Hey there, before we start I need to admit a little mistake.

So far, I went through the constituents of the FTSE AIM All-Share index. To my surprise, not all shares listed on AIM are part of the index as a reader pointed out. As of 19th of May, the index cosists of 583 stocks, while there are 667 (+2 that I have already profiled which are now delisted) listed on AIM.

As my goal was and still is to look at all stocks on AIM, I updated parts 1-4 with the 9 companies I skipped so far due to the described issue. I also updated the x) numbers and wrap ups accordingly.

You don’t have to go back to the old articles, I will now share the 9 skipped companies in this article too and then, continue as usual. Sorry for the little confusion. Let’s go.

In part 1, tickers 450, AEG and ADME were added.

2) 450 (Ticker: 450)

14£m no revenue investment vehicle that wants to become ‘market leader in the tradional and digital creave industries, capitalising on the ongoing transformaon of the content, media and technology sectors as well as considering opportunies in e-commerce and retail.’ Pass.

11) Active Energy (Ticker: AEG)

0,35£m biomass energy company. Just announced a new patent. No revenue. Pass.

14) ADM Energy (Ticker: ADME)

1,4£m O&G company. Can’t even find recent reports. Pass.

In part 2, AGY was added.

26) Allergy Therapeutics (Ticker: AGY)

7£m unprofitable biotech focused on allergy vaccines.Growing strongly but so are losses. Currently in final phase of its allergy vaccine. Pass.

No new ticker in part 3.

In part 4, BCE, BMK, BXP, BMT & BMTO were added.

68) Beacon Energy (Ticker: BCE)

0,76£m O&G company with projects in Germany. Unprofitable. Pass.

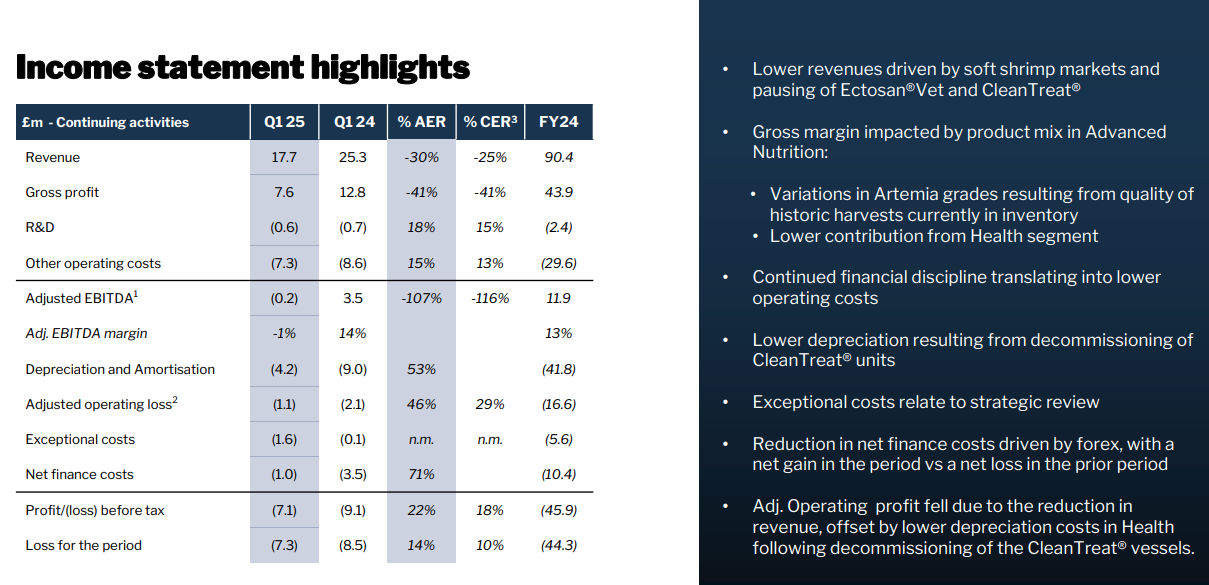

72) Benchmark Holdings (Ticker: BMK)

168£m aquaculture biotech company. Just sold its genetics business, redeemed its green bond and is now debt free. The sale got them about 194£m in cash + an earn-out option.

As far as I understand they sell nutrition for shrimps, fishes and also healthcare products. Kinda reminds me of the livestock nutrition business I came across earlier. Pass.

74) Bexmico Pharmaceuticals (Ticker: BXP)

160£m manufacturer of generic pharmaceutical products and active pharmaceutical ingredients in Bangladesh. Delayed its Q3 results due to allegations of corruption in Covid-19 vaccine procurement. Pass.

88) & 89) Braime Group (Ticker: BMT / BMTO)

Seems like a unique share structure here. 7£m company involved in the manufacture of metal presswork and the distribution of bulk material handling components. A flat year 2024. Paying a small dividend. Most cash is used to pay leases and interests.

Chairman with them since 1972. Two joint CEOs since 2003 and 2010. 9x P/E. Rather a pass. Valuation is low, but company is exposed to usual industry cycles and I find nothing that sparks my interest.

Edit: This write-up by @ indicates it may be more interesting:

Now let’s continue as usual. Number 95-105:

95) Cadence Minerals (Ticker: KDNC)

As a reminder that we are on AIM, we start with another no-revenue mining company. 5£m gold, iron and lithium exploration and development company with projects in Brazil and Mexico. Pass.

96) Cake Box Holdings (Ticker: CBOX)

A stock that was/is fairly popular and I have on my watchlist since ever. 85£m seller of egg-free cream cakes through 232 franchised stores. H1 2024 results showed only 4% revenue growth, but >10% profits growth. Online sales are growing >20%, partners with Nutella to launch branded products.

Just raised 7£m through new shares to partially fund the Ambala acquisition for 22£m (incl. 6£m for their manufacturing facility). Ambala produces and sells Asian sweets through 22 stores. Ambala has revenues of 14£m and profits before tax of 1,6£m. Fwd. P/E of 16 (Koyfin). Stays on the watchlist.

Most recent write-up I could find by @

:Write-ups from 2023: InvestingWithWes Newsletter on CBOX by @

andSmart Micro Caps on CBOX by @

97) Caledonia Mining (Ticker: CMCL)

246£m gold miner from Zimbabwe. Just sold its solar park for 22£m. Q1 saw 45% revenue growth to 56£m with 33% EBIT margins. About 80% of profits go to CMCL, other are minority interests. 6x fwd. P/E (Koyfin). Pass for me as always, probably worth a look for others.

98) Caledonian Holdings (Ticker: CHP)

2£m investing company focused on financial service markets in private but mostly public markets. CEO has M&A experience. Trades on a premium to fair asset value (excl. cash). Pass.

99) Calnex Solutions (Ticker: CLX)

48£m manufacturer of test and measurement instrumentation and solutions for the telecommunications and cloud computing industries. I know this one a little, it was a great growth story until telco companies reduced their spending on network expansion in the last years. Financials are not looking as ugly anymore, but still far below pre-2024, where profits were 6£m.

With 48£m market cap on <1£m depressed profits, this setup does not seem interesting to bet on a rebound. 20% is owned by founder and CEO Tommy Cook. Pass. @

provided an overview last year for those interested (spanish, easy to translate):100) Cambridge Cognition Holdings (Ticker: COG)

15£m software group specialising in digital products to advance clinical research and patient treatment for brain health. FY update shows -25% revenue and continued unprofitability. Order book of 15,8£m and expects at least 8,5£m in revenue this year plus further sales from Q2-Q4.

Looking for a new CEO. Aims for 75-100£m in sales in 2030. Announced two contract wins worth 1£m each. Pass for me.

101) Cambridge Nutritional Sciences (Ticker: CNSL)

6£m unprofitable biotech delivering a personalised approach to nutrition for better health. Alleged violation of regulations in 2018. Pass.

102) Camellia (Ticker: CAM)

145£m company investing in agriculture businesses in Africa, Asia and SA.

The Operating Companies collectively own and manage 50,000 hectares of mature land across seven countries (Bangladesh, Brazil, India, Kenya, Malawi, South Africa, and Tanzania). The majority of the Group's revenue is derived from the growing of tea, avocado, macadamia, rubber, wine grapes, blueberries, arable crops, forestry and livestock.

Worth mentioning here that the adj. numbers are lower than the reported numbers. CEO, CFO, Chair are all fairly new. Just announced a Value Enhancement Plan to create value and profitability. Is returning 19£m to shareholders via a tender offer. Naturally exposed to global market fluctuations. Pass.

103) Cap-XX (Ticker: CPX)

9£m Australia-based company which develops, manufactures and markets thin, prismatic supercapacitors. Just announced a distribution agreement with Premier Farnell, the second-largest electronic components distributor in the world and a design win for headphones. Chairman just stepped down after 12 years. Operates highly unprofitable. Pass.

104) Capital Metals (Ticker: CMET)

9£m no-revenue exploration and development company for various minerals in Sri Lanka. Share prices jumped 70% for no obvious reason. Pass.

105) Caspian Sunrise (Ticker: CASP)

62£m O&G development and exploration company with projects in Kazakhstan. Just sold interest in a project and acquired another. Latest report from H1 2024 showed 16% profits margins. Fwd. P/E of 3,5 (Koyfin). Pass, maybe worth a look for O&G friends.

Wrap-up

105/669 companies covered so far.

Watchlist: 18/105.

Pass: 87/105.

No-Revenue counter: 25/105.

Feel free to provide opinions and sources on any of the stocks. Cheers.

This is lovely. Just like Buffett said in the last AGM. Turning the pages, one by one.

Thanks for the shot out! Also, really nice work with this A-Z section. I'm looking to read more