly focused on a graphite mine when looking at the RNS news flow. Pass.

265) Griffin Mining (Ticker: GFM)

346£m mining company operating in China. Operating with 20% EBIT margins, but profits and revenue down in H1 due to less mined and processed ore. Operations were suspended in one mine in Q4 2024 which impacted Q1 2025 as well. Production volumes now recovered and are at record highs. Buyback for up to 10£m ongoing. 14x fwd. P/E (Koyfin). Pass for me.

266) Guardian Metal Resources (Ticker: GMET)

141£m no-revenue exploration and development company with projects in Nevada, USA. Share priced doubled on positive drilling results and an award from the Department of Defense of 6£m for a project. Wants to list in the US. Pass.

267) Gunsynd (Ticker: GUN)

2£m no-revenue exploration and development company for various metals with projects in Canada. Pass.

268) Hardide (Ticker: HDD)

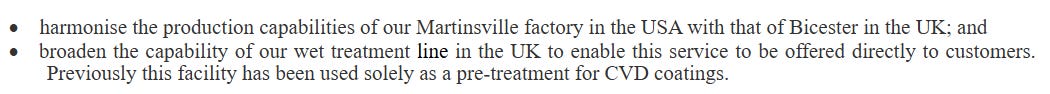

6£m provider of surface coating technology based on tungsten-carbide. AGM TU shows 30% revenue growth and expected profitability on EBITDA basis. Growth driven by development of aerospace business and recovery of O&G markets. Expects further growth from:

One director owns 13% of shares, CEO joined last year. >50% gross margins, new CEO right-sized the cost base to improve margins. Says they are not exposed to tariffs.

Focus on becoming profitable and cash generative as soon as possible, driven by increased sales to existing and new customers, utilising proven coating technology and existing production capacity.

We made good progress on this objective during the year. The focus now is very much to leverage profit and cash generation through an acceleration in revenue growth, thereby better utilising substantial spare capacity and driving return on investment. (Source)

H2 could benefit from roll out of new services and new projects. Wants to double revenue to >10£m ‘over the next few years’. Net cash. Expects to meet market expectations which are 20% top line growth and 0,7£m in EBITDA or breakeven on EBIT. You’ll find Cavendish Research here. I can’t trade it, but for the statistics it’s one for the watchlist.

269) Hargreaves Services (Ticker: HSP)

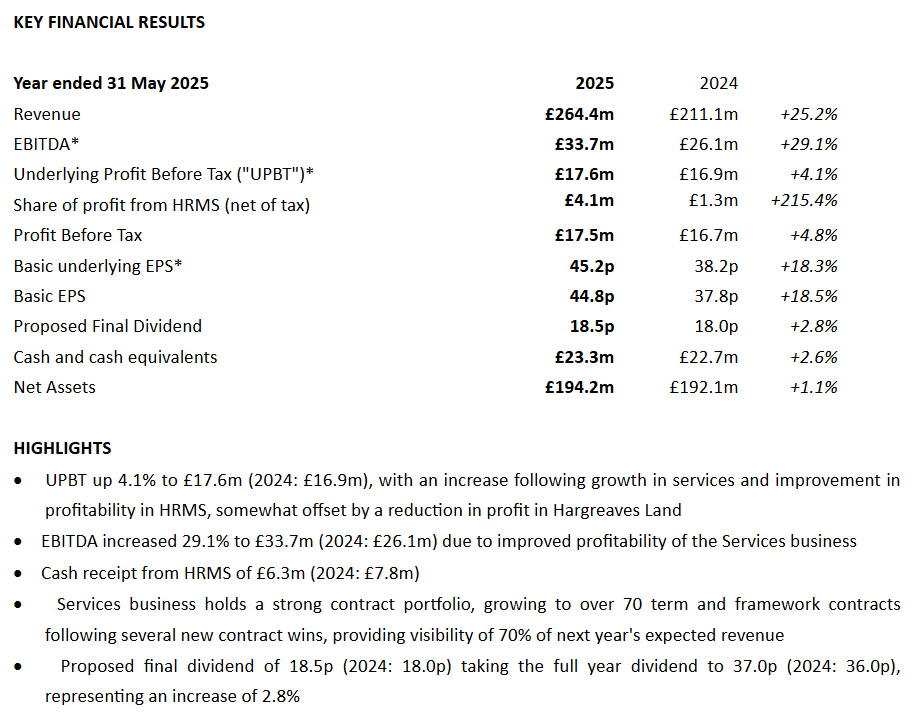

238£m provider of services such as materials handling, mechanical and electrical contracting, logistics, major earthworks, development of abandoned sites or recycling of steel waste. New COO since June.

HRMS is a german joint venture offering steel waste recycling. General growth was driven by more earthmoving activities and infrastructure projects. Seems to be working on the unwind of a site, where plot sales generated 13,8£m cash inflow. Wants to develop its renewable energy land assets to realise their value. Also owns commercial and residential projects. Overall seems a little messy with all these things going on. Fwd. P/E of 13 (Koyfin). CEO joined in 2001.

The service segment is growing consistently, but HRMS segment is exposed to commodity cycles and development projects are ongoing. Seems like they sell after succesful development. Maybe there is some sort of hidden asset on the balance sheet, but I usually stay away when things look messy and it’s hard to estimate cash flows (due to the sale of properties in this case, but maybe it’s easy here and I’m just overwhelmed). Pass for me.

270) Harvest Minerals (Ticker: HMI)

2£m company considering themselve ‘low-cost, high margin Brazilian remineraliser’. Surprise, they printed over 3£m losses in the last two years. Just raised 0,3£m. Pass.

271) Haydale Graphene Industrials (Ticker: HAYD)

24£m company operating in advanced material engineering, mainly focused on enhancing strength, durability, … Share priced just 3x due to commercial progress of its JustHeat product line which launched in April. Seeing strong demand from landlords in the UK, also received certification for the US and Canada. Expects 6£m over 5 years from one contract, but there seem to be more agreements without detailed numbers.

Reduced cost base by shutting down unprofitable operations in South Korea, Thailand and the USA and reducing its footprint in the UK. Wants to reduce cost base further to 2,4£m per year by the end of 2025 (~50% of FY24 revenue). Gross margin >55%. Can’t tell if they’ll operate profitable with the successful launch of JustHeat, but it sounds likely revenues could grow quickly in FY26. If that’s really achieved with the lower cost base they could operate breakeven by achieving FY24 revenues. One for the watchlist to follow along.

272) Heath Samuel & Sons (Ticker: HSM)

8£m designer and manufacturer specializing in luxury bathroom fittings and architectural hardware. Recent results show -3% in revenue, but EBIT grew 20% to ~1£m due to cost savings. Trades at 2/3 of NAV. Management expects to pass tariff costs to customers. 4% dividend. Heath family owns 58% of shares, but executive directors are not part of the family and do not own significant amount of shares. Managing director joined in 1995. Nothing here sparking my interest, also no sign of liquidation or asset sale pass.

273 - 275) Heavitree Brewery (Ticker: HVT, HVTA, HVTB)

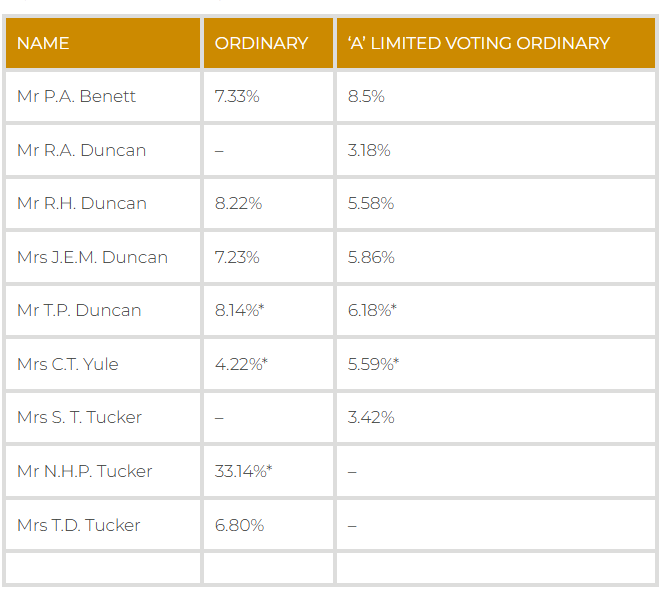

Highly illiquid 9£m operator of pubs. Recent results show more or less flat numbers, about 1,2£m operating profit on average over the last 20 years. Saying that because profits are flat since then and revenue is about 7,5£m since the financial crises. 2,5% dividend, no buybacks, only 1£m cash on the balance sheet. Seems most cash is used to maintain their pubs. Trades at 50% of NAV. Sold a closed location for 1£m, but it does not seem there are any plans to close gap to NAV. Seems like a historic little company controlled by two families:

N.H.P Tucker is the Chairman and T.P Duncan is on the board as well. Pass.

276) Helios Underwriting (Ticker: HUW)

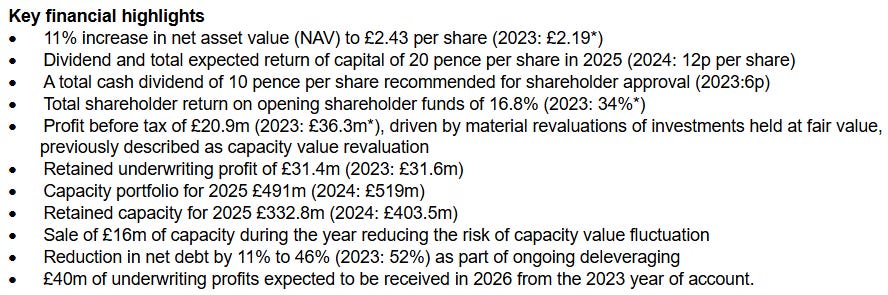

148£m investment company ‘which offers growth and returns by building a portfolio of capacity of syndicates at Lloyd’s and by acquiring high quality Limited Liability Vehicles’. Lloyds is a insurance marketplace, LLVs are instruments to participate in underwriting at Lloyds. Trades at 90% of tangible asset value.

Fwd. P/E of 6, but I assume that’s not really helpful considering revaluations of investments. I never looked at an insurance company, so my understanding here is fairly limited, pass.

277) Helium One Global (Ticker: HE1)

21£m no-revenue exploration and development company from Tanzania focused on Helium. Share price crashed 70% within 3 months, not sure why as it was a steady decline. But a lot of drilling results RNS statements suggests these were not as good as expected. Pass.

278) Helix Exploration (Ticker: HEX)

42£m no-revenue exploration and development company from the US, with helium projects in Canada. Successful drilling and test results, plant construction ongoing. Pass.

279) Hercules (Ticker: HERC)

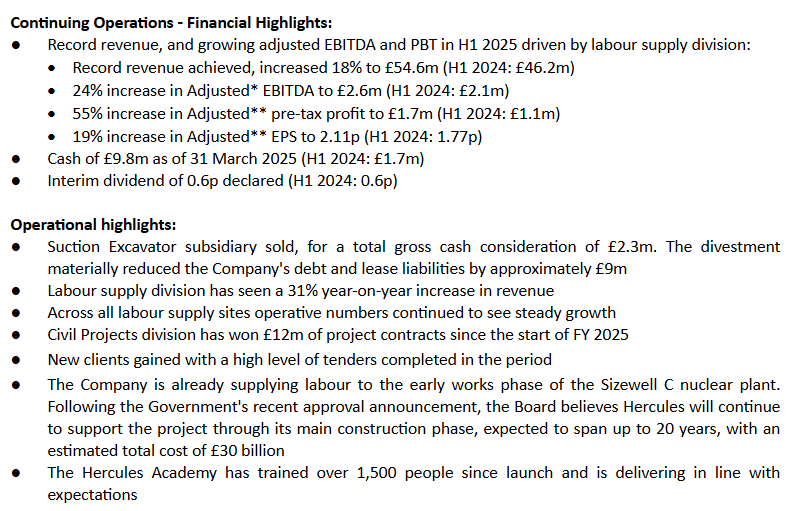

31£m labour supply company for the UK infrastructure and construction sectors.

Growth is mainly driven by the huge HS2 railway project in the UK. The sold subsidiary was unprofitable, accounted for less than 5% of revenue but for 90% of liabilities due to its leases. Expects services for nuclear projects to be a long-term growth driver. Adjusted numbers are adj. for R&D expenses. Increase in cash attributable to the sale, a share issue and higher debt.

Just acquired two labour supply companies. No public numbers for one, the other was acquired for 10x PBT and marks the entry into UK’s power and energy sector for HERC. Fwd. P/E of 10 (Koyfin), >4% dividend. CEO is also the founder and owns 45%. Wasdell Packaging and Ged Mason, a contract service provider and an engineering consultancy, own 12,7% and 9,5%. Looks interesting overall, biggest risk is the delay or cancellation of projects, especially in huge infrastructure projects which always depend on political circumstances. But the valuation, dividend and expertise of shareholders are worth a look. Watchlist.

280) HSS Hire (Ticker: HSS)

65£m operator of a digital marketplace business focussed on customer and supplier acquisition and secondly allows customers to rent and manage equipment. Sold its subsidiary in Ireland for 26£m (7x EBITDA). Sold another division in 2024 reduced its footprint. Underlying EBITA for FY24 was 10£m, which should be about 9£m for FY25 (assuming no growth) as the Ireland division accounted for ~10% of revenue and EBITDA. There is no annual report yet, because the fiscal year was changed to April - March. Fwd. P/E of 8 (Koyfin). Paid 4£m dividends last year, but I assume that’s not sustainable.

CEO joined in 2017, interim CFO is in his interim role since one year, not sure whether he will be replaced or not. Found this randomly in the annual report of 2023:

Insider ownership is not material, but what’s the purpose of a shareholding rule when not sticking to it? CEO got a 392£k base salary in 2023. Revenues are flat since 2017, EBIT below levels of 2013. I don’t see the bull case here. Pass.

Wrap-up

280/669 companies covered so far.

Watchlist: 41/280.

Pass: 239/280.

No-Revenue counter: 66/280.

Feel free to provide opinions and sources on any of the stocks. Cheers.

Hercules seems interesting but overall not the best company to own.