AIM A-Z Part 19: NAV Discounts, Fire Protection and Asset Managers

Ticker 341 to 355 on London's Alternative Investment Market (AIM)

Welcome to part 19,

15 companies today. Only two pre-revenue, two for my watchlist. Most are profitable. You’ll find some asset managers/investment firms, two companies providing fire safety solutions and two distributor like in the last part.

Here you find the last part:

Here you find all other parts: https://increasingodds.substack.com/s/a-z-uk-aim

At the end of the post you find all ‘watchlist’ companies.

341) Lexington Gold (Ticker: LEX)

17£m no-revenue gold exploration and development company from the USA. Test drillings ongoing. Pass.

342) Light Science Technologies Holdings (Ticker: LST)

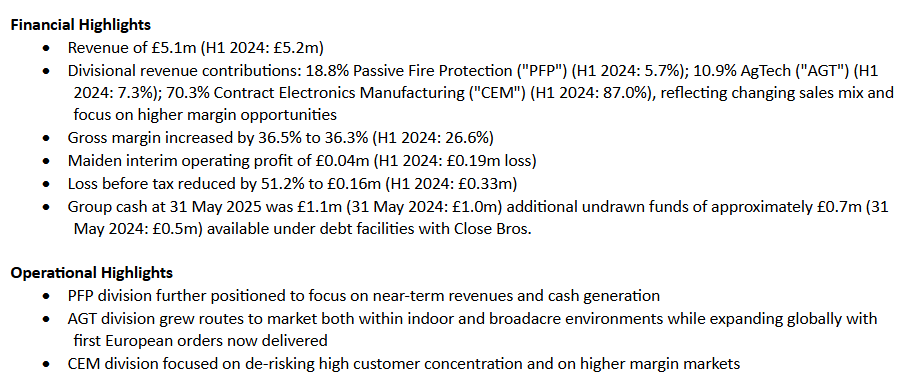

13£m manufacturing business with solutions for food security and fire safety, but most revenue comes from contract manufacturing. Revenues flat YoY, but profits up (or losses reduced) as the low margin contract manufacturing division saw -22% revenues, mainly because one large customer stopped producing a product, while the fire safety division (~35% EBIT margin) trippled revenues YoY to 0,9£m. But it was acquired in 2022 for 1,75£m with revenues of 0,8£m, so there also seems to be some customer concentration and big contracts make or break a year.

AGT division is operating unprofitable. Management focused on de-risking CEM and growing PFP division. Generally highlights strong sales pipeline. Chairman owns 9% (ex-CEO of ITM Power), CEO and founder owns 29%. It seems he already owned the food safety and manufacturing companies before LST was formed.

CEO wants to grow the business to 50£m revenue in 5 years while ‘building cash generation’. Growing high-margin PFP division while de-risking CEM division looks interesting, customer concentration and a probably overambitious growth target should be kept in mind. Watchlist.

343) Likewise Group (Ticker: LIKE)

71£m distributor of residential and commercial flooring through 12 distribution centers. Share price up 75% ytd on two small 0,25£m buybacks, acquisition of a logistics centre, permission to expand another and double digit growth with higher growth for its own brands, driven by marketing and sales efforts. Sees path to 250£m revenues (150£m last FY) over 5 years. ~3£m in adj. PBT, mostly adjusted for restructuring, relocation, investments and bad debt. ~0,4£m of that are adjustments for amortisation of intangibles. Reported PBT is <1£m. CEO joined in 2018, owns 11% and got a flooring background. 7% owned by other insiders. Operating cash flow eaten up by Capex and lease payments. Pass.

344) Litigation Capital Management (Ticker: LIT)

12£m ‘alternative asset manager specialising in litigation financing solutions’. Share price down 90% Ytd. Special situations are not my cup of tea, pass, but @

wrote about the ongoing strategic review and general situation two weeks ago:345) Livermore Investments Group (Ticker: LIV)

82£m asset manager focused on ‘Collateralized Loan Obligations (“CLOs”) and other securities or instruments with exposure primarily to senior secured and usually broadly syndicated US loans.’ Owns warehouses too. NAV of 98£m, down from 118£m YoY due to less generated income and unrealized losses. 6% dividend. No buybacks, but board is aware that discount to NAV is an important figure for potential buybacks as it seems. Pass.

346) Logistics Development Group (Ticker: LDG)

62£m investment company. Owns 25% of a speciality bakery business which was taken private in 2023. Owns 25% of Alliance Pharma (stock number 23 of this A.Z series) which was taken private in Q2 2025. Alliance Pharma reported a PBT loss last year, but 29£m in FCF. Owns 11% of a digital commerce and services agency. Just invested 15£m into APC, the UK’s largest independent parcel delivery network (owns about 50%).

NAV of 110£m, 103£m attributable to investments in companies. Repurchased ~20% of shares. DBAY owns 27% of LDG. Seems LDG is rather an investment vehicle for DBAY than a ‘real’ company with an operating management. Pass.

347) London Security (Ticker: LSC)

423£m company focused on fire security e.g. fire extinguishers. I was surprised the stock seems so illiquid and well, 80,4% of shares are owned bei EOI Fire and 18,4% by Tristar Fire, both companies are related to the Murray family, two of them are on the board. The same family controls Andrew Sykes (number 29 of this A-Z series). Both companies were owned by Tony Murray, a British billionaire who died in 2023. 3% dividend, ~13x EV/EBIT. Revenues and profits doubled in the last 10 years, entered many new markets through M&A deals. Solid niche company, but I’m wondering why they are listed. Pass.

348) Seascape Energy Asia (Ticker: SEA)

55£m no-revenue O&G exploration company with projects in Malaysia. Share price tripled on positive project news. Pass.

349) Lords Group Trading (Ticker: LORD)

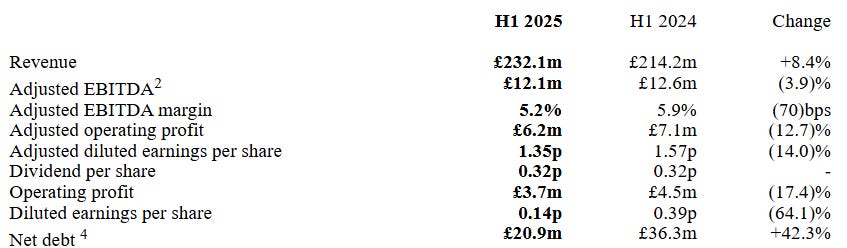

53£m ‘distributor of building, plumbing, heating and DIY goods in the UK’. Mostly focused on the repair, maintenance and improvement market.

Highlights weak market, but gained market share. Adj. EBITDA 2024 includes a 0,8£m regulatory one-off benefit, excl. this would show 3% growth there. Gross margin down 1% to 19,3% due to product mix. Acquired the largest online-only retailer of construction products for 1,8£m and completed sale and leaseback of 4 sites for 13,1£m which should decrease capex but increases lease payments.

Is focused on new sites, M&A and deleveraging. New COO’s for the two main divisions Merchanting and Plumbing & Heating. Expects trading in line with market expectations: adj. EBITDA of ~25£m. 50% of that is D&A, excl. acquired intangibles. Net debt excl. the ~60£m lease liabilities. Including them, LORD trades on 5x EV/adj. EBITDA or 11x EV/adj. EBIT when only adjusting for acquired intangibles. CEO owns 32%, two other family members own 9% each. Financials are a little messy due to property gains, M&A, opening new sites. Already struggled last year, maybe cheap when market rebounds, pass for now.

350) LPA Group (Ticker: LPA)

6£m electronic engineering ‘specialist’. Sold a property for 0,355£m to reduce debt. Expects 27£m in revenue and 0,6£m in adj. PBT for the full year. Zero cash. Operating unprofitable since years, only reported profits due to ‘negative goodwill’. Pass.

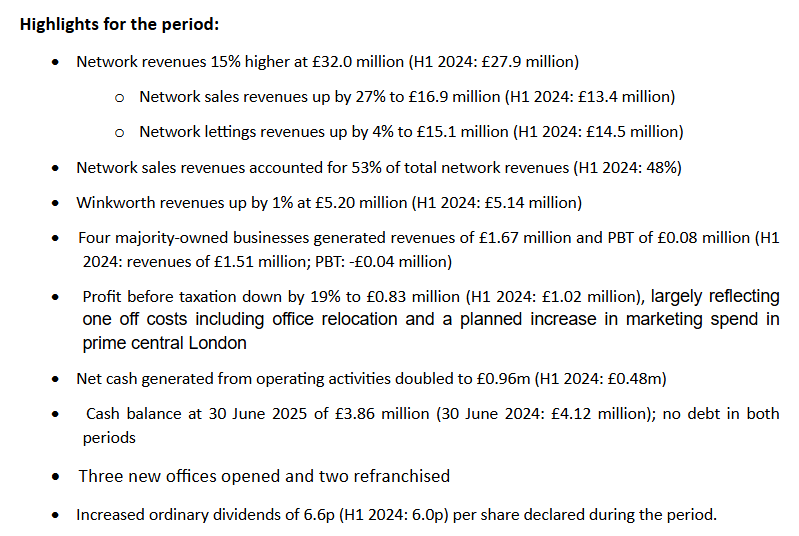

351) M Winkworth (Ticker: WINK)

25£m franchised estate agency offering transactions and property management, mostly in London. Reports increased property sales activity, generally dependent on activity levels on residential property markets.

Wants to grow by expanding the franchise network, no long-term debt. 6% dividend, 12x fwd. P/E (Koyfin). CEO (owns 6%) joined in 2001 and was promoted in 2006, COO worked with WINK prior to 2006 already and rejoined in her current role last year. Chair joined in 1974 and owns 41%. One to keep an eye on, with the 6% dividend there is not much needed for a solid return assuming higher activity on property markets. Watchlist.

352) M&A Saatchi (Ticker: SAA)

174£m marketing services business. Recent results show -5% revenue and -36% EBIT. Blaming macro environment in Australia. Excl. Australia revenues were more or less flat. Profits down due to ‘strategic investments’. Sold its South Africa business, plans to divest operations in Malaysia, Pakistan and Mexiko and acquire 100% interest in Brazilian subsidiary. Still, 10£m operating profit and cost saving programmes are implemented. Just acquired a media rights consultancy, price not disclosed. Fwd. EV/EBIT ~ 10. New CEO & CFO in 2024. Nothing sparks my interest here, pass.

353) MP Evans Group (Ticker: MPE)

706£m producer of crude palm oil, operating in Indonesia. Just reported 50% increased profit of 47£m for H1 due to increased palm oil prices and a focus on production from own harvest. Fwd. EV/EBIT ~7. Not a fan of food producing business relying on world market prices. Pass.

354) Made Tech Group (Ticker: MTEC)

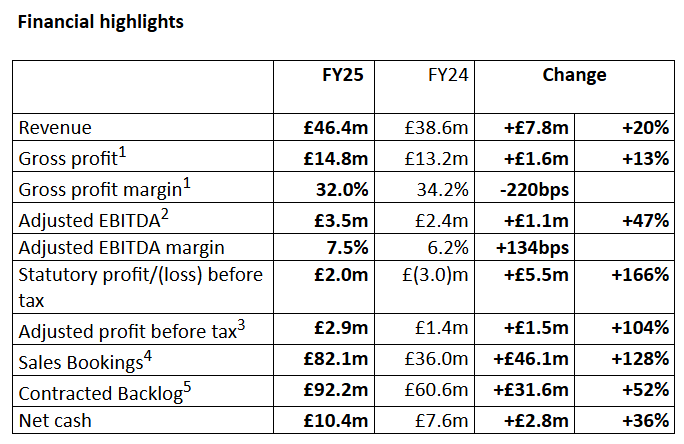

49£m ‘provider of digital, data, and technology services to the UK public sector’. CFO will leave. Latest results looking strong, but management highlights that the last two years were weak in term of government spending, so this may rather be some sort of rebound and not a sustainable growth track:

Is confident about government relying on its services, highlights strong start into 2026. Profits driven by increased internal productivity, but mentions pricing competition (which is common for public sector contracts I assume). Fwd. P/E of 21 (Koyfin). CEO and founder owns 28%, ex-COO owns 15%. No capex spent on intangibles last year, ~3£m FCF, no debt. Potential growth linked to government spending is always risky, especially in countries with a track record of changing leadership regularly (UK: 4 prime ministers in 6 years). Not a bad company, but rather a pass for me.

355) Maintel Holdings (Ticker: MAI)

22£m unprofitable ‘provider of cloud, networking, and security managed communications services’. Recent results show flat top line (75%$ recurring), but heavily decreased adjusted profits (3,4£m adj. EBITDA, 1,8£m adj. PBT) due to ‘increased employer costs, increased investment in IT systems and marketing’. Net debt of 18£m. New COO hired, worked at Vodafone and Motorla priorly. New CEO since February. Definitely a pass for now, but probably worth a look soon again to see if new management turns to profitable growth.

Wrap-up

355/669 companies covered so far.

Watchlist: 48/355.

Pass: 307/355.

No-Revenue counter: 80/355.

Feel free to provide opinions and sources on any of the stocks. Cheers.

Watchlist:

The hyperlinks send you directly to the section in each article for the parts.

Part 1: 4GBL (Delisted), ABDP, ASCO, AMS; Part 2: ALT, ALU, AMCO, ANG; Part 3: ANCR, AT, AVG, BPM; Part 4: BGO, BEG, BIG, BRCK; Part 5: CBOX; Part 6: CLBS, CEPS, CER, CKT, CHH Part 7: CFX; Part 8: CSSG, CRPR, CVSG; Part 9: DFCH, DOTD; Part 10: EAAS; Part 11: None; Part 12: FIN, FNTL, FKE; Part 13: FLO, TUNE, FRAN, GBG; Part 14: DATA; Part 15: HDD, HAYD, HERC; Part 16: IDOX, ING; Part 17: JNEO, JDG; Part 18: KITW; Part 19: LST, WINK

Interesting thing on Tony Murray btw, he was Anglo French. Fascinating man, i think he was in the free French army during the war and was based in the UK. Fell in love with the UK and applied for and got British citizenship after the war. Then became a very successful entrepreneur.

He was born Gaston Jacques Kalifa but changed it to Jacques Gaston Murray after citizenship. Lived to 103. He clearly kept some of his French routes though because he gives his children French names (Jean-Jacques and Jean-Pierre)

If you want to look more closely at WINK, I can recommend Maynard Paton's blog