Exploring AIM: A-Z Part 13

Mixed Bag of Turnarounds, Professional Services and Niche Businesses

Welcome to part 13,

this part is definitely one of the more interesting ones. 11/20 are profitable, 4 for my watchlist. You’ll find more or less everything: new managements improving businesses, solid professional services groups, gaming, audio hardware, identity software and a special situation. And of course, the usual no-revenue mining/biotech stuff. Let’s go!

Here you find the last part:

Here you find all other parts: https://increasingodds.substack.com/s/a-z-uk-aim

226) Flowtech Fluidpower (Ticker: FLO)

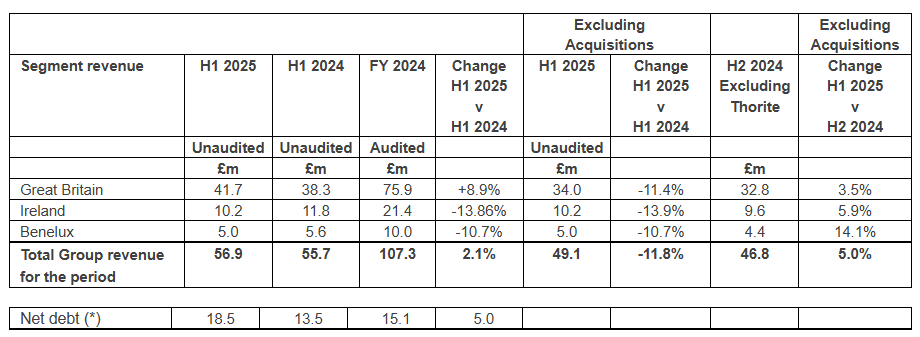

35£m specialist hydraulics, pneumatics and process engineering solutions provider. Recent update shows -12% organic decline YoY, offset by M&A. Nevertheless highlights positive momentum, June was the best of the last 12 months.

Integration of acquisitions is progressing as planned. Considers acquired businesses as the foundation for future organic growth. Expects good performance in H2 and 2026, whatever that exactly means. Top line flat since years, also operating unprofitable, but did pay dividends in 2022 & 2023. New CEO since 2023, who priorly was COO of RS Group for 3 years. 25£m impairment in 2024. Reading through RNS statements suggests the new CEO has made some necessary changes like cancelling the dividend, restructuring units and focusing on cost control.

FLO is/was a struggling company itself, acquired distressed other businesses with a new CEO who wants to turn it all around as it seems. I’d say it’s too early to tell if it works out. Did about 10£m in EBIT pre covid. If we see a market rebound and the CEO is able to turn it around, FLO is way too cheap. Watchlist.

227) Focus Xplore (Ticker: FOX)

1£m no-revenue exploration and development company focused on ‘critical minerals’ with projects in Canada. Exploration ongoing. Pass.

228) Focusrite (Ticker: TUNE)

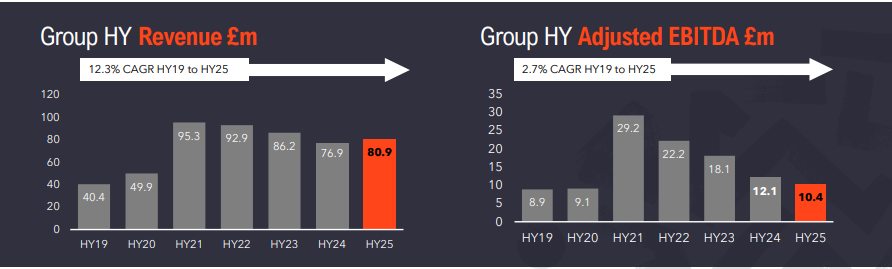

93£m music and audio products group, e.g. audio interfaces. I’ve looked at TUNE before and skipped because I have absolutely no clue about niche audio products. Demand for its products saw an after covid boom, which normalized afterwards. Looking at the latest TU, revenue was up 5%, but adj. EBITDA down 20% to 10,4£m due to higher freight costs and a less favourable product mix.

Chairman/founder owns 32%. Liontrust owns 15%. 12% of group revenue is related to chinese products exported to the US, so tariffs will have a notable, but no severe impact. They reported about 11£m profits pre-covid and I assume in these niche audio markets it’s a lot about gaining trust of musicians who then stick to your products. So the track record and expertise of the founder is definitely interesting. Watchlist (no high priority), even though it’s likely I’ll pass on it if I look deeper again due to their unique end markets and my non-existent understanding for the tech behind audio. Also worth to dig into the role of AI in audio production. I assume there may be application where AI complements hardware and others where it replaces it? @

wrote about TUNE some months ago:229) Fonix (Ticker: FNX)

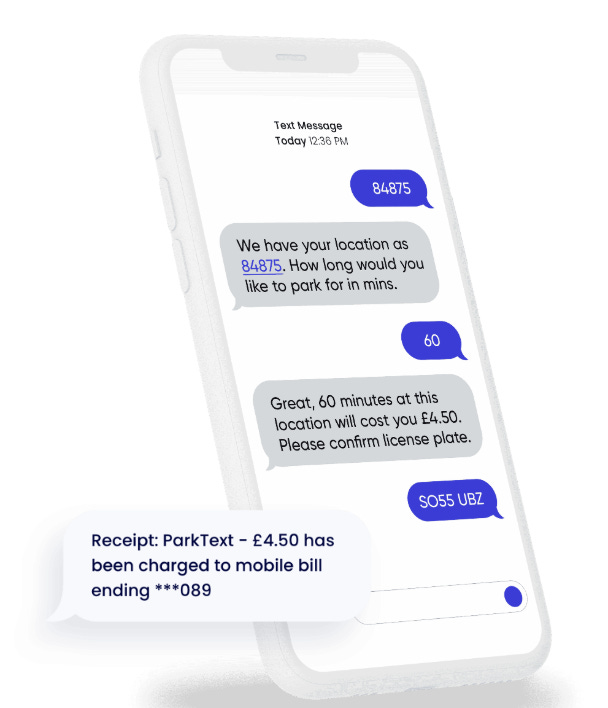

211£m provider of mobile payments solutions and messaging services. Last FY saw single digit growth. I guess this picture is the best description of their service:

Works similarly for charity or gambling e.g. when you are supposed to send a keyword to a certain number with the chance to win money. Everybody knows these kind of services, but I’m wondering if it couldn’t be replaced by Paypal or other providers. I don’t see the long-term need for this service. P/E ~ 20. Pass. Write-up by @

:230) Franchise Brands (Ticker: FRAN)

267£m multi-brand franchisor focused on B2B van-based services with seven franchise brands. Franchises include four water & waste service brands and three home service brands (car repair, oven cleaner, dog sitting). Also owning Azura, a franchise management software provider. Board expects FY25 to be flat operationally (35£m adj. EBITDA), with increased profits from lower interest payments due to deleveraging.

Shares outstanding doubled in the last 2 years, 4x since 2017, I assume money was spend on acquiring franchises:

15x fwd. P/E (Koyfin), 2% dividend. Executive Chair co-founded FRAN while being CEO and Chairman of Domino’s Pizza, so there is a lot of franchise expertise. He further owns 12% of shares. Another director owns 8%. CEO was managing director of an acquired franchise and was appointed to Group CEO in 2024, love to see that. CFO joined in 2017 and was promoted in 2024. Is preparing for a main market uplisting in H2 2027.

Implementing group-wide tools to standardize reporting, HR, IT and so on. Watchlist, while being aware that share issues and M&A deals in that size come with risks, but deleveraging and expertise with growing franchises are kind of an easy setup based on a low valuation and rather macro resilient services.

231) Frenkel Topping Group (Ticker: FREN)

60£m specialist financial and professional services firm operating within the personal injury and clinical negligence marketplace. Is in discussions with Harwood Private Equity about a possible offer for all shares. Either 50p per share in cash or 10p in cash + 6p in loan notes + 1p in shares in Bidco (a newly formed investment vehicle) + 33p preference shares in Bidco. Deadline has been extended three times. Share price is 47p. 2/3 of revenue is recurring, about 4£m in profits last year. Pass.

232) Frontier Development (Ticker: FDEV)

146£m developer and publisher of video games, some may know Planet Zoo, Planet Coaster or Jurassic World Evolution. Share price doubled since May after strong FY25 results, an announced 10£m buyback programme and the anticipated release of Jurassic World Evolution 3 in October. There is no annual report for 2025 yet, but gross and operating margins improved, also due to a lower operating cost base. Cash as of May was 42,5£m (which was about 60% of market cap before the share price increase). The three mentioned franchises all grew or were stable in 2025.

FDEV is still lead by the founder David Braben in his role as ‘President’. The CEO joined in 1998 and was promoted in 2022 as David stepped down. CFO joined in 2011. David Braben owns 33% of shares, Tencent owns 8,6%. Fwd. P/E of 30 (Koyfin). Those who follow this series for some time know I usually stay away from gaming companies, so I pass here, also because I played their games and I am absolutely positively biased. There are some older write-ups about FDEV you find on Substack, but I guess the thesis changed a little compared to 2+ years ago, as capital allocation and operational performance improved.

233) Frontier IP Group (Ticker: FIPP)

12£m venture capital like group. Just announced a partnership with the Cambridge Innovation Hub. Lot of ‘reach’ RNS statements, meaning they publish news that are not necessary but serve to create a positive sentiment. Looking at the share price, it does not work at all. Little revenue on big losses, pass.

234) FRP Advisory Group (Ticker: FRP)

355£m financial advisory group. Growth was led by adding more employees and five acquisitions. Ranks 19th in ‘most active financial advisers in UK M&A market’, 13% market share in administration appointments. Got 108 partners.

CEO and COO are co-founders. Fwd. P/E of 12 (Koyfin). Shares out increased by 10% in 5 years, seems like SBC. 4% dividend. Many of these consulting businesses look good, no matter if strategic, financial or IT consulting. The growth story is always the same, they add more employees, therefore can work on more projects. But for me, every company looks the same, there seems to be absolutely no obvious USP. It’s probably all about having a good network. FRP seems solid, but so do most other advisory groups, pass. Another write-up by @

:235) Fulcrum Metals (Ticker: FMET)

4£m no-revenue company focused on recovery of precious metals from mine tailings. Also involved in exploration and development. Projects in Canada. Just raised 1£m. Pass.

236) Fusion Antibodies (Ticker: FAB)

17£m contract research business providing a range of antibody engineering services for the development of antibodies for both therapeutic drug and diagnostic applications. Bumpy revenues and heavy losses. Share price just doubled on grant of US patent. Pass.

237) Futura Medical (Ticker: FUM)

29£m developer of sexual health products. New CEO with pharma background. COO and finance director will also step down. Considers sales performance ‘unpredictable’.

‘Reflecting on this slower momentum, alongside the challenges and learnings from Eroxon's initial product launches, the Board, led by Alex Duggan, is conducting a thorough review of the current business and its commercial plans. This includes, but is not limited to, the Company's sales and marketing strategies for Eroxon as well as the costs associated with the business and other possible strategic options available to the Group.’

I have no idea what this leads to, but it does not rule out strategic reviews, including sales of assets or the whole company. Despite the disappointment about the launch of their products, FUM reached profitability, but questionable if it’s sustainable. Pass.

238) Future Metals (Ticker: FME)

8£m no-revenue exploration and development company from Australia. Another mining company bought 13% of shares. Pass.

239) Galantas Gold Corporation (Ticker: GAL)

4£m no-revenue gold exploration and development company with projects in the UK. Pass.

240) Galileo Resources (Ticker: GLR)

10£m no-revenue ‘battery metals’ exploration and development company with projects in the US and Africa. Exploration ongoing. Pass.

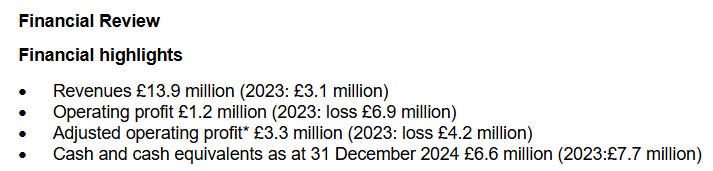

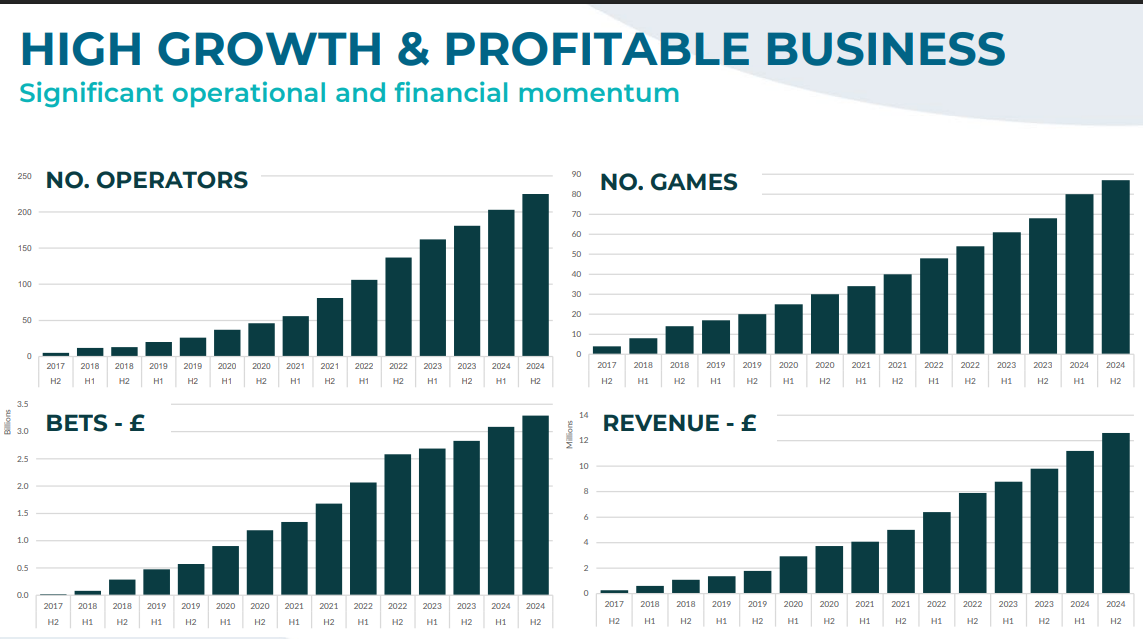

241) Gaming Realms (Ticker: GMR)

153£m mobile games developer and licensor. H1 results show 18% revenue growth, 30% ad. EBITDA growth, driven by new games and 19 new distribution partners. Expects the momentum to continue in H2. 13% insider ownership. Chair and CEO both worked for Cashcade until it has been acquired.

I am not sure if they are 100% focused on gambling, but at least it’s a big part of the business. 16x fwd. P/E (Koyfin). No long-term debt. Likely worth a look for investors who like gambling, not my cup of tea due to regulatory risk, pass.

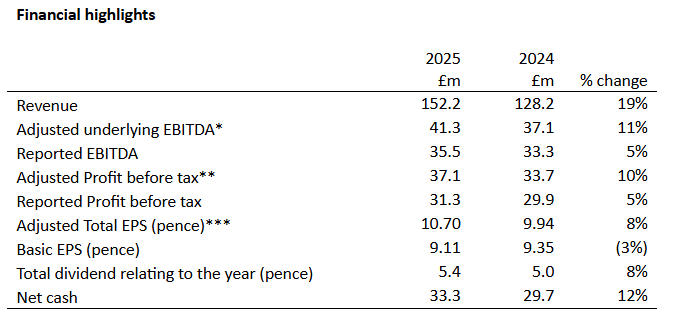

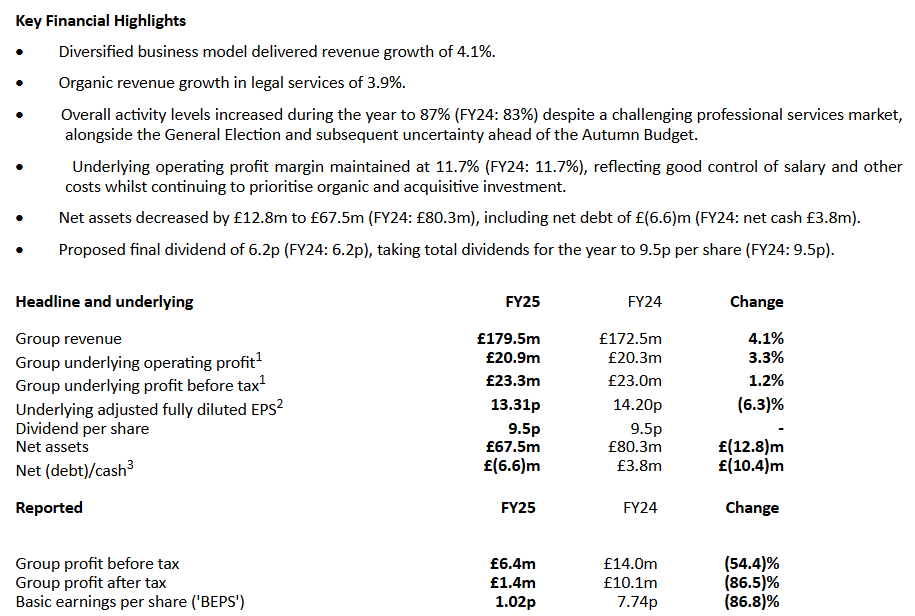

242) Gateley Holdings (Ticker: GTLY)

168£m professional services group focused on legal advisory. Slowly growing but highlights challenges in the market.

Trading in FY26 in line with expectations (single digit growth). Wants to increase operating margin to 13,5%. CEO joined in 2010 and was promoted in 2020, COO is with GTLY since over 20 years, CFO joined in 2008. Fwd. P/E of 10, 7,5% dividend. Revenue was consistently growing over the last decade, EBIT flat since three years.

Reported numbers are lower than adjusted mostly due to ‘contingent consideration treated as remuneration’, which should be payments to sellers of acquired businesses. Kind of like earn-outs, just going through the income statement instead the CF statement. I am not sure if it’s fair to adjust for that as I know nothing about the deal structures, but it’s a real cash outflow so I’d take a closer look at free cash flow after M&A costs here. But as with FRP, it’s just another advisory business, even though it’s cheaper. Maybe interesting for dividend people, pass for me.

243) Gattaca (Ticker: GATC)

32£m recruitment service company focused on defense, infrastructure,, energy, mobilitiy and TMT (something related to tech). CEO is with GATC since 20 years, was promoted in 2022. Buyback for 1,5% of shares authorised by the board. Latest TU shows flat revenue, but +10% profit before tax to ~3,2£m due to a focus on ‘costs and improved productivity’. Also announced an acquisition for 5x EBIT. Expects 4£m PBT in FY26 despite a challenging market. <0,5% PBT margin. Net cash ~1/3 of market cap. Fwd. P/E of 13 (Koyfin). Nothing sparks my interest here, pass.

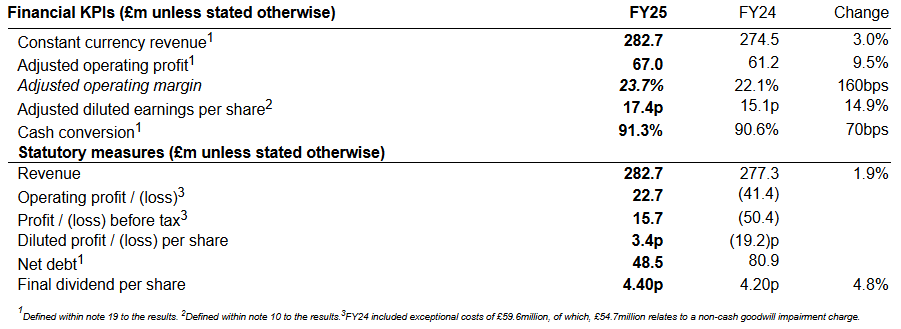

244) GB Group (Ticker: GBG)

530£m ‘identity technology business enabling safe and rewarding digital lives’. 25£m buyback announced. Profit growth attributable to ‘simplification and efficiency’ and lower interest payments due to deleveraging.

FY25 was a year of transition with a new leadership, is focussed on growing ‘GBG Go’, an all-in-one platform identify platform, as GBG is transitioning to a ‘platform business’. 35£m amortisation of acquired intangibles per year, so seems like there was a lot of M&A activity. FY24 includes a 55£m goodwill impairment. Probably the good news is that the current CEO just joined 2 years ago, so he likely was not responsible for the M&A deals. Chief Strategy officer joined 7 months ago.

57% of revenue is subscription based, 37% is transaction based. I am not sure how their business model works, but I assume it’s some sort of identity verification system considering most revenue comes from the financial service sector, gaming (micro transactions?) and retail. Wants to move to Main Market. Fwd. P/E of 12 (Koyfin), 2% dividend. Stable gross margin at 70% since years, operating margin between 21,5% and 26%. Revenue flat since 2 years. Considering a somewhat new management, low valuation, high-margin business model and solid capital allocation I’m interested, watchlist. But I definitely need to spend some time and what they are actually doing.

245) GCM Resources (Ticker: GCM)

21£m no-revenue exploration and development company focused on coal in Bangladesh. Considers the new government of Bangladesh to support its business by focusing on reducing Bangladesh’s coal imports. Pass.

Wrap-up

245/669 companies covered so far.

Watchlist: 37/245.

Pass: 208/245.

No-Revenue counter: 58/245.

Feel free to provide opinions and sources on any of the stocks. Cheers.

As someone who works in UK professional services, I can vouch for the strength of both FRPs network and reputation. I think it's quite rare here to have an organisation with a good reputation on general in the sector.

Thanks as always, this one it was a good set! With the professional services the good thing is that usually they have a low valuation, high yields and so on