Exploring AIM: A-Z Part 14

Audio Equipment Distribution, Photonics Engineering und Global Data Analytics

Welcome to part 14,

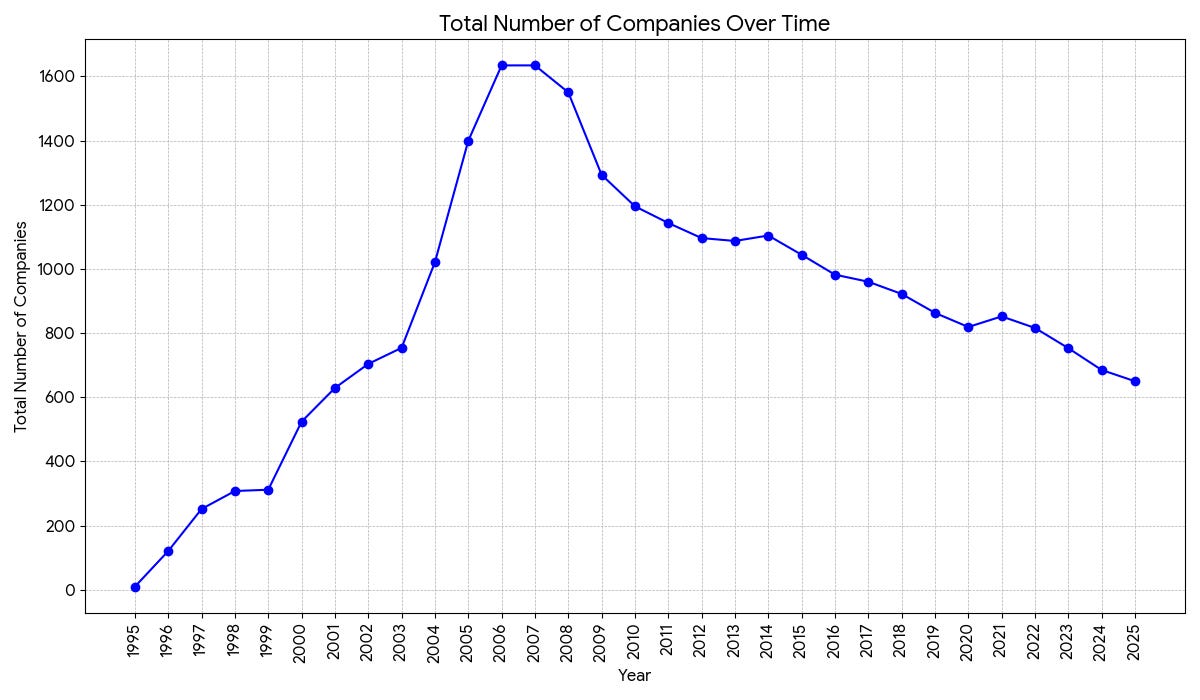

this part can’t keep up with the quality of part 13, but at least there are only two companies without revenue. One for my watchlist. You may remember Focusrite from last part, you’ll get to know a matching music equipment distributor today. I also came across some official data regarding companies listed on AIM:

As you can see, number of listed companies is decreasing since the peak prior to the financial crises. As of today there are 650. Let’s see how many are left at the end of this series, let’s look at the next tickers!

Here you find the last part:

Here you find all other parts: https://increasingodds.substack.com/s/a-z-uk-aim

246) Gear4music (Ticker: G4M)

54£m group selling own-brand musical instruments and music equipment alongside third-party brands. Share price doubled after buying assets worth 2,4£m for 1,2£m from a failed competitor and solid FY25 results:

Expects double digit growth for FY26 with PBT of at least 2,65£m. Growth is attributable to ‘revised strategy’ and failure of two UK competitors. New leadership since July 2024. Growth strategy is based on ‘targeted AI initiatives’, enhanced product offering, more distribution channels and better customer experience. Some may remember Focusrite (TUNE.L) from last part, G4M is distributing their products for example.

Own brands are 2/3 of revenue. Own brand revenue was down 5% due to ‘problems with an outsourced AI-based marketing system’. Saw a similar post-covid boom like Focusrite. Founder and chair own 23%, Liontrust owns 14%, Fidelity another 10%. Seems to fight for 2nd place in terms of market share with two other competitors in Europe. Thomann is the leader, 10x as large, based in Germany. I’d say the case here is kinda similar to Focusrite: it’s a great niche with a lot of expertise in management, but the business model is easier to understand. Fwd. P/E ~ 25. The market adjusted the price quickly as the outlook improved. Pass, mainly for valuation reasons, but I’ll keep it in mind as a niche distributor.

EDIT: G4M provided an trading update this friday morning, showing 27% growth YoY and raises its outlook, even though they do not mention any numbers. Likely expects more than 3£m in PBT for FY26 (April 25 - March 26), growth mostly attributable to increased market share.

247) Gelion (Ticker: GELN)

36£m no-revenue energy storage company, using Lithium-Sulfur and Zinc-based hybrid cells. Share price doubled after progress in R&D. Pass.

248) Gemfields Group (Ticker: GEM)

99£m miner and marketer of coloured gemstones with mines in Africa. Just sold its interest in a subsidiary for 50m USD. Operates unprofitable. >200m USD revenue. Pass.

249) Genedrive (Ticker: GDR)

3£m pharmacogenetic testing company. Expects 1£m in revenue for FY25 with heavy losses. Pass.

250) GeninCode (Ticker: GENI)

4£m company specialising in genetic risk assessment of cardiovascular disease. Growing revenues with persisting losses. Food and Drug Administration highlighted some ‘deficiencies’ for a product. Board as working on them. Pass.

251) GenIP (Ticker: GNIP)

4£m ‘technology business providing Generative Artificial Intelligence (GenAI) services to help research organisations and corporations commercialise their innovations’. 0,128£m revenue in H1, order book of 0,831£m which should lead to more revenue in H2. 1£m cash on hand, 0,9£m losses last FY. Pass.

252) Geo Exploration (Ticker: GEO)

17£m no-revenue ‘mineral resource and hydrocarbon exploration’ company. Seems focused on gold and O&G. Share price just 4x on exploration progress. Pass.

253) Getbusy (Ticker: GETB)

29£m provider of productivity software for professional and financial services. Latest TU shows 6% growth in ARR to 21,3£m. Adj. EBITDA reduced in last two years, but 2024 was the first profitable year on adj. profits base. Nearly 100% recurring revenue. Number of customers down 10% since peak in 2021. Is working on reducing churn rates and expects acclerated ARR growth in 2026 due to a partnership with Intuit and new ‘AI-driven workflows’. Not sure what’s exactly the pitch here, I didn’t read anything about increased profitability e.g. Pass.

254) Getech (Ticker: GTC)

3£m company ‘applying its world-leading geoscience data and unique geospatial software products to accelerate the energy transition by locating, developing and operating geoenergy and green hydrogen projects’. New CEO since January, who joined the company in 2016 already and was COO priorly. He reduced cost base by 20% and lowered adj. EBITDA losses to 0,1£m. Expects to be EBITDA positive for the whole year. Highlights challenging end markets. Never operated profitable and is focused on O&G. Pass.

255) Gfinity (Ticker: GFIN)

4£m esports advisory business. Lot of ‘AI’ is recent update. Two share issues Ytd. Is reducing headcount and wants to intensify working with freelancers. H2 2024, revenues were down 50% and losses increased. Trading was suspended for some days in January as GFIN did not publish annual results on time. Pass.

256) GlobalData (Ticker: DATA)

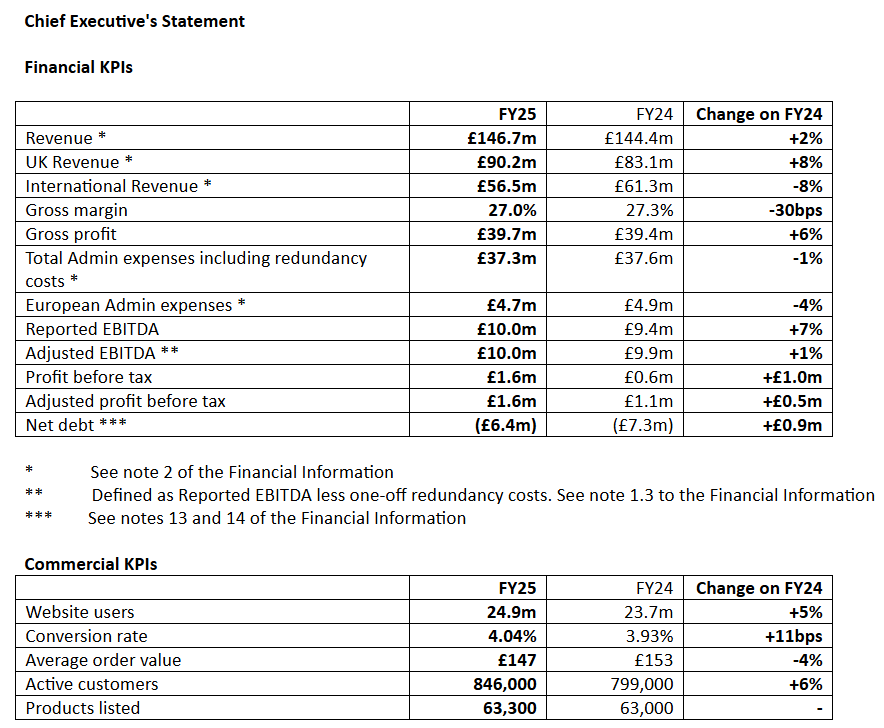

1,064£b provider of data analytics through its own platform. Rather a slow grower doing various acquisitions.

Expects margin uplift in H2 as costs ‘to deliver on synergies’ are not recurring. Tender offer for 60£m, after 40£m were spent on buybacks in H1. CEO, who owns ~60% of shares, founded a company which was sold to Informa in 2007. DATA acquired parts of that company in 2015 from Informa and the GlobalData we know today emerged from the consolidation of various data analytics providers in 2016, further consolidation is part of the strategy.

Revenue is growing consistently (also due to M&A), profits are a little bumpy. Fwd. P/E of 15 (Koyfin) on adj. numbers I assume. Uplisting to Main Market in Q4. My problems with companies offering solutions like this is that it’s hard to look into the product and there are hundred other players offering ‘data analytics’. Nevertheless, management expertise in the market and with M&A deals combined with buybacks and the uplisting to Main Market makes it interesting enough to take a closer look. Especially the M&A strategy and behavior of the controlling shareholder deserve attention here. Watchlist.

257) Globalworth Real Estate Investments (Ticker: GWI)

598£m real estate company with a focus on Poland and Romania, developing and managing offices. 85,9% occupancy across the portfolio. Reporting in €: Portfolio value of 2,6€b, long-term debt of 1,3€b, annualised rent of 187,7€m, EBITDA of 58€m. BBB- rating from Fitch. Pays a small dividend, regularly issuing shares. Nothing sparks my interest here, pass.

258) Goldplat (Ticker: GDP)

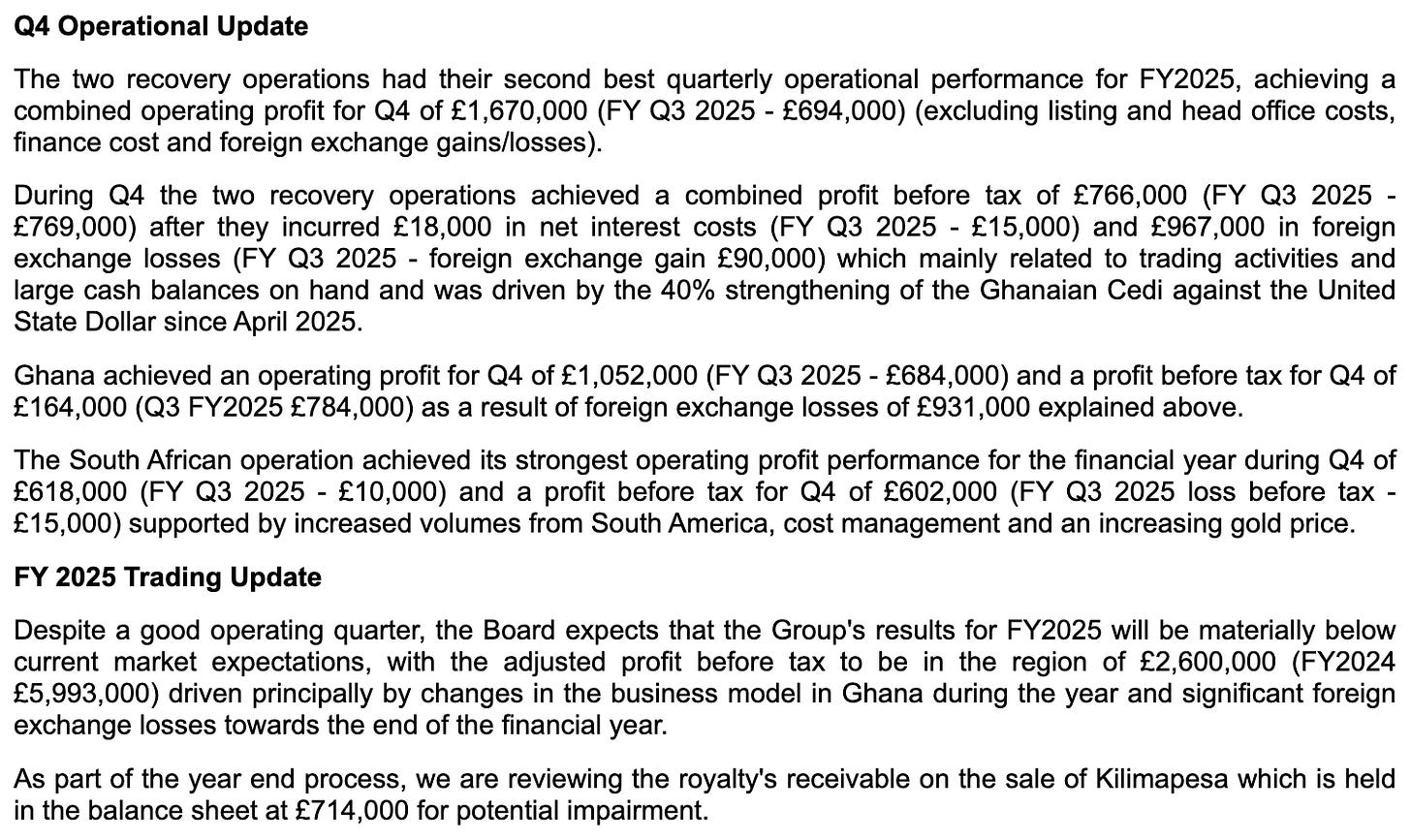

14£m Mining Services Group offering international gold recovery operations. Operates highly profitable, but suffering from exchange losses.

No long-term debt. A director owns 28%, CEO in his position since 2017. Not my cup of tea generally, maybe worth a look for others. Pass.

259) Goldstone Resources (Ticker: GRL)

4£m gold exploration and development company with its main project in Ghana. Is expanding its production and operating unprofitable, but at least got a couple millions in revenue. Pass.

260) Gooch & Housego (Ticker: GHH)

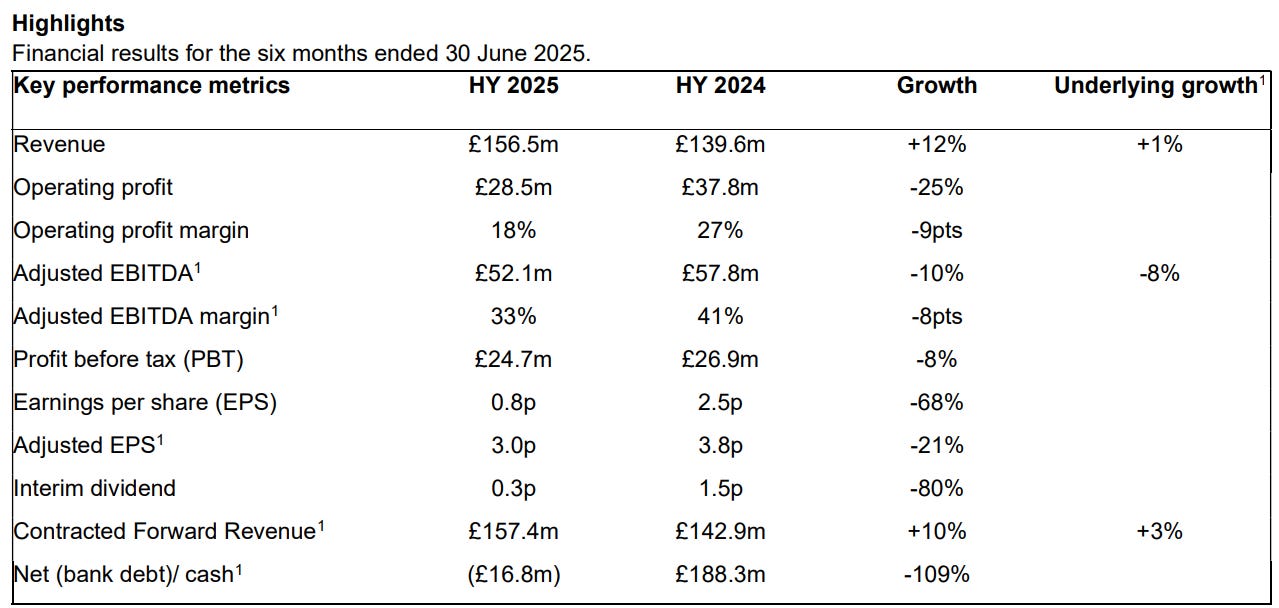

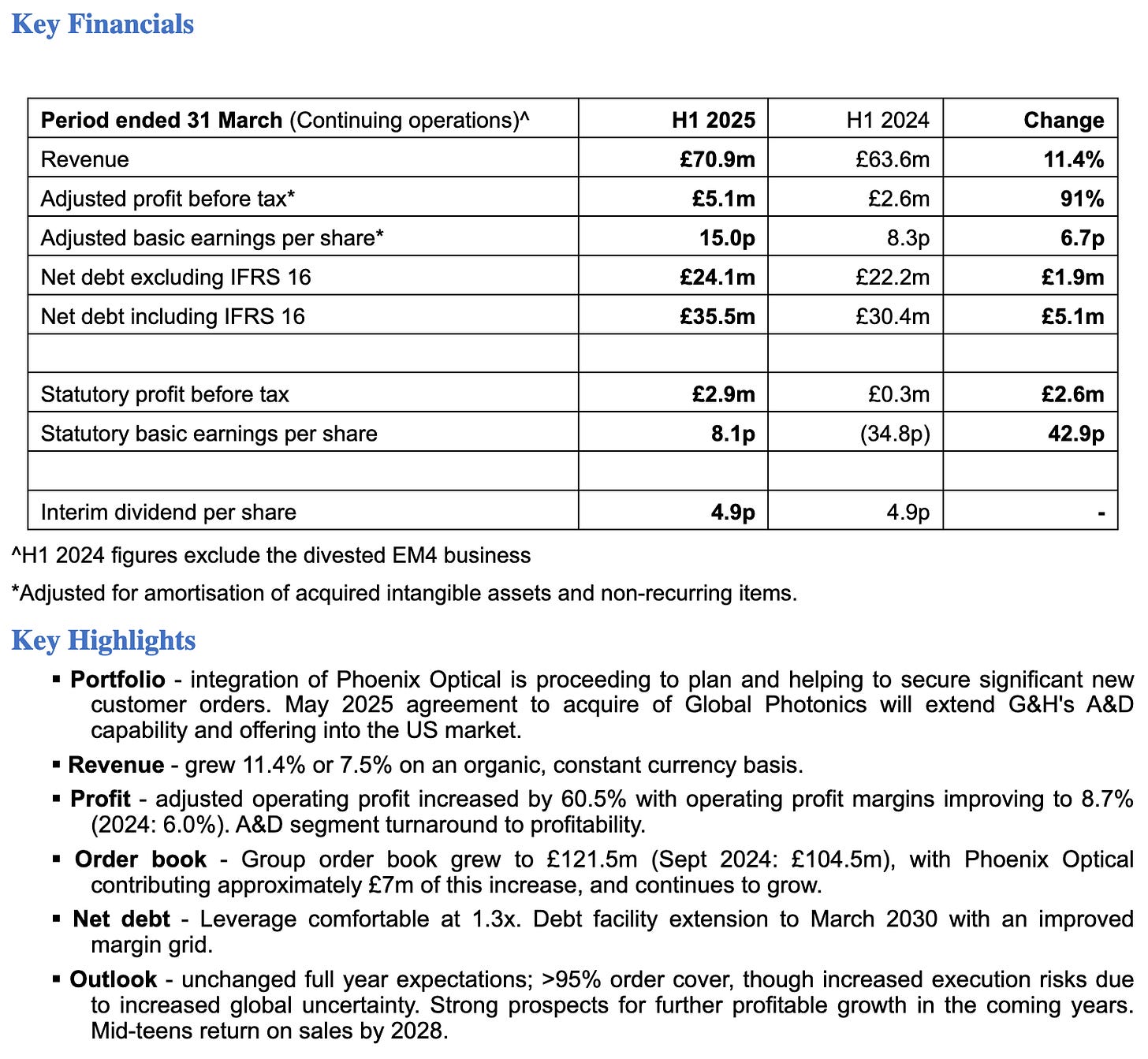

152£m provider of photonics engineering and manufacturing solutions used in life sciences, industry, telco, defense and space. CFO will step down in September. Just acquired Global Photonics in the US for 17,5$m, 50% of that in new shares. Paid about 10x EBITDA. Recent results looking good:

GHH was struggling with reduced industrial demand, but seems like the market recovered. Shut down some defense operations last year (this segment is operating unprofitable). Expects ‘mid-teens return on sales’ in 2028. Assuming this is related to their EBIT margin and assuming 170£m revenue in 2028 (136£m in 2024 + M&A + some low organic growth) GHH would achieve about 25£m in EBIT → 7x EV/EBIT on 2028 numbers. Just a simple calculation to get an idea.

CEO joined in 2022 from TT Electronics. I know TT as Volex wanted to acquire them a year ago as they struggled, but I can’t tell whether that was related to decisions this CEO was responsible for. No noteworthy insider ownership. Seems like the case mostly depends on recovery of industrial markets. Their defense segment is unprofitable and the life science segment is facing more competition. ~10x P/Ee28 for a cyclical industrial stock seems not interesting. Pass.

Wrap-up

260/669 companies covered so far.

Watchlist: 38/260.

Pass: 222/260.

No-Revenue counter: 60/260.

Feel free to provide opinions and sources on any of the stocks. Cheers.

GWI is worth a closer look. It trades at a discount of 50% to NAV, while the CRE sector has rerated. They have no immediate debt maturities, the balance sheet is well funded and most of the portfolio is relatively new. Little development activity in the region and still strong GDP growth is pushing rental rates higher, especially in good locations. Problem is in the Polish regional cities, where vacancy is still high - but they are working on this. Potential rerating coming from balance sheet deleveraging and there could be a concentration of the shareholding down the road, potential for a tender offer at book value. Disclaimer: long stock.

Getbusy - "Not sure what’s exactly the pitch here"

The elevator pitch is that the company has a profitable division (Virtual Cabinet) that is subsidising their growth in another (Smartvault). They deliberately have operated near breakeven to scale their business over time in a cash neutral manner, which, due to advance billing has historically been an accounting loss.

They have had very mixed results on their investment in the past few years and just recently have told the market in their 2024 results that "Our SmartVault business has reached a scale at which it will generate rapidly increasing EBITDA margins and cashflows over the next couple of years.".

The management has a VERY strong divestment incentive to sell the company for 70-150m GBP by year end 2029. I know for a fact that they have turned away many lowballs, otherwise this probably would've gotten bought out some time ago.

To make the business more strategically viable for acquirers they have worked on making it more enterprise-grade and partner-led which has caused an outflow of subscribers and slowing growth, but retention rates have improved, ARPU increased dramatically, and they have embedded themselves within the ecosystem of giants such as Intuit, Turnkey IPS, and Netsuite whilst partnering with the likes of Rightworks etc.

(I am a shareholder, and have been for ~3 years).