AIM A-Z Part 21: Rebounding Mortgage Advisor, Defense Exposure and okay-ish Businesses

Ticker 376 to 390 on London's Alternative Investment Market (AIM)

Hello there,

this part definitely reminds us that there may be gems in between the trash. Well, not no-brainer fat-pitch gems, but at least solid companies. 15 tickers, two for my watchlist again. Lot of unprofitable ones, customer concentration, cash shell, … let’s go.

Here you find the last part:

Here you find all other parts: https://increasingodds.substack.com/s/a-z-uk-aim

376) Mineral & Financial Investments (Ticker: MAFL)

13£m investment company focused on junior mining companies. As I read the name I expected another trashy company, but they seem to be doing things right:

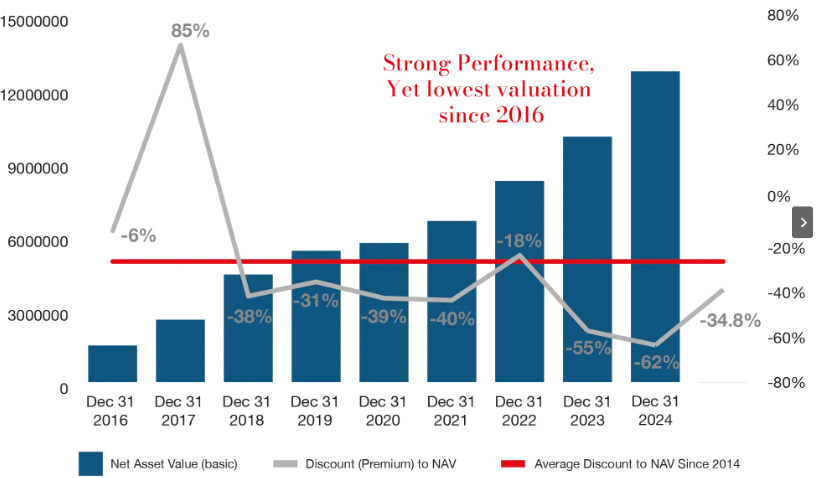

The gap to NAV shown in that picture closed, NAV (as of March 25) equals market cap today. CEO (owns 19% through another investment company) and Chair have operational experience in mining. Pass for me, but an interesting way of exposure to the mining industry.

377) Minoan Group (Ticker: MIN)

Bankrupt company. Pass.

378) Mirriad Advertising (Ticker: MIRI)

2£m marketing company with 2,7£m losses on 0,1£m revenue in H1. Stock crashed in May after talks about a potential offer failed combined with a challenging market. Cost base has been reduced by 2/3 and cash was raised. Discontinued US operations and highlights positive momentum in Europe. Likely still unprofitable, burned millions for years. Pass.

379) Mkango Resources (Ticker: MKA)

193£m no-revenue company, aiming to ‘become a market leader in the production of recycled rare earth magnets, alloys and oxides’, also owns rare earth projects. Share price just 3x on an announced merger of a subsidiary with another mining company and positive project news. Pass.

380) Mobile Streams (Ticker: MOS)

66£m suspended, unprofitable sports entertainment company offering gambling, NFTs (I didn’t know that’s still a thing) and fan channels for news and highlights. Seems focused on Mexico. Board says they are ‘on track in our transition to delivering operational profitability’. H1 revenue of 0,4£m on 0,8£m losses. Pass.

381) Mobilityone (Ticker: MBO)

1£m unprofitable ‘virtual distributor of mobile prepaid reload and bill payment services in Malaysia’. H1 revenue of 116£m, reduced losses to 1,14£m. CEO owns 50%. ‘The Group anticipates a challenging business environment and remains cautious about the outlook for the remainder of 2025’. Has been profitable during covid (~2£m EBIT). Only explanation for 1£m market cap on 200£m revenue and tiny losses in relation to sales is that market expects MBO to die soon. 16£m current liabilities on 9£m current assets. Working on a merger/JV with Super Apps Holdings that will ‘enhance the Group’s financial position and future growth’. But this was announced in 2022 already, so I’m not sure what’s really going on here. Pass.

382) Mortgage Advice Bureau (Ticker: MAB1)

395£m network of advisors for mortgage, lending and insurance procuration. Uplisting to main market in 2026. CEO joined in 2001 and owns 18%.

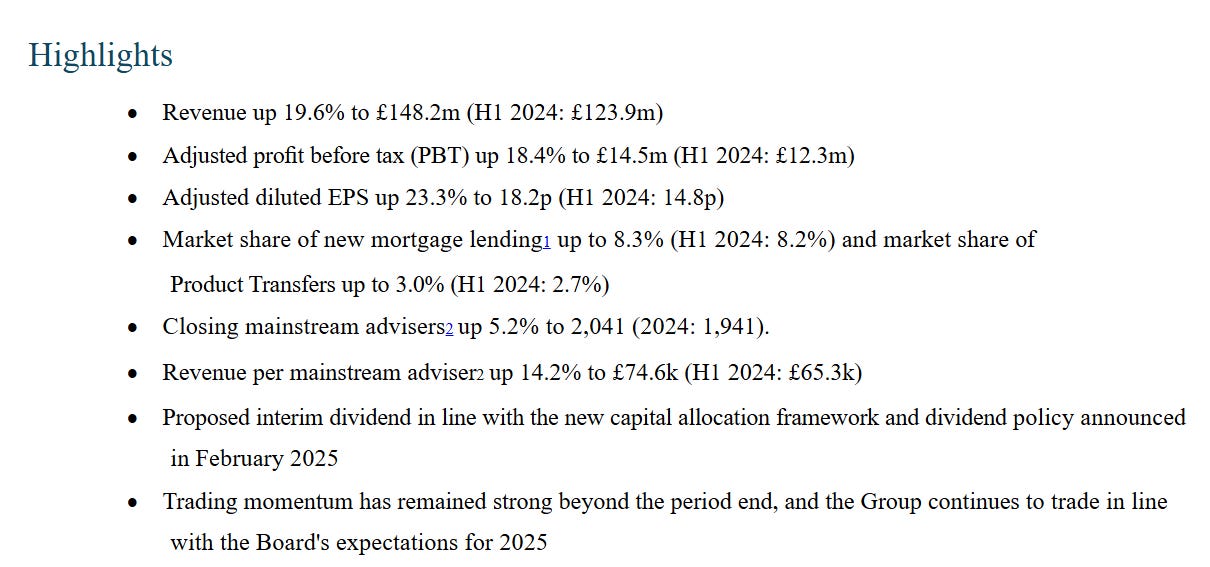

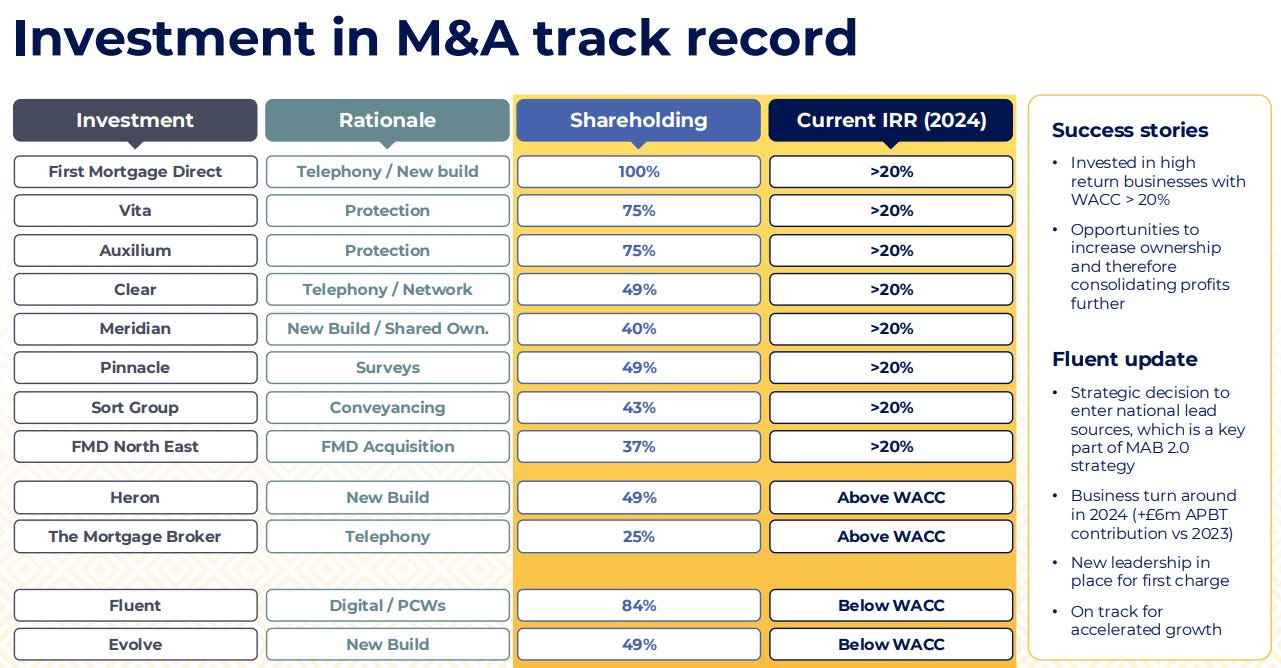

Growth driven by more advisors and 35% growth in house purchases in line with the overall market. Confirms trading in line with board expectations multiple times without mentioning what they look like. M&A part of the strategy, internal hurdle rate of 20% for deals. Debt-free. ~10£m FCF in H1. High growth seems unsustainable, rather attributable to a market rebound after 2023’s rate hikes. 16x fwd. P/E (Koyfin), 3% dividend. What I like a lot is their overview of M&A activity:

About 40% of revenues from mortgage procuration, another 40% from protection and insurance fees. Looks interesting overall. Watchlist.

383) Mosman Oil & Gas (Ticker: MSMN)

5£m unprofitable helium, hydrogren and hydrocarbon exploration and development company with projects in the US and Australia. New CEO & CFO, just raised 1,7£m. Pass.

384) Mothercare (Ticker: MTC)

16£m ‘British heritage brand, that connects with the parents of newborn babies and children across multiple product categories throughout their early life as parents’. But also offering basic stuff like supplements, medicine, beauty stuff, cameras, … seems like a brand which lost its focus? FY25 results show -18% revenues due to uncertainty in the middle east. New joint venture with Reliance Industries in India, restructuring of of South Asian operations, new license agreement in Turkey. Deferring pension contributions to ‘look for growth opportunities’. Adj. numbers look strong, but include a 15£m sale of ip rights. Financials look somewhat messy generally. Pass.

385) Mpac Group (Ticker: MPAC)

84£m packaging automation company. Shares crashed in July following slow order intake due to US uncertainty, leading to lower H2 revenue. Reported numbers for H1 looking good due to M&A, but organically revenue decreased 20% and profits reduced by 1/3. Consolidated their US footprint. I’ve looked at MPAC before and passed due to bumpy financials, as their products depend on capex of customers. In the last 10 years, margins were never similar to the prior year. Pass.

386) MS International (Ticker: MSI)

241£m engineering group, mostly focused on defense and security, forgings and ‘petrol station superstructures’. Just announced a 35£m US navy contract for gun mounts. 14,5£m profits for FY25, no bank debt, 23£m cash. Benefits from the Ukraine war. Largest customer accounts for 37% of revenue, the second largest for 13,6% - both in defense and security. CEO joined in 1972 and owns 18%, Ms. Bell owns 15%, another ‘Bell’ is on the board. 1,5% dividend. Website looks like the Berkshire Hathaway one (that’s probably a good sign). Pass due to customer concentration, succession for multiple directors is also important to keep in mind, 4 joined prior to 2000. Nicely written by @

:And @

: https://substack.com/home/post/p-161945890387) MTI Wireless Edge (Ticker: MWE)

35£m ‘technology group focused on comprehensive communication and radio frequency solutions’. More precisely, offering antennas, remote water control and defense solutions and distribution for Motorola. Revenues and profits flat since years (~45$m & ~4$m). But latest results show 8% revenue and 6% profit growth, driven by antennas. Fwd P/E ~10 (Koyfin), 6% dividend, 2% share buyback in 2024. New chair. Announced multiple small contract wins. New chair and ceo belong to the Borovitz Family, who owns 33%. Considering telco and defense capex are somewhat cyclical, it’s surprising to me MWE’s financials are so stable. Looks interesting overall, with a 6% dividend not much needed for okay-ish returns, questionable whether there is more upside. Watchlist.

388) Mulberry Group (Ticker: MUL)

67£m brand selling bags and accessories. Just raised 20£m to ‘accelerate its growth strategy. Once again, Frasers Group owns shares here - 37%. 56% is owned by Challice Limited. Frasers wanted to acquired MUL for 83£m, but Challice rejected. FY25 results look ugly, with -21% revenue on persisting losses. Pass.

389) Mycelx Technologies (Ticker: MYX)

7£m unprofitable water treatment solutions company. Sold its Saudi Arabia business. 4,9$m revenue last year (reporting in USD), expects significantly increased revenue from projects: ‘The Company remains on track to meet its current financial guidance for FY 2025 of revenue between $12.5 million and $15.5 million’. There is definitely some customer (or project) concentration. New chair. No long-term liabilities. Questionable whether MYX will be profitable on the big contracts. Even if it’s likely not sustainable. Had profitable years and big revenue jumps in the past. Pass.

390) Myhealthchecked (Ticker: MHC)

4£m healthcare company focused at at-home tests. Benefited from covid, but returned to low revenues and losses. Just sold a subsidiary for 2,375£m. MHC will become a cash shell with ~5,7£m in cash.

‘The Board will carefully consider the strategic options available in order to maximise Shareholder value. As the Chairman has experience in utilising cash shells to acquire growing businesses, with a demonstrable record of increasing shareholder value, this will include reviewing acquisition opportunities in a variety of sectors as well as considering a return of cash to Shareholders.’

I saw many cash shells on AIM already and most simply fail (or maybe don’t even try) to acquire something and get suspended from trading. We’ll see how this story continues, pass.

Wrap-up

390/669 companies covered so far.

Watchlist: 52/390.

Pass: 338/390.

No-Revenue counter: 83/390.

Feel free to provide opinions and sources on any of the stocks. Cheers.

Watchlist

Part 1: 4GBL (Delisted), ABDP, ASCO, AMS; Part 2: ALT, ALU, AMCO, ANG; Part 3: ANCR, AT, AVG, BPM; Part 4: BGO, BEG, BIG, BRCK; Part 5: CBOX; Part 6: CLBS, CEPS, CER, CKT, CHH Part 7: CFX; Part 8: CSSG, CRPR, CVSG; Part 9: DFCH, DOTD; Part 10: EAAS; Part 11: None; Part 12: FIN, FNTL, FKE; Part 13: FLO, TUNE, FRAN, GBG; Part 14: DATA; Part 15: HDD, HAYD, HERC; Part 16: IDOX, ING; Part 17: JNEO, JDG; Part 18: KITW; Part 19: LST, WINK; Part 20: MLVN, MBH; Part 21: MAB1, MWE

Saesch.

Mkango is not 'no revenue' - it is currently recycling REEs from its main site in Tyldesley Birmingham

Its not a 'developer'. It has patented technology for recycling REEs.

It also owns a mine (upstream assets) which is being floated as a SPAC this year at a price equivalent to 89p of its current FD sp.

Plus it has other exploration assets.

But the main driver of the business is its Hypromag solution, which it has JVs with Cotec in the USA and in Germany. Worth c. £2.33 ps on the npvs.

And all the money is being put in by its partners.

It's not a 'developer'