Exploring AIM: A-Z Part 11

Indie Games, Cinemas & Media Productions next to the usual AIM Adventures.

Welcome to part 11,

Before diving into the next 10 tickers, I want to share some numbers. As I started this series in April, there were 669 listed companies on AIM, as of today there are 651. 18 companies are gone, at least. There have been some IPO’s, so the real number of delistings is ~25. That’s about 4% of all listed companies which left this market within 4 months. I can’t tell what happened to all of them, but 6 companies I covered already are part of this group:

3) 4GBL, 16) AFN and 108) CEL switched to another exchange, the JP Jenkins share dealing platform. None of them was a stable solid business. 26) APH and 43) AQX got acquired as planned. 147) CRV got delisted for not paying fees to its advisor and not appointing a new one. There are various additional special situations ongoing.

Some more numbers for the fans of statistics: 43,5% of the 200 companies so far were profitable, while 22% did not even have revenues. 15,5%were mining businesses, energy accounted for 9,5% and biotechs for 8%. This excludes businesses that are related to these industries such as energy/mining infrastructure & services or medtechs.

Today’s part is as horrible as the last one. But if you like indie games or got some expertise in media & entertainment industry, 208) - 210) may be worth a look for you. None for my watchlist. Let’s go!

Here you find the other parts: https://increasingodds.substack.com/s/a-z-uk-aim

201) Essensys (Ticker: ESYS)

14£m software provider to the commercial real estate industry. CEO and founder resigned in March but remains on the board. New CEO is the prior COO who joined in 2022. 90% of revenue is recurring. Transition to SaaS pure play and cost control appears successful, with OPEX reduced 30% and adj. EBITDA turning positive. Debt-free.

However, revenue is down due to less demand from one customer and operating unprofitable, so there seems to be some customer concentration. The software is related to network security, e.g. when you log into a Wi-Fi in a building. I’m not a tech guy at all so my understanding of why this needs a niche provider like ESYS and shouldn’t simply be covered by larger tech firms is limited, pass.

202) Ethernity Networks (Ticker: ENET)

1£m supplier of data processing and PON semiconductor technology for networking appliances. Revenue is down 60% and operating highly unprofitable, mostly due to R&D expenses. Successfully repaid liabilities to all creditors under a creditor agreement. SBC is about 10% of gross profit. No way to profitability, pass.

203) Eurasia Mining (Ticker: EUA)

146£m exploration and development company for various metals from Russia. Wants to list on the Astana International Exchange. Wants to sell all its Russian assets. Would operate highly profitable, but is suffering from currency exchange losses related to the Rouble. Maybe worth to keep an eye on if they really sell all assets, but pass for me.

204) Europa Metals (Ticker: EUZ)

1£m no-revenue exploration and development company with a zinc and silver project in Spain. At least that’s what their business description says. Looking at RNS statements it appears they invested in a mining project in Ireland and own shares of other mining companies. Trading is suspended under AIM Rule 15, which refers to cash shells, as these have to acquire something within 6 months under AIM Rule 14, which describes reverse takeovers. Pass.

205) Europa Oil & Gas Holdings (Ticker: EOG)

7£m unprofitable O&G exploration and development company with projects in the UK, Ireland and Guinea. Various exploration projects ongoing, maybe worth a look for O&G people, pass.

206) European Green Transition (Ticker: EGT)

10£m investment company with a focus on ‘distressed, revenue generating opportunities’. Well, at least that’s their focus for the future. Currently EGT is involved in a rare earth project and a copper project in Sweden and a carbon sink project to generate carbon credits in Ireland. But it aims to sell or partner its exploration projects. So far, EGT is not generating a single penny in revenue. Pass.

207) European Metals Holdings (Ticker: EMH)

20£m no-revenue exploration and development company with a lithium project in the Czech Republic. Just received a preliminary mining permit. Scrolling through RNS statements it appears things are developing well. Pass.

208) Everplay Group (Ticker: EVPL)

553£m global indie games label developer and publisher with a portfolio of over 140 titles. Share price doubled since March. Recent trading update suggests trading above expectations, whatever those expectations were.

They did a lot of M&A and 2023 numbers include a 32£m impairment. 2024 saw tighter cost control leading to higher profitability. Nevertheless numbers are below 2022. 63% of revenues from third-party games. Wants to focus on own IPs. Fwd. adj. P/E of 15 (Koyfin), debt free. CEO and CFO/COO joined recently, both have a video game background. Definitely not a bad business, but the video game industry is a tough one. It’s all about managing expectations pre-release (greetings to all Cities Skylines 2 players) while hyping the game and afterward, you have to find the balance between upselling and community sentiment. My gut doesn’t like the gaming industry, pass.

209) Everyman Media Group (Ticker: EMAN)

38£m operator of 48 cinemas. Opened two cinemas in 2025 and plans for two more next year. Market share of 5,8%. Operates on the edge of profitability. Recent trading update shows +21% in revenue with 6% increases for money spent on tickets, food and beverage.

The Everyman brand is positioned at the premium end of the UK leisure/cinema market. The Company’s proposition is based on high quality and unique venues in central high street locations. The Group seeks to differentiate itself by focusing on delivering a high-quality offering through its venues, content, staff and food and beverage.

Considering they are not able to operate profitable, at least after covid, I’d argue it remains an open question whether the differentiation strategy works out for cinemas nowadays. Pass.

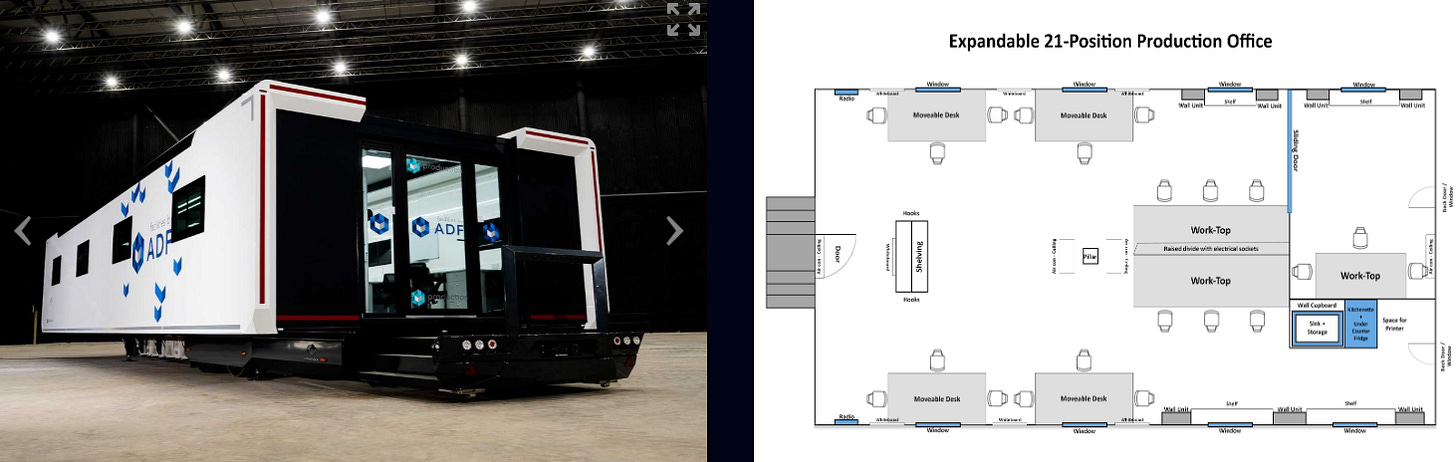

210) Facilities by ADF (Ticker: ADF)

21£m provider of serviced production facilities to the UK film and high-end television industry like mobile make-up and costume trailers, production offices, mobile bathrooms or diners. CEO just stepped down. Netflix accounts for 20% of revenues. Operating on the edge of profitability.

The business depends on production cycles of studios. Highlights uncertainty in the market over and over again. Seems to complement its offering by acquiring Autotrak Portable Roadways for 21£m. They do exactly what their name suggests: offering portable roadways to build up infrastructure on sets. Overall ADF appears to be a cool niche business, which is probably not an interesting investment considering management changes, big M&A and tough end markets. Pass.

Wrap-up

210/669 companies covered so far.

Watchlist: 30/210.

Pass: 180/210.

No-Revenue counter: 47/210.

Feel free to provide opinions and sources on any of the stocks. Cheers.

There's some decent F businesses in AIM so hopefully you'll get a higher hit rate for the next couple

I like ADF, asset backed recovery play. Harwood invested so they clearly see something interesting.