Exploring AIM: A-Z Part 8

Family Businesses, an Activist Fund and boring Locksmith Services

Hello Hello,

this is part 8 of my A-Z on AIM. The next 20 tickers. After part 7 showed us 8 pre-revenue companies, part 8 comes up with only 2 - I consider that a high-quality sample. Also only one biotech and energy company. Some pharma software, a locksmith roll-up and a veterinary service facing regulatory pressure. Let’s go. Three for my watchlist.

Here you find the other parts: https://increasingodds.substack.com/s/a-z-uk-aim

146) Craneware (Ticker: CRW)

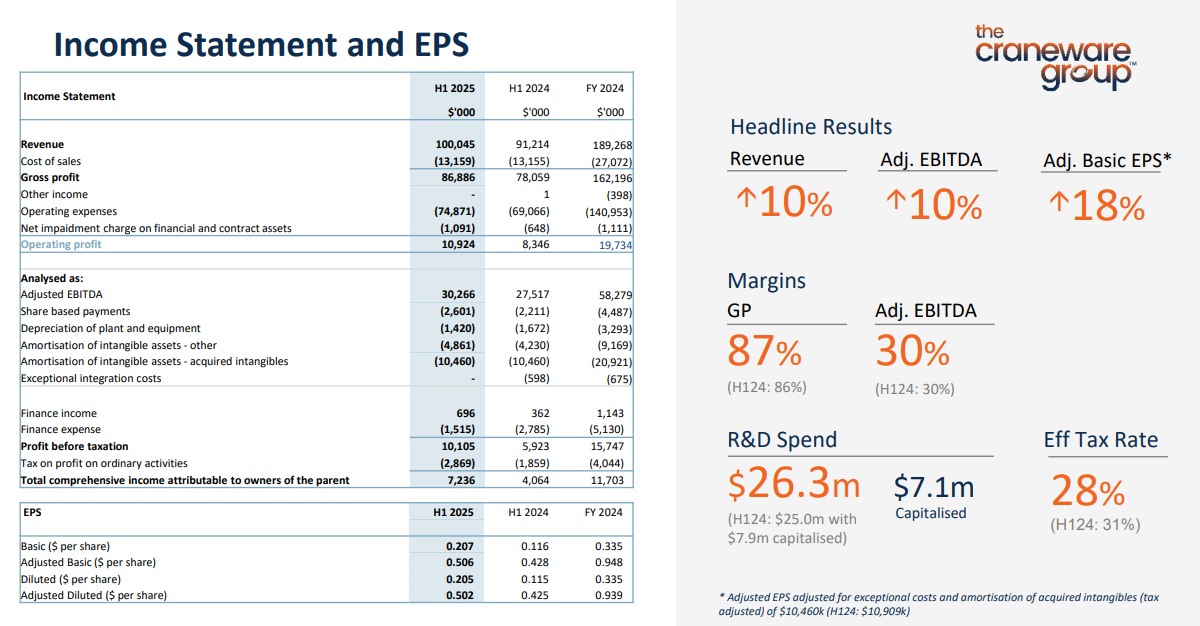

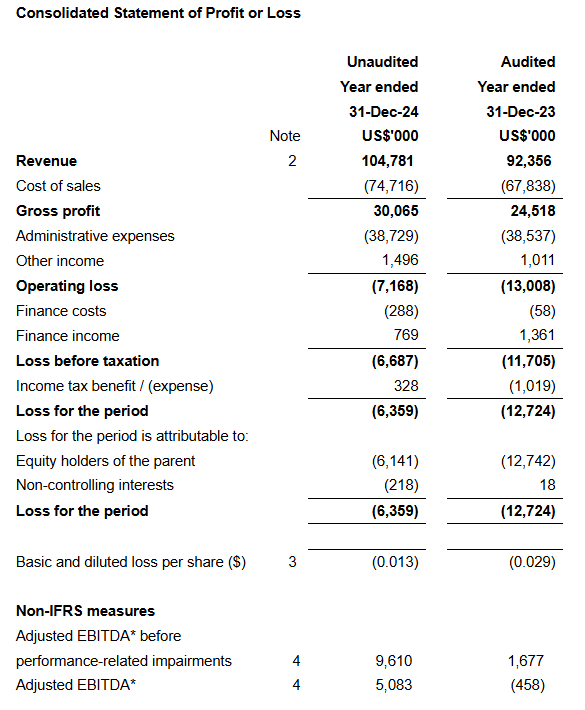

715£m provider of automated value cycle solutions, collaborates with 12.000 U.S. healthcare providers to plan, execute, and monitor operational and financial performance. Board just rejected a PE takeover offer of 927£m. 90% of revenue is recurring, >90& customer retention, recent results look strong:

CEO is the Founder and owns 10%. Trades on fwd. P/E of 26 (Koyfin). Seems like one of the rare quality names on AIM. The focus on the US may be some sort of policital concentration risk. Quality priced for what it is, pass for me, maybe worth a look for quality-compounder people.

147) Craven House Capital (Ticker: CRV)

0,35£m investment company. Mainly invested into 3 loss making businesses. One owns 25% of a license to manufacture and distribute a chemotherapy drug, one operates TV channels and the third is another biotech company.

There is no executive management and only non-executive board members as CRV is managed by Demond Holdings, a holding company from Hongkong. Pass.

148) Creightons (Ticker: CRL)

28£m company selling personal care and beauty products with own manufacturing sites. Operates 7 own brands, but also offers contract manufacturing and private labelling. Brands are Emma Hardie, Feather & Down, The Curl Company, Balance Active, T-Zone, Janina and Creightons. Recently moved from the main market to AIM.

Net cash. Brands showed -15% revenue in last HY update, but the privat label business grew 17%, leading to only -2% in revenue. Brand revenue was reduced due to rationalized product portfolio and competition. Privat label grew due to new customer wins.

Profits look strong due to increased gross margin through price increases and overall cost reductions, e.g. relocated logistics to reduce distribution costs. Board owns 10% of shares. CEO & CFO joined in recent years. It seems there is no sell side coverage. Expects 0,2£m impact from national minimum wage increase, but is overall confident for the next current year. Pass for me, I simply dislike brand-consumer businesses in fashion/beauty. Also not too cheap assuming about 2,5£m full year profits.

149) Creo Medical Group (Ticker: CREO)

61£m medical device company focused on minimally invasive electrosurgical devices. Sold 51% of its european business for 30£m. A lot going on:

The discontinued operations were nearly profitable, the remaining are highly unprofitable. Founders still involved. The move of selling the more or less profitable part makes this one less interesting for me, pass.

150) Crimson Tide (Ticker: TIDE)

4£m provider of the field service management platform mpro5. An aborted M&A deal lead to increased losses.

15%+ churn rate seems high to me. Sales down due to decreased demand and not renewed covid contracts. Management and Chair stepped down, search for new people ongoing. Interim Chair talks about way to profitability, but who knows if he remains Chair. Maybe interesting for people into this kind of special situation where it’s all about management changes and who are comfortable with software businesses, pass for me now, worth to revisit at some point.

151) Crism Therapeutics Corp (Ticker: CRTX)

7£m no revenue biotech for cancer treatments. Created through a takeover by a mining cash shell. Just created a scientific advisory board. Share priced doubled for no obvious reason. Pass.

152) Croma Security Solutions (Ticker: CSSG)

12£m provider of locksmith and other security related services, sold it’s biggest division for 6,5£m in June 2023, back then this case was all about what will happen to the cash that is paid in 10 quarterly payments. Check out the Write-up by @

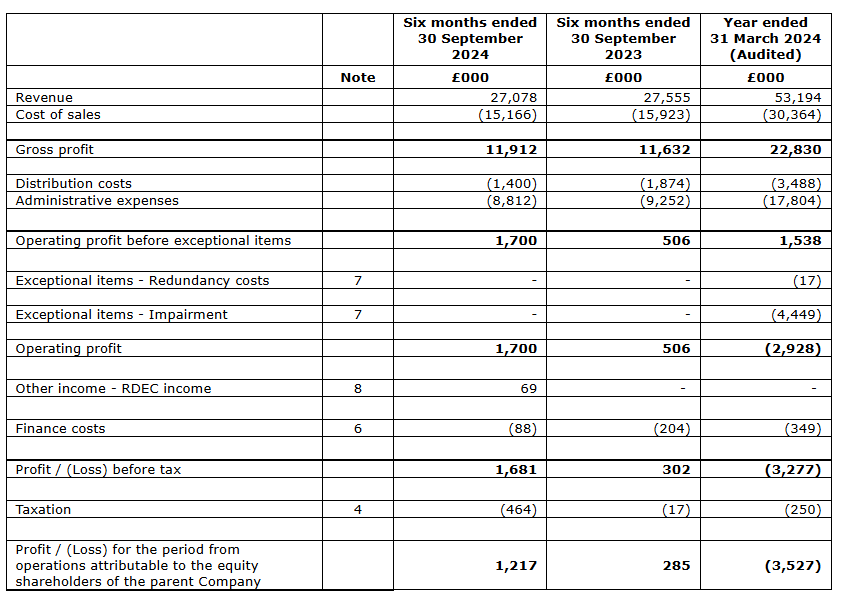

from a year ago:Ytd two locksmith businesses have been acquired for 0,35£m. Management is confident to proceed with its acquisition strategy going forward. Got no debt and 4,2£m cash. Expects 2,5£m over the next 6 quarters from its segment sale in 2023. Interim results look solid:

In the past, prior to the disposal, profits were bumpy and revenues were flat. I generally like these niche roll-up stories. CSSG is now trading on fwd. P/E of 17 (Koyfin). Certainly not cheap, but considering niche expertise and receiving 20% of market cap in cash over the next 6 quarters it’s interesting enough. CEO owns 29%. Watchlist.

153) Cropper James (Ticker: CRPR)

26£m manufacturer of paper, packaging and advanced materials like nonwovens and electrochemical coatings. Recent trading update shows a flat year. Expects low revenue growth in FY26. New CEO focussed on cash management, growing the advanced material segment and improving the paper & packaging segment. He just purchased shares for 26k. Will hold a capital markets event on June 18th. Cropper family owns 32%.

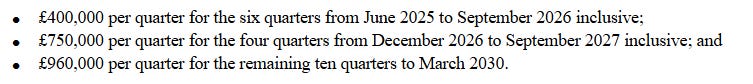

Just sold a non-core ip for up to 2£m and may receive up to 2,2£m additionally if there are revenues generated by projects deploying the ip over the next 9 years. Recent drawn 15£m loan has to be repayed with the following conditions:

10£m cash. Reported cost pressure in paper & packaging segment last HY, leading to unprofitability. FY24 was also unprofitable even if an 5£m PP&E write-off is excluded. Their products seem industrial focused, therefore somewhat cyclical. Profits were always bumpy with margins between 1% and 5%. I’ll give this one a ticket for my watchlist as it’s a family business going through a tough time, with a new CEO hired from another tech-materials company it is interesting enough to check out the capital markets event. Write-up by @

:154) Crystal Amber Fund (Ticker: CRS)

85£m activist fund company trading at 30% discount to NAV. Returned 13,5£m to shareholders via buybacks, announced a new 6£m programme. Most interesting holding is De La Rue. CRS owns 17% here (as of June 30 2024). De La Rue is about to be acquired for 263£m. If CRS still owns 17% here, that’s about 44£m for CRS. Reading older press releases, their case for De La Rue played out as expected, or even better.

Considering they pay a dividend and do buybacks I would expect some sort of special cash return to CRS shareholders, but I have absolutely no idea how large that will be and how much cash will stay on the sheet for future investments. Rather a pass for me as I prefer companies with an own operating business and the cash return case is a big IF situation.

155) CT Automotive Group (Ticker: CTA)

31£m designer and manufacturer of bespoken automotive interior finishes. FY24 show -16% revenue but increased profits through automation investments, improving cost efficiencies. Manufactures in China, Mexiko and Türkiye. Highlights uncertainty in the market, but is confident to grow mid-single digits and further expand margins in FY25.

Is talking a lot about using AI for production planning and quality control. Founder still involved, management and board own 27%. Trades on 4x P/E. Seems interesting looking at the income statement, but all cash is used for capex, interests and leases. Considering the industry and cash flow statement, it deserves a 4x P/E. Pass.

156) CVS Group (Ticker: CVSG)

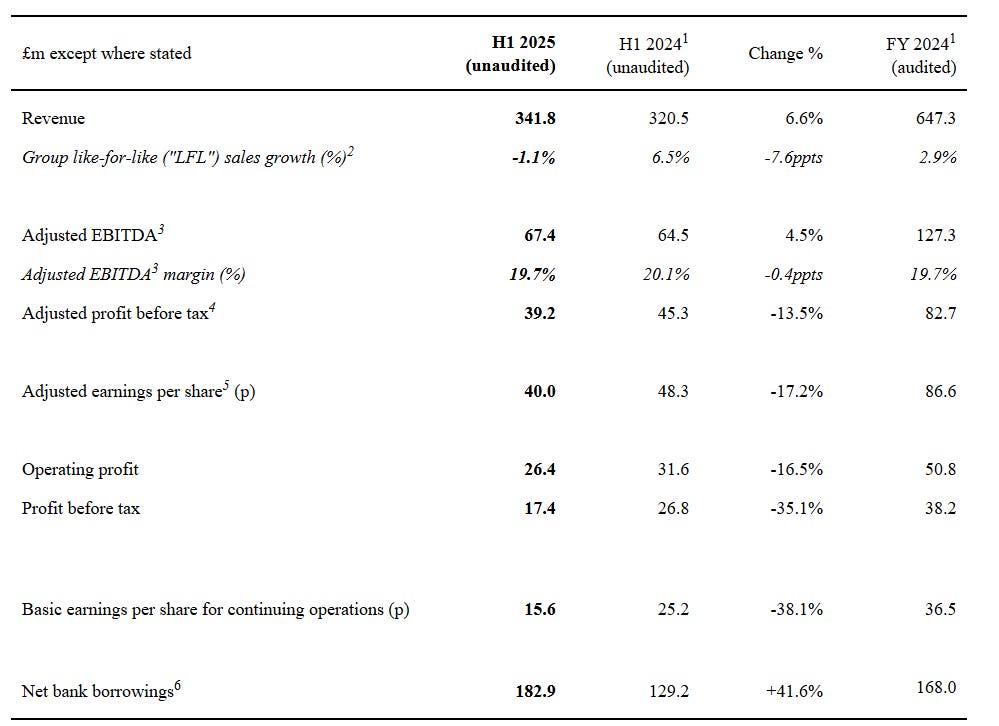

914£m provider of veterinary services in the UK and Australia. The Competition and Markets Authority is currently investigating the competetitive landscape in the sector in the UK as the large groups have a 60% market share. The investigation was just extended for 6 months. I’ve looked at them some time ago and the investigation was already a concern back then.

I am not sure whether this is related to the investigation, but CVSG sold its crematoria operations for 42£m (10x adj. EBITA). But also acquired 14 veterinary practices in Australia ytd for 28£m.

Profits down due to increased D&A and costs associated with the investigation. Profit before tax further down because of higher interest payments. Management joined in 2018/2019. Numbers are adj. for costs of business combinations which I would not consider costs you should adjust for here as M&A is an important part of their strategy. Adj. PBT would be about 55£m then. So it’s definitely >20x P/E. Watchlist to see how this plays out. Write-ups from @

:157) Cyanconnode Holdings (Ticker: CYAN)

26£m provider of Narrowband RF mesh networks that ‘enable the Internet of Things’. Received a letter of interest for a contract by a local indian government worth 70£m over 8 years. Order book of 180£m which translates into revenue over the next 3 years. Operates unprofitable and is suffering from delayed shipments to customers. If the revenue expectation really materialize it’s still questionable whether it’s profitable growth, pass.

158) DCI Advisors (Ticker: DCI)

43£m luxury residential resort investor with 7 projects. Sellings project in Croatia and Cyprus. A lot of related party transactions: 12 loans from different shareholders totalling 3,9€m with 9-12% interests. Seems weird to me, pass.

159) Dekel Agri-Vision (Ticker: DKL)

6£m West African agriculture company that wants to build a portfolio of sustainable projects. Operating palm oil and cashew plants. Production numbers, sales and profits are really bumpy. CEO owns 12%. Pass.

160) Deltic Energy (Ticker: DELT)

5£m no revenue offshore O&G company with projects in the UK. Just increased resource estimates. Pass.

161) Devolver Digital (Ticker: DEVO)

109£m publisher and developer of indie video games. Revenues are growing and profits shrinking. Purchases of intangible assets > operating cash flow. Reporting in $.

4,5$m write-off in FY24. Highlights release of Nintendo Switch 2 as a potential growth opportunity. Revenue flat since 2021. I think gaming is kind of comparable to fashion are similar consumer focused businesses. Either you need to establish a brand you can build strong customer relationships on or you need to participate in every new trend and push out new products. DELT seems like the latter spending 30$m on intangible capex a year without achieving sustainable growth. Pass.

162 & 163) Dewhurst Group (Ticker: DWHA & DWHT)

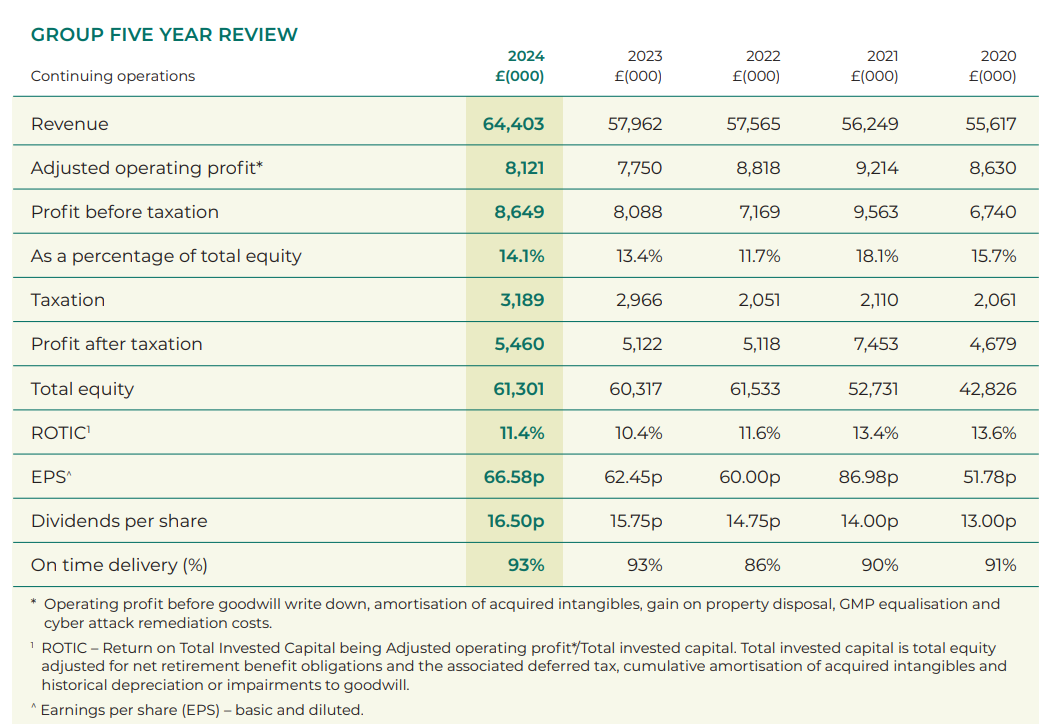

54£m global supplier of quality components to the lift, transport and keypad industries. Family business, lead by Dewhurst family who owns 48%. 20% owned by other single shareholders. 3% dividend, reduced share count by 10% in last 5 years.

50% of market cap in cash on the sheet and no long-term debt. Recent growth attributable to rail infrastructure growth and new business in Singapore. Cash is worthless just chilling on the sheet. Seems like a sleepy, but well managed family business, deserving the 10x P/E. Pass.

164) Diaceutics (Ticker: DRXR)

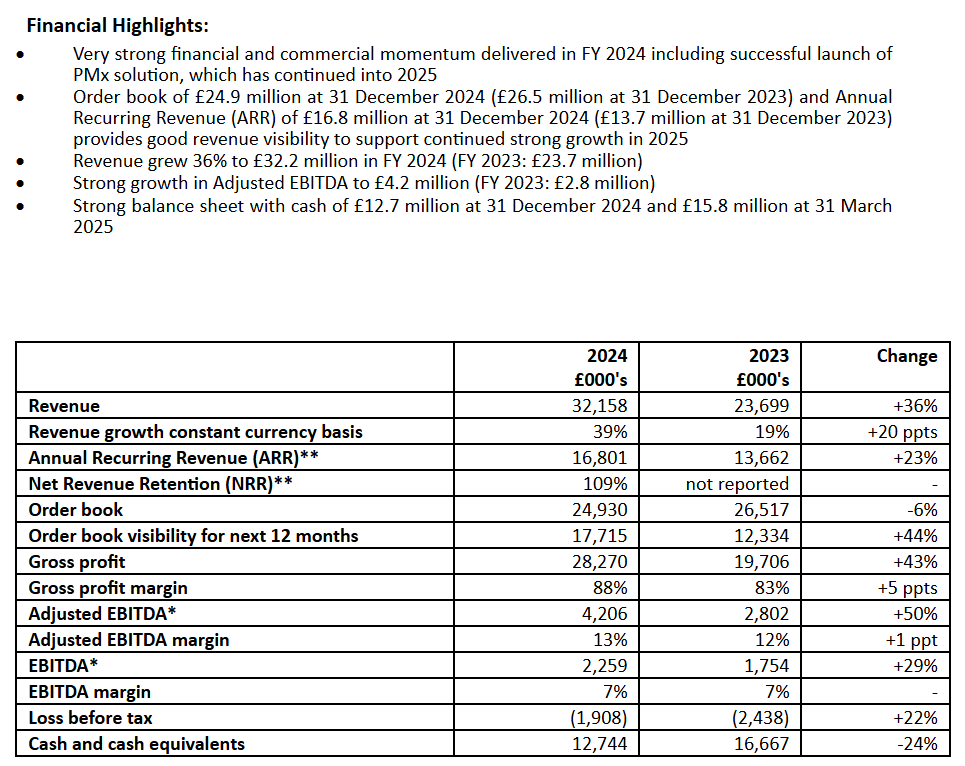

106£m provider of end-to-end commercialisation solutions for precision medicines through data analytics, scientific and advisory services. 50% of revenue is recurring.

Is growing strongly but operating unprofitable. No debt. Expects profitability on PBT basis in FY25. High-growth unprofitable software is nothing I’m interested in, but this may be worth a look for growth investors, pass.

165) Diales Group (Ticker: DIAL)

12£m dispute avoidance and dispute resolution consultancy in the construction industry. Chair will step down in September. Expects tariffs to have a positive impact. Closed it’s US business. Revenues flat, gross margin down, partly offset by administrative cost reductions. Returned 1£m via buybacks and dividends last year. 15x fwd. P/E (Koyfin). I see nothing that interests me here, pass.

Wrap-up

165/669 companies covered so far.

Watchlist: 27/165.

Pass: 138/165.

No-Revenue counter: 37/165.

Feel free to provide opinions and sources on any of the stocks. Cheers.

I don't hold a stake in DEVO but worth pointing out they have an excellent reputation in the indie gaming space, exemplified by NetEase owning 7% and Sony owning 5% (another 4% owned by a UK dev setup by the former head of Codemasters). Founders own another half so float is tiny after considering employee stakes. They have an offbeat, subversive identity. They tend to avoid the micro transaction model and so rely on a steady stream of successful titles to avoid bumpiness, which they're generally pretty good at, but is riskier to investors.

Like Tinybuild and other US listed AIM stocks, not really sure what they're doing in London rather than New York, maybe taking advantage of looser listing requirements. Another potential listing-switch candidate.

Thanks for the post and for sharing my write-up!